The EUR/USD currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 1.1777

- Prev. Cerrar: 1.1814

- % cambio. en el último día: +0.31%

Friday’s sharp rally in stock markets weakened demand for the US dollar. Additional pressure on the greenback stemmed from the negative trend established on Thursday, when weaker-than-expected US labor market data raised the probability of a Fed rate cut at the upcoming FOMC meeting. Dollar weakness supported the euro, which recovered from a two-week low on Friday despite poor German industrial production data. In December, production contracted by 1.9% m/m, significantly missing market expectations of 0.3% m/m and marking the sharpest decline in four months. These figures once again highlighted the vulnerability of the industrial sector in the Eurozone’s largest economy.

Recomendaciones de trading

- Niveles de soporte: 1.1804, 1.1777, 1.1754, 1.1726

- Niveles de resistencia: 1.1839, 1.1874, 1.1953, 1.1859, 1.2050, 1.3000

The euro has reached the liquidity zone above 1.1839, and further dynamics will be determined by the price reaction at this level. A strong impulsive break and hold above resistance will open potential for continued growth toward 1.1874. Should sellers respond actively, forcing a quick return below 1.1839, the market is likely to transition into a corrective move targeting the 1.1804 area. Given the lack of significant news triggers today, a moderate pullback scenario currently appears more probable.

Escenario alternativo:- Trend: Neutral

- Sup: 1.1777

- Res: 1.1839

- Note: Consider buy trades intraday if there is an impulsive breakout of 1.1839. For sells, wait for the price to close below 1.1839 with a target of 1.1804.

Noticias para: 2026.02.09

- Eurozone ECB President Lagarde Speech at 18:00 (GMT+2). – EUR (LOW)

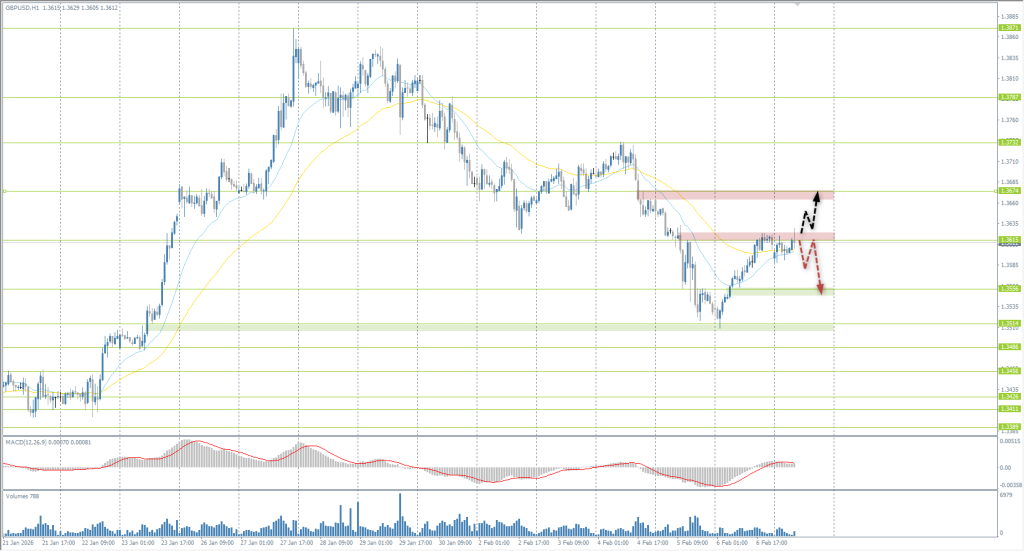

The GBP/USD currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 1.3533

- Prev. Cerrar: 1.3610

- % cambio. en el último día: +0.56 %

Sterling returned to the $1.36 level by the end of a highly volatile week which, despite the Friday recovery, marked the pound’s sharpest weekly decline against the dollar since late October. The currency was pressured by a combination of political uncertainty and a more dovish-than-expected tone from the Bank of England. Investors were surprised by the extremely narrow vote: the decision was supported by only five MPC members, while four voted for an immediate 25-basis-point rate cut. The market is already pricing in a nearly 70% chance of a rate cut in March.

