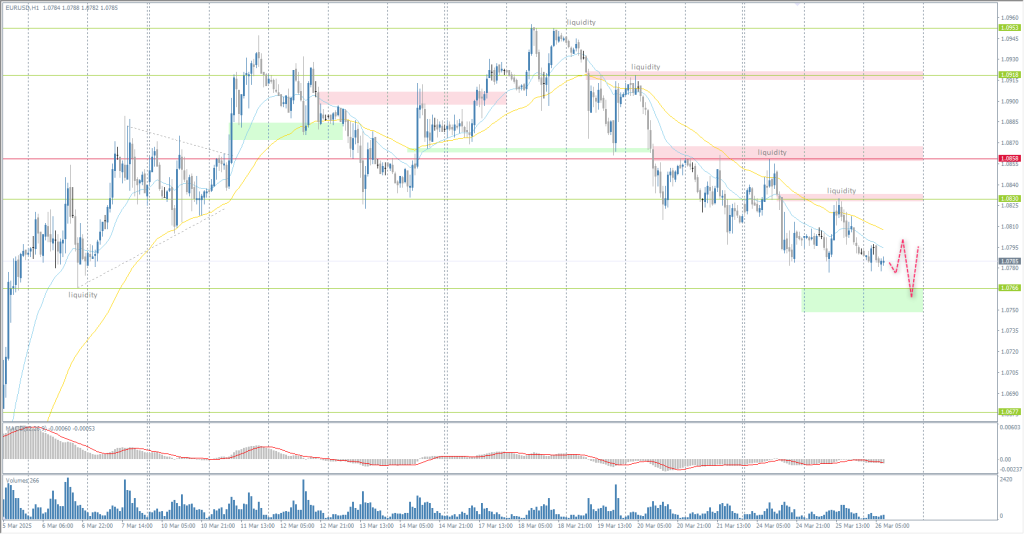

The EUR/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.0802

- قبلی بستن: 1.0791

- % chg. در طول روز گذشته: -0.10 %

The March IFO German business climate survey rose 1.4 to an 8-month high of 86.7, matching expectations. A representative of the ECB’s governing council, Kazimir, said the ECB is “already in the neutral rate zone” and did not rule out a pause in interest rate cuts. Another ECB Governing Council spokesman, Muller, said he “does not rule out a pause in ECB rate cuts,” any further rate cuts would depend on the nature of tariffs to be announced by the US soon. Swaps put the odds of a 25 bps ECB rate cut at the April 17 meeting at 68%, with the value not exceeding 50% as recently as a week ago.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.0766, 1.0677, 1.0602, 1.0561, 1.0466

- سطوح مقاومت: 1.0830, 1.0858, 1.0918, 1.0947, 1.0979

The EUR/USD currency pair’s hourly trend is bearish. Currently, the price seeks to test the liquidity below 1.0766. This level can be considered for buying, but only with confirmation from the buyers’ reaction. For selling, the resistance level of 1.0830 or 1.0858 is best used.

سناریوی جایگزین:if the price breaks the resistance level of 1.0858 and consolidates above it, the uptrend is likely to be resumed.

خوراک خبری برای: 2025.03.26

- US Durable Goods Orders (m/m) at 14:30 (GMT+2).

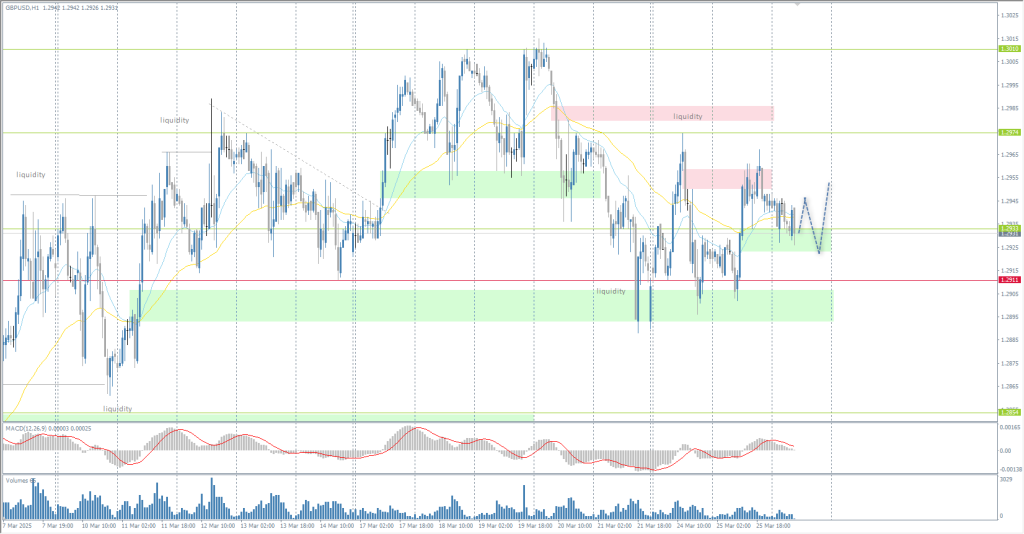

The GBP/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.2923

- قبلی بستن: 1.2945

- % chg. در طول روز گذشته: +0.17 %

The Confederation of British Industry’s measure of UK retail sales fell 18 points to 41.0 in March 2025, the lowest level since April 2024 and well below market expectations of 28.0. This marked the sixth consecutive month of decline in the sector. Retailers and wholesalers cite global trade tensions and the Autumn Budget as key factors reducing consumer and business confidence and dampening demand. For sterling, this is a negative narrative.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.2933, 1.2911, 1.2866, 1.2811, 1.2768, 1.2704, 1.2645

- سطوح مقاومت: 1.2974, 1.3010

From the technical analysis point of view, the trend on the GBP/USD currency is bullish. Buyers were able to push the price away from the priority change level of 1.2911. Moreover, they have built another support level at 1.2933, which can be considered for buying, but with confirmation. Selling should only be considered if the price consolidates below 1.2911 or if it reacts to the resistance level at 1.2974.

