The EUR/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.1414

- قبلی بستن: 1.1444

- % chg. در طول روز گذشته: +0.26 %

The euro remained above the $1.1450 mark, supported by the weakening of the dollar and investors’ reaction to the widely expected rate cut by the European Central Bank, as well as the deterioration in inflation forecasts. At her press conference, President Christine Lagarde stated that the ECB is nearing the completion of its easing cycle, signaling that a pause may be forthcoming. According to forecasts, core inflation is expected to average 2.0% in 2025, 1.6% in 2026, and then return to 2.0% in 2027. The estimates for 2025 and 2026 have been revised downwards by 0.3 percentage points compared to March, reflecting lower energy price forecasts and a stronger euro.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.1431, 1.1393, 1.1356, 1.1312, 1.1296, 1.1269, 1.1220, 1.1200

- سطوح مقاومت: 1.1456, 1.1483

The EUR/USD currency pair’s hourly trend is bearish. Yesterday, the euro briefly reached the resistance level of 1.1483, at which point sellers reacted sharply. A divergence has formed on the MACD indicator, with a bearish reaction to the surge in volume. It is important to assess the price action at the support level of 1.1431. A break below this level will trigger a wave of selling, targeting 1.1394. If buyers react at 1.1431, we can expect the price to rise to 1.1483 and above.

سناریوی جایگزین:if the price breaks through the support level of 1.1356 and consolidates below it, the downward trend is likely to resume.

خوراک خبری برای: 2025.06.06

- German Industrial Production (m/m) at 09:00 (GMT+3);

- German Trade Balance (m/m) at 09:00 (GMT+3);

- Eurozone GDP (q/q) at 12:00 (GMT+3);

- US Nonfarm Payrolls (m/m) at 15:30 (GMT+3);

- US Unemployment Rate (m/m) at 15:30 (GMT+3).

The GBP/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.3555

- قبلی بستن: 1.3570

- % chg. در طول روز گذشته: +0.11 %

The British pound rose to $1.355, approaching a three-year high since May 26, as investors welcomed stronger UK economic data and a new defense plan. In addition, the dollar weakened after President Trump announced plans to double tariffs on steel and aluminum, and China responded to allegations of trade. In terms of data, the UK manufacturing sector contracted less than expected in May, and house prices rose 3.5% year-on-year, helped by buyers rushing to take advantage of tax changes. Investors now expect only a small chance of further interest rate cuts by the Bank of England this year.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.3548, 1.3505, 1.3454, 1.3435, 1.3390, 1.3333, 1.3291, 1.3121