Recomendaciones de trading

- Niveles de soporte: 1.3556, 1.3514

- Niveles de resistencia: 1.3615, 1.3674, 1.3732, 1.3787, 1.3871, 1.4000

The dynamics for the British pound largely mirror the euro: the price has reached the liquidity zone above 1.3615, where a decision point is currently forming. An impulsive hold above this level will confirm buyer initiative and open up growth potential toward 1.3674. If active selling emerges near 1.3615 and the market returns with a close below the level, a shift to a corrective move with a near-term target of 1.3556 is likely.

Escenario alternativo:- Trend: Neutral

- Sup: 1.3556

- Res: 1.3615

- Note: It is appropriate to look for intraday buys after an impulsive breakout of 1.3615. For sells, wait for a close below 1.3615 with a target of 1.3556.

No hay noticias para hoy

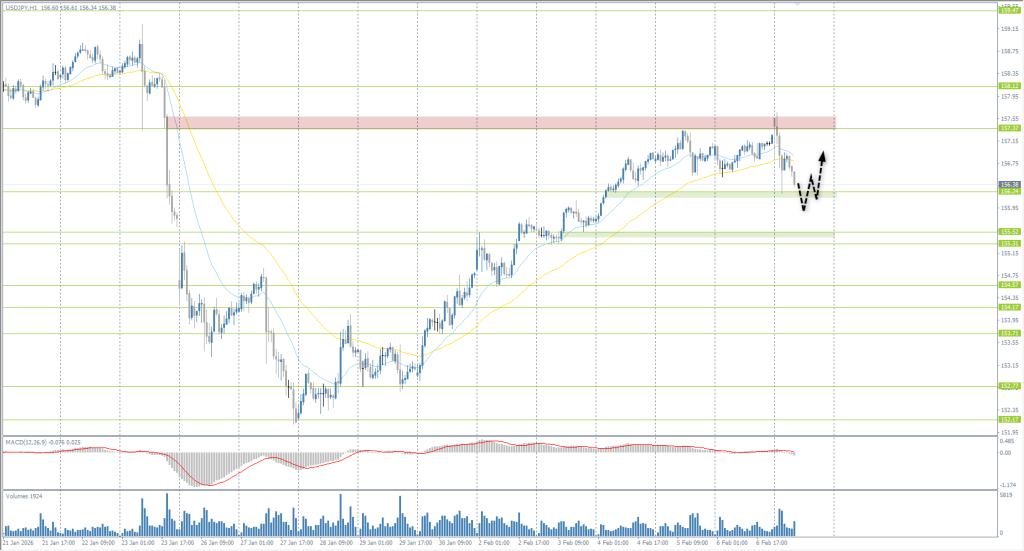

The USD/JPY currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 156.89

- Prev. Cerrar: 157.25

- % cambio. en el último día: +0.22 %

On Monday, the Japanese yen strengthened above 157 per dollar, bouncing off a two-week low following the landslide victory of the ruling Liberal Democratic Party (LDP) led by Prime Minister Sanae Takaichi in the Lower House elections – an outcome largely anticipated by the market. This result reinforces expectations of an expansionary fiscal policy, including increased government spending and potential tax concessions. Thus, the current strengthening of the yen appears more corrective, while further currency dynamics will largely depend on the combination of the new government’s fiscal steps, Bank of Japan policy, and official rhetoric regarding the exchange rate.

Recomendaciones de trading

- Niveles de soporte: 156.24, 155.52, 155.31, 154.57, 154.17, 153.71

- Niveles de resistencia: 157.37, 158.12

The Japanese yen opened with an upside gap and strengthened sharply thereafter; however, the current movement appears more technical than fundamentally justified. There are currently few significant macroeconomic or political factors capable of providing sustained support for the yen, so the current strengthening is perceived as a corrective phase. In this context, a decline in quotes looks like a more attractive scenario for finding buy entry points. Zones near 156.24 and 155.52 are considered key areas of potential demand, though entries are only advisable after confirming signals. Selling opportunities appear limited in the current market structure.