سناریوی جایگزین:if the price breaks the support level of 1.2911 and consolidates below it, the downtrend is likely to be resumed.

خوراک خبری برای: 2025.03.26

- UK Consumer Price Index (m/m) at 09:00 (GMT+2);

- UK Annual Budget Release at 12:00 (GMT+2).

The USD/JPY currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 150.68

- قبلی بستن: 149.88

- % chg. در طول روز گذشته: -0.53 %

The Japanese yen fell back to 150 per dollar on Wednesday, cutting gains from the previous session, as investors expect retaliatory tariffs from the US that could affect key Japanese exports. The Bank of Japan (BoJ) may consider tightening monetary policy if a sharp rise in food prices causes broader inflation, BoJ Governor Kazuo Ueda told a parliamentary committee on Wednesday. That, he said, could create sustained inflationary pressures, potentially justifying an interest rate hike. Ueda also expressed growing caution over economic uncertainties, including potential risks from US trade policy, which could weigh on Japan’s outlook.

توصیه های معاملاتی

- سطوح پشتیبانی: 149.51, 148.95, 148.58, 148.25

- سطوح مقاومت: 151.32, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bullish. The situation has not changed much. The yen is aiming to test liquidity above 151.32. There are no strong counterresistances up to this level, so intraday traders should look for buy trades. It is best to use EMA lines to join the trend. There are no optimal entry points for selling right now.

سناریوی جایگزین:if the price breaks through the support level at 149.51 and consolidates below it, the downtrend is likely to be resumed.

برای امروز خبری نیست

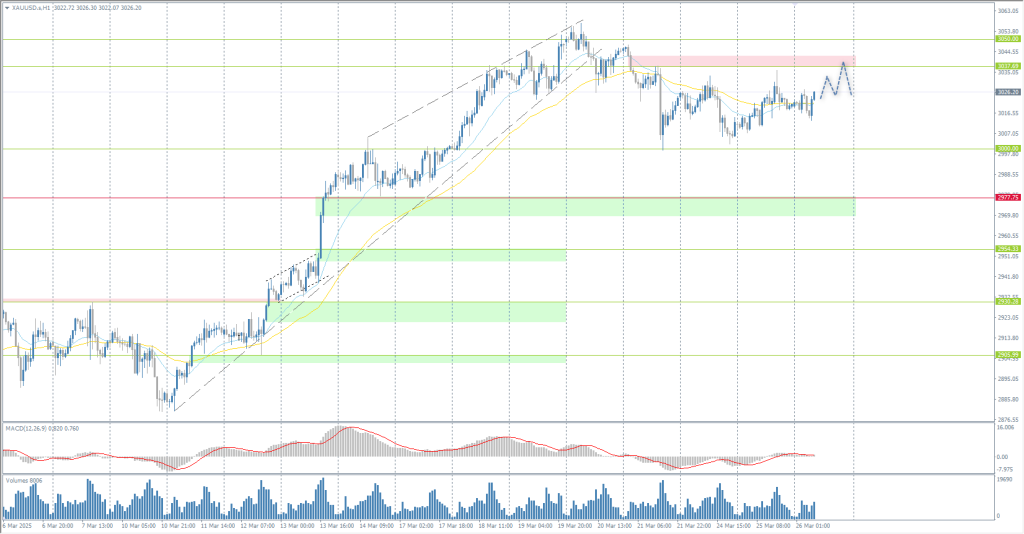

The XAU/USD currency pair (gold)

شاخص های فنی جفت ارز:

- قبلی باز کن: 3011

- قبلی بستن: 3021

- % chg. در طول روز گذشته: +0.33 %

Gold climbed above $3020 per ounce on Wednesday, hovering near record highs, helped by its appeal as a “safe-haven” currency amid uncertainty over the US’s impending rollout of retaliatory tariffs. While President Donald Trump’s tariff plan set for April 2 is expected to be more targeted and limited than his previous promises, a new round of duties would still mean a significant escalation for the US and its trading partners. Meanwhile, investors await speeches from several Federal Reserve officials to get a glimpse of monetary policy for this year, as well as Friday’s US PCE data for clues on the Fed’s future actions.

توصیه های معاملاتی

- سطوح پشتیبانی: 3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- سطوح مقاومت: 3037, 3050, 3100

From the technical analysis point of view, the trend on the XAU/USD is bullish. Gold is again forming a broadly volatile flat with 3000-3037, with the price now trading at the moving averages in the accumulation center, making it difficult to find good entry points. Since the intraday bias is for buyers, it is best to focus on buying with a target up to the upper boundary of flat 3037. This level can be considered for selling, but only with confirmation.

سناریوی جایگزین:if the price breaks below the support level 2906, the downtrend is likely to resume.

خوراک خبری برای: 2025.03.26

- US Durable Goods Orders (m/m) at 14:30 (GMT+2).

این مقاله منعکس کننده یک نظر شخصی است و نباید به عنوان یک توصیه سرمایه گذاری و/یا پیشنهاد و/یا درخواست مداوم برای انجام معاملات مالی و/یا تضمین و/یا پیش بینی رویدادهای آتی تفسیر شود.