The EUR/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.1414

- 前一收盤價: 1.1444

- 過去一天的變化%: +0.26 %

The euro remained above the $1.1450 mark, supported by the weakening of the dollar and investors’ reaction to the widely expected rate cut by the European Central Bank, as well as the deterioration in inflation forecasts. At her press conference, President Christine Lagarde stated that the ECB is nearing the completion of its easing cycle, signaling that a pause may be forthcoming. According to forecasts, core inflation is expected to average 2.0% in 2025, 1.6% in 2026, and then return to 2.0% in 2027. The estimates for 2025 and 2026 have been revised downwards by 0.3 percentage points compared to March, reflecting lower energy price forecasts and a stronger euro.

交易建議

- 支撐價位: 1.1431, 1.1393, 1.1356, 1.1312, 1.1296, 1.1269, 1.1220, 1.1200

- 阻力價位: 1.1456, 1.1483

The EUR/USD currency pair’s hourly trend is bearish. Yesterday, the euro briefly reached the resistance level of 1.1483, at which point sellers reacted sharply. A divergence has formed on the MACD indicator, with a bearish reaction to the surge in volume. It is important to assess the price action at the support level of 1.1431. A break below this level will trigger a wave of selling, targeting 1.1394. If buyers react at 1.1431, we can expect the price to rise to 1.1483 and above.

選擇場景:if the price breaks through the support level of 1.1356 and consolidates below it, the downward trend is likely to resume.

新聞動態: 2025.06.06

- German Industrial Production (m/m) at 09:00 (GMT+3);

- German Trade Balance (m/m) at 09:00 (GMT+3);

- Eurozone GDP (q/q) at 12:00 (GMT+3);

- US Nonfarm Payrolls (m/m) at 15:30 (GMT+3);

- US Unemployment Rate (m/m) at 15:30 (GMT+3).

The GBP/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.3555

- 前一收盤價: 1.3570

- 過去一天的變化%: +0.11 %

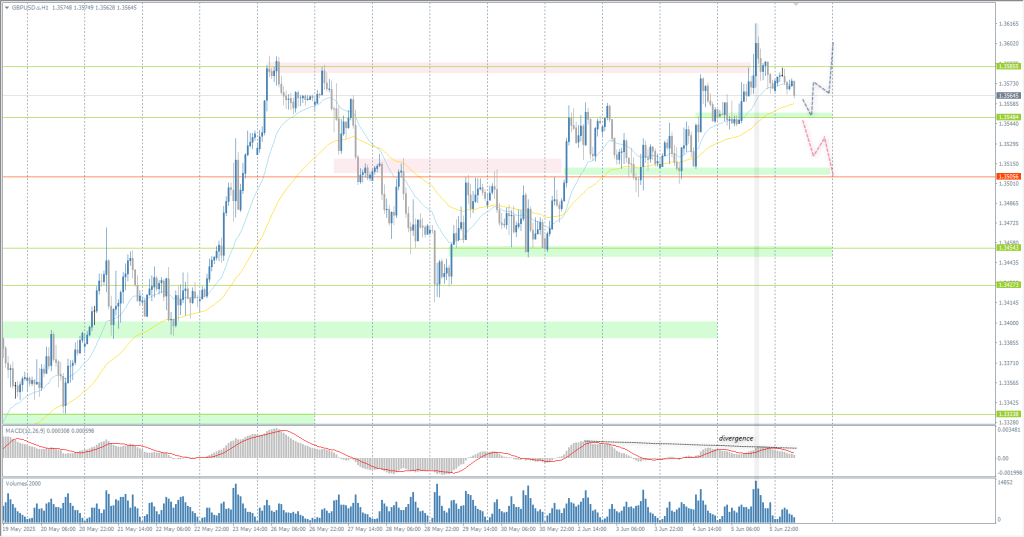

The British pound rose to $1.355, approaching a three-year high since May 26, as investors welcomed stronger UK economic data and a new defense plan. In addition, the dollar weakened after President Trump announced plans to double tariffs on steel and aluminum, and China responded to allegations of trade. In terms of data, the UK manufacturing sector contracted less than expected in May, and house prices rose 3.5% year-on-year, helped by buyers rushing to take advantage of tax changes. Investors now expect only a small chance of further interest rate cuts by the Bank of England this year.

交易建議

- 支撐價位: 1.3548, 1.3505, 1.3454, 1.3435, 1.3390, 1.3333, 1.3291, 1.3121

- 阻力價位: 1.3585

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly chart is bullish. The British pound briefly reached 1.3600, then closed below that level at the end of the day. The MACD divergence and a bearish reaction to the surge in volume indicate that the movement is corrective. For buy deals, consider the support level of 1.3548, but with confirmation. Sell deals can be considered if the price consolidates below 1.3548. In this case, there will be room for a fall to 1.3505.

選擇場景:if the price breaks through the support level of 1.3390 and consolidates below it, the downtrend is likely to resume.

今天沒有新聞

The USD/JPY currency pair

貨幣對的技術指標:

- 前一開盤價: 142.75

- 前一收盤價: 143.52

- 過去一天的變化%: +0.53 %

The Japanese yen fell to 144 per dollar on Friday, continuing the losses from the previous session, as traders took a cautious stance ahead of the closely watched monthly US employment report. On the domestic front, data showed that Japanese household spending unexpectedly declined in April as rising prices continued to weigh on consumer demand. The weak data added to the list of factors that the Bank of Japan is monitoring as it assesses the timing of its next interest rate hike.

交易建議

- 支撐價位: 142.62, 142.19

- 阻力價位: 143.27, 143.64, 144.44, 145.45, 146.27, 146.85, 148.28

From a technical perspective, the medium-term trend of the USD/JPY is bullish. The price has corrected to the resistance level of 143.85, but the reaction of sellers here is weak. A breakout of this level will pave the way for the next priority level, which is 144.44. If sellers manage to bring the price back below 143.85, the sell deals to 143.27 can be considered.

選擇場景:if the price breaks through the resistance level of 144.44 and consolidates above it, the uptrend is likely to resume.

今天沒有新聞

The XAU/USD currency pair (gold)

貨幣對的技術指標:

- 前一開盤價: 3373

- 前一收盤價: 3353

- 過去一天的變化%: -0.59 %

Gold rose to $3,400 per ounce on Thursday, reaching a monthly high, as soft US economic data and expectations of less hawkish Federal Reserve policy boosted the metal’s appeal as a safe haven ahead of the release of non-farm payroll data. Initial jobless claims rose to their highest level since early October 2024 at the end of May, exceeding expectations. Earlier in the week, the ADP report showed the lowest job growth in May since March 2023, and the ISM services PMI index showed a contraction in the sector for the first time in nearly a year.

交易建議

- 支撐價位: 3343, 3325, 3303, 3276, 3248

- 阻力價位: 3365, 3414

From the technical analysis perspective, the trend on the XAU/USD is bullish. Yesterday, gold briefly reached the psychological level of 3400, but then the price fell sharply amid profit-taking. The support level of 3343 stopped this decline, but sellers managed to form a resistance zone near 3365. Consolidation above this level will open up room for further growth. If sellers manage to defend this level, a retest of 3343 is inevitable.

選擇場景:if the price breaks and consolidates below the support level of 3272, the downtrend will likely resume.

新聞動態: 2025.06.06

- US Nonfarm Payrolls (m/m) at 15:30 (GMT+3);

- US Unemployment Rate (m/m) at 15:30 (GMT+3).

本文僅反映個人觀點,不應被視為投資建議和/或要約和/或進行金融交易的持續要求和/或擔保和/或對未來事件的預測。