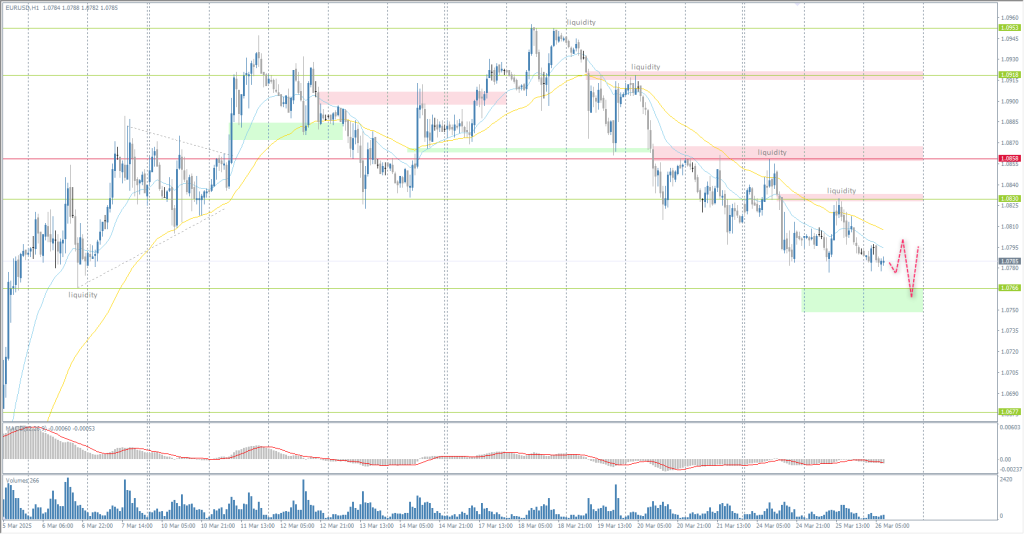

The EUR/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.0802

- 前一收盤價: 1.0791

- 過去一天的變化%: -0.10 %

The March IFO German business climate survey rose 1.4 to an 8-month high of 86.7, matching expectations. A representative of the ECB’s governing council, Kazimir, said the ECB is “already in the neutral rate zone” and did not rule out a pause in interest rate cuts. Another ECB Governing Council spokesman, Muller, said he “does not rule out a pause in ECB rate cuts,” any further rate cuts would depend on the nature of tariffs to be announced by the US soon. Swaps put the odds of a 25 bps ECB rate cut at the April 17 meeting at 68%, with the value not exceeding 50% as recently as a week ago.

交易建議

- 支撐價位: 1.0766, 1.0677, 1.0602, 1.0561, 1.0466

- 阻力價位: 1.0830, 1.0858, 1.0918, 1.0947, 1.0979

The EUR/USD currency pair’s hourly trend is bearish. Currently, the price seeks to test the liquidity below 1.0766. This level can be considered for buying, but only with confirmation from the buyers’ reaction. For selling, the resistance level of 1.0830 or 1.0858 is best used.

選擇場景:if the price breaks the resistance level of 1.0858 and consolidates above it, the uptrend is likely to be resumed.

新聞動態: 2025.03.26

- US Durable Goods Orders (m/m) at 14:30 (GMT+2).

The GBP/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.2923

- 前一收盤價: 1.2945

- 過去一天的變化%: +0.17 %

The Confederation of British Industry’s measure of UK retail sales fell 18 points to 41.0 in March 2025, the lowest level since April 2024 and well below market expectations of 28.0. This marked the sixth consecutive month of decline in the sector. Retailers and wholesalers cite global trade tensions and the Autumn Budget as key factors reducing consumer and business confidence and dampening demand. For sterling, this is a negative narrative.

交易建議

- 支撐價位: 1.2933, 1.2911, 1.2866, 1.2811, 1.2768, 1.2704, 1.2645

- 阻力價位: 1.2974, 1.3010

From the technical analysis point of view, the trend on the GBP/USD currency is bullish. Buyers were able to push the price away from the priority change level of 1.2911. Moreover, they have built another support level at 1.2933, which can be considered for buying, but with confirmation. Selling should only be considered if the price consolidates below 1.2911 or if it reacts to the resistance level at 1.2974.

選擇場景:if the price breaks the support level of 1.2911 and consolidates below it, the downtrend is likely to be resumed.

新聞動態: 2025.03.26

- UK Consumer Price Index (m/m) at 09:00 (GMT+2);

- UK Annual Budget Release at 12:00 (GMT+2).