Escenario alternativo:- Trend: Up

- Sup: 156.24

- Res: 157.37

- Note: We expect a correction to 156.24 and 155.52 to look for buy trades. There are no optimal entry points for selling.

Noticias para: 2026.02.09

- Japan Average Cash Earnings (m/m) at 01:30 (GMT+2). – JPY (MED)

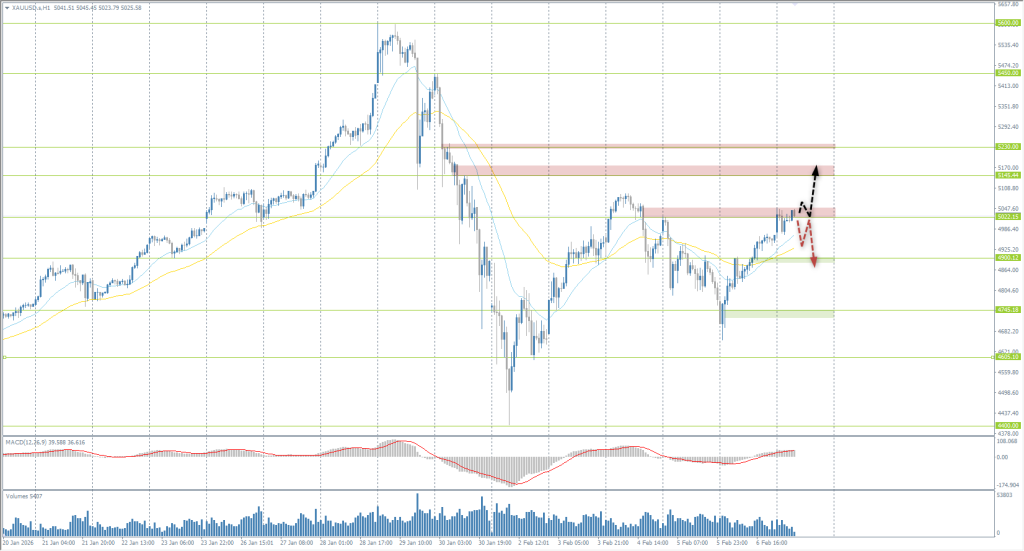

The XAU/USD currency pair (gold)

Indicadores técnicos del par de divisas:

- Prev. Abrir: 4771

- Prev. Cerrar: 4968

- % cambio. en el último día: +4.12 %

On Monday, gold prices climbed above $5,000 per ounce, reaching a one-week high. The rally was driven by a weakening US dollar amid expectations of key macroeconomic releases that could clarify the Federal Reserve’s interest rate trajectory. Market focus is centered on the US January Jobs Report (scheduled for Wednesday) and inflation data (slated for Friday). These releases will be critical for assessing the timing and scale of potential Fed easing. Fundamentally, robust institutional demand persists: the People’s Bank of China increased its gold reserves for the 15th consecutive month in January, confirming strategic official-sector support for the metal.

Recomendaciones de trading

- Niveles de soporte: 4900, 4745, 4605, 4400

- Niveles de resistencia: 5022, 5145, 5230

On Monday, gold opened with a small gap that was quickly closed, after which the price moved toward key resistance near 5022. At this point, the market is in a decision phase, and further movement will depend on the participants’ reaction to this level. A hold above 5050 will indicate buyer readiness to continue the move, opening potential toward 5145. Otherwise, increased seller activity from 5022 could lead to a corrective decline with a near-term target of 4900, where the market may again seek support.

Escenario alternativo:- Trend: Neutral

- Sup: 5022

- Res: 4900

- Note: If 5022 is broken intraday, look for buys targeting 5145. Sells should only be considered after evaluating the price reaction to liquidity at 5022.

No hay noticias para hoy

Este artículo refleja una opinión personal y no debe interpretarse como un consejo de inversión, y/o una oferta, y/o una solicitud persistente para realizar transacciones financieras, y/o una garantía, y/o una previsión de eventos futuros.