- سطوح مقاومت: 1.3585

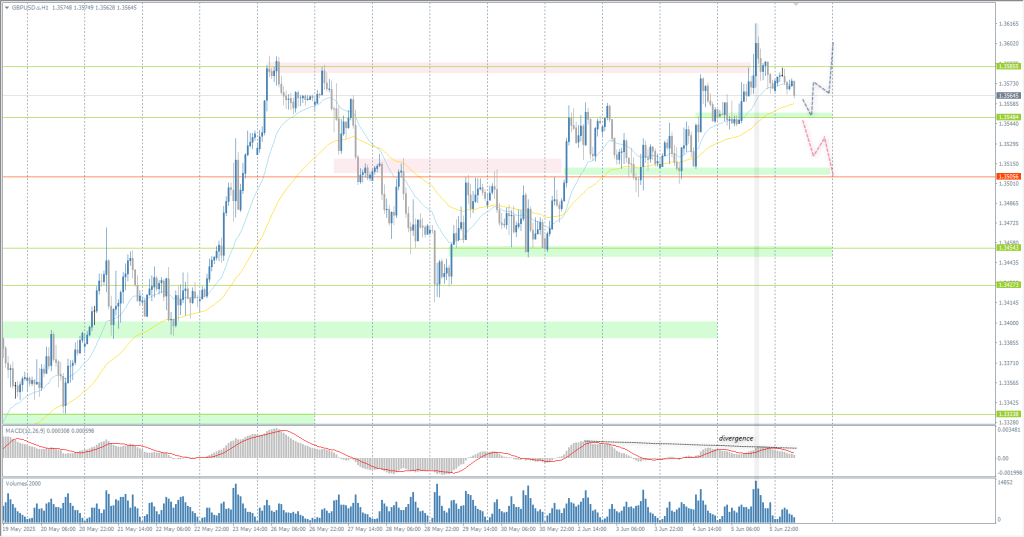

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly chart is bullish. The British pound briefly reached 1.3600, then closed below that level at the end of the day. The MACD divergence and a bearish reaction to the surge in volume indicate that the movement is corrective. For buy deals, consider the support level of 1.3548, but with confirmation. Sell deals can be considered if the price consolidates below 1.3548. In this case, there will be room for a fall to 1.3505.

سناریوی جایگزین:if the price breaks through the support level of 1.3390 and consolidates below it, the downtrend is likely to resume.

برای امروز خبری نیست

The USD/JPY currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 142.75

- قبلی بستن: 143.52

- % chg. در طول روز گذشته: +0.53 %

The Japanese yen fell to 144 per dollar on Friday, continuing the losses from the previous session, as traders took a cautious stance ahead of the closely watched monthly US employment report. On the domestic front, data showed that Japanese household spending unexpectedly declined in April as rising prices continued to weigh on consumer demand. The weak data added to the list of factors that the Bank of Japan is monitoring as it assesses the timing of its next interest rate hike.

توصیه های معاملاتی

- سطوح پشتیبانی: 142.62, 142.19

- سطوح مقاومت: 143.27, 143.64, 144.44, 145.45, 146.27, 146.85, 148.28

From a technical perspective, the medium-term trend of the USD/JPY is bullish. The price has corrected to the resistance level of 143.85, but the reaction of sellers here is weak. A breakout of this level will pave the way for the next priority level, which is 144.44. If sellers manage to bring the price back below 143.85, the sell deals to 143.27 can be considered.

سناریوی جایگزین:if the price breaks through the resistance level of 144.44 and consolidates above it, the uptrend is likely to resume.

برای امروز خبری نیست

The XAU/USD currency pair (gold)

شاخص های فنی جفت ارز:

- قبلی باز کن: 3373

- قبلی بستن: 3353

- % chg. در طول روز گذشته: -0.59 %

Gold rose to $3,400 per ounce on Thursday, reaching a monthly high, as soft US economic data and expectations of less hawkish Federal Reserve policy boosted the metal’s appeal as a safe haven ahead of the release of non-farm payroll data. Initial jobless claims rose to their highest level since early October 2024 at the end of May, exceeding expectations. Earlier in the week, the ADP report showed the lowest job growth in May since March 2023, and the ISM services PMI index showed a contraction in the sector for the first time in nearly a year.

توصیه های معاملاتی

- سطوح پشتیبانی: 3343, 3325, 3303, 3276, 3248

- سطوح مقاومت: 3365, 3414

From the technical analysis perspective, the trend on the XAU/USD is bullish. Yesterday, gold briefly reached the psychological level of 3400, but then the price fell sharply amid profit-taking. The support level of 3343 stopped this decline, but sellers managed to form a resistance zone near 3365. Consolidation above this level will open up room for further growth. If sellers manage to defend this level, a retest of 3343 is inevitable.

سناریوی جایگزین:if the price breaks and consolidates below the support level of 3272, the downtrend will likely resume.

خوراک خبری برای: 2025.06.06

- US Nonfarm Payrolls (m/m) at 15:30 (GMT+3);

- US Unemployment Rate (m/m) at 15:30 (GMT+3).

این مقاله منعکس کننده یک نظر شخصی است و نباید به عنوان یک توصیه سرمایه گذاری و/یا پیشنهاد و/یا درخواست مداوم برای انجام معاملات مالی و/یا تضمین و/یا پیش بینی رویدادهای آتی تفسیر شود.