The USD/JPY currency pair

貨幣對的技術指標:

- 前一開盤價: 150.68

- 前一收盤價: 149.88

- 過去一天的變化%: -0.53 %

The Japanese yen fell back to 150 per dollar on Wednesday, cutting gains from the previous session, as investors expect retaliatory tariffs from the US that could affect key Japanese exports. The Bank of Japan (BoJ) may consider tightening monetary policy if a sharp rise in food prices causes broader inflation, BoJ Governor Kazuo Ueda told a parliamentary committee on Wednesday. That, he said, could create sustained inflationary pressures, potentially justifying an interest rate hike. Ueda also expressed growing caution over economic uncertainties, including potential risks from US trade policy, which could weigh on Japan’s outlook.

交易建議

- 支撐價位: 149.51, 148.95, 148.58, 148.25

- 阻力價位: 151.32, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bullish. The situation has not changed much. The yen is aiming to test liquidity above 151.32. There are no strong counterresistances up to this level, so intraday traders should look for buy trades. It is best to use EMA lines to join the trend. There are no optimal entry points for selling right now.

選擇場景:if the price breaks through the support level at 149.51 and consolidates below it, the downtrend is likely to be resumed.

今天沒有新聞

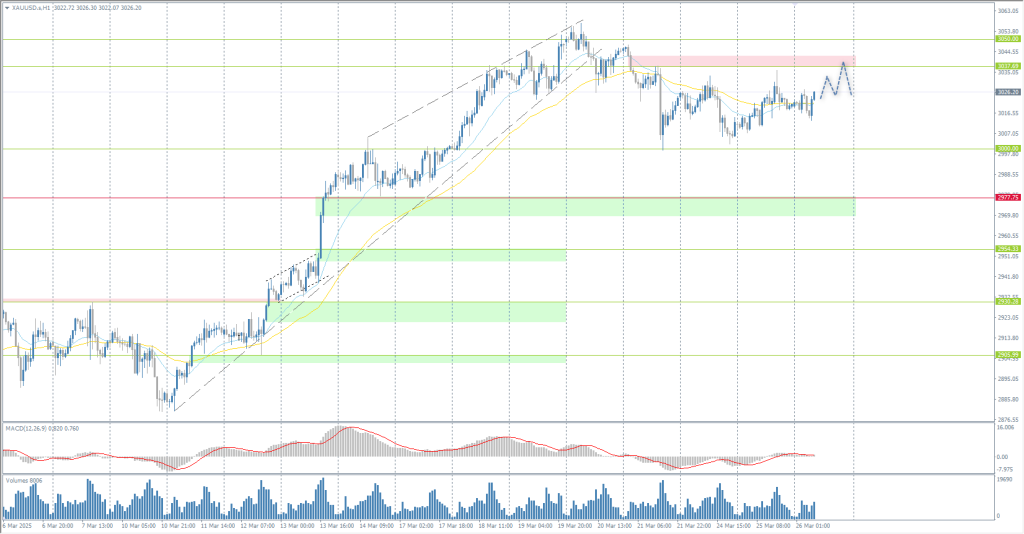

The XAU/USD currency pair (gold)

貨幣對的技術指標:

- 前一開盤價: 3011

- 前一收盤價: 3021

- 過去一天的變化%: +0.33 %

Gold climbed above $3020 per ounce on Wednesday, hovering near record highs, helped by its appeal as a “safe-haven” currency amid uncertainty over the US’s impending rollout of retaliatory tariffs. While President Donald Trump’s tariff plan set for April 2 is expected to be more targeted and limited than his previous promises, a new round of duties would still mean a significant escalation for the US and its trading partners. Meanwhile, investors await speeches from several Federal Reserve officials to get a glimpse of monetary policy for this year, as well as Friday’s US PCE data for clues on the Fed’s future actions.

交易建議

- 支撐價位: 3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- 阻力價位: 3037, 3050, 3100

From the technical analysis point of view, the trend on the XAU/USD is bullish. Gold is again forming a broadly volatile flat with 3000-3037, with the price now trading at the moving averages in the accumulation center, making it difficult to find good entry points. Since the intraday bias is for buyers, it is best to focus on buying with a target up to the upper boundary of flat 3037. This level can be considered for selling, but only with confirmation.

選擇場景:if the price breaks below the support level 2906, the downtrend is likely to resume.

新聞動態: 2025.03.26

- US Durable Goods Orders (m/m) at 14:30 (GMT+2).

本文僅反映個人觀點,不應被視為投資建議和/或要約和/或進行金融交易的持續要求和/或擔保和/或對未來事件的預測。