The EUR/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.1777

- 前一收盘价: 1.1814

- 过去一天的变化%: +0.31%

Friday’s sharp rally in stock markets weakened demand for the US dollar. Additional pressure on the greenback stemmed from the negative trend established on Thursday, when weaker-than-expected US labor market data raised the probability of a Fed rate cut at the upcoming FOMC meeting. Dollar weakness supported the euro, which recovered from a two-week low on Friday despite poor German industrial production data. In December, production contracted by 1.9% m/m, significantly missing market expectations of 0.3% m/m and marking the sharpest decline in four months. These figures once again highlighted the vulnerability of the industrial sector in the Eurozone’s largest economy.

交易建议

- 支撑价位: 1.1804, 1.1777, 1.1754, 1.1726

- 阻力价位: 1.1839, 1.1874, 1.1953, 1.1859, 1.2050, 1.3000

The euro has reached the liquidity zone above 1.1839, and further dynamics will be determined by the price reaction at this level. A strong impulsive break and hold above resistance will open potential for continued growth toward 1.1874. Should sellers respond actively, forcing a quick return below 1.1839, the market is likely to transition into a corrective move targeting the 1.1804 area. Given the lack of significant news triggers today, a moderate pullback scenario currently appears more probable.

选择场景:- Trend: Neutral

- Sup: 1.1777

- Res: 1.1839

- Note: Consider buy trades intraday if there is an impulsive breakout of 1.1839. For sells, wait for the price to close below 1.1839 with a target of 1.1804.

新闻动态: 2026.02.09

- Eurozone ECB President Lagarde Speech at 18:00 (GMT+2). – EUR (LOW)

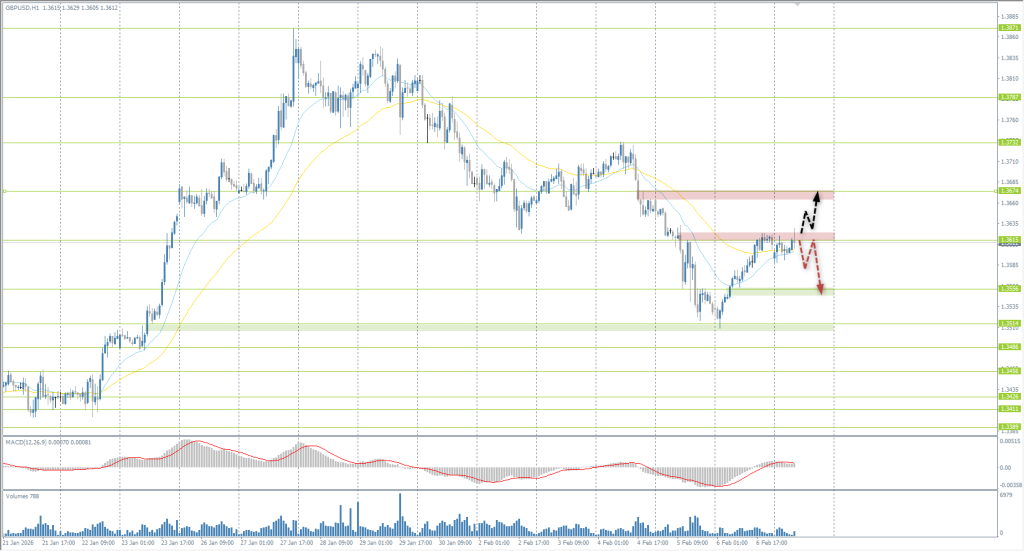

The GBP/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.3533

- 前一收盘价: 1.3610

- 过去一天的变化%: +0.56 %

Sterling returned to the $1.36 level by the end of a highly volatile week which, despite the Friday recovery, marked the pound’s sharpest weekly decline against the dollar since late October. The currency was pressured by a combination of political uncertainty and a more dovish-than-expected tone from the Bank of England. Investors were surprised by the extremely narrow vote: the decision was supported by only five MPC members, while four voted for an immediate 25-basis-point rate cut. The market is already pricing in a nearly 70% chance of a rate cut in March.

交易建议

- 支撑价位: 1.3556, 1.3514

- 阻力价位: 1.3615, 1.3674, 1.3732, 1.3787, 1.3871, 1.4000

The dynamics for the British pound largely mirror the euro: the price has reached the liquidity zone above 1.3615, where a decision point is currently forming. An impulsive hold above this level will confirm buyer initiative and open up growth potential toward 1.3674. If active selling emerges near 1.3615 and the market returns with a close below the level, a shift to a corrective move with a near-term target of 1.3556 is likely.

选择场景:- Trend: Neutral

- Sup: 1.3556

- Res: 1.3615

- Note: It is appropriate to look for intraday buys after an impulsive breakout of 1.3615. For sells, wait for a close below 1.3615 with a target of 1.3556.

今天没有新闻

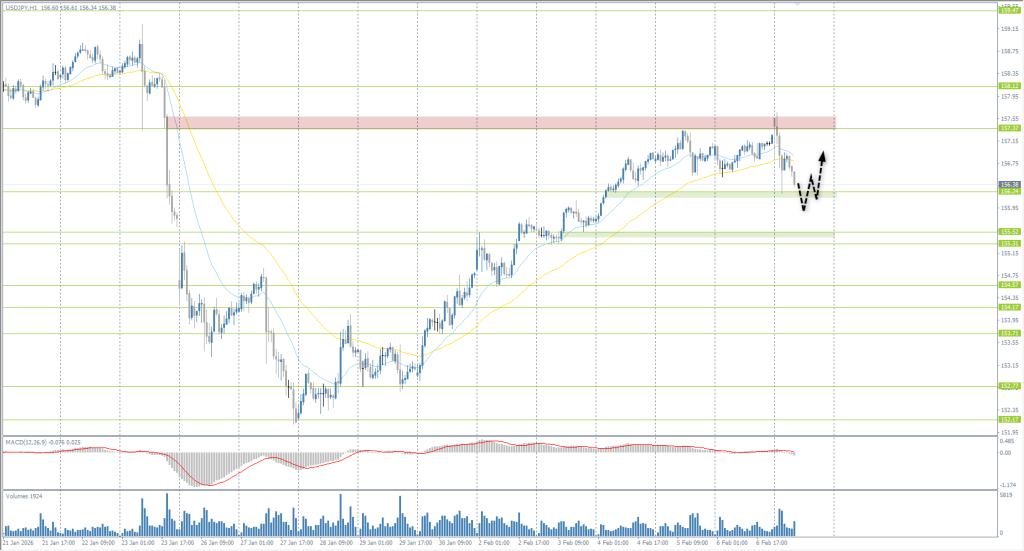

The USD/JPY currency pair

货币对的技术指标:

- 前一开盘价: 156.89

- 前一收盘价: 157.25

- 过去一天的变化%: +0.22 %

On Monday, the Japanese yen strengthened above 157 per dollar, bouncing off a two-week low following the landslide victory of the ruling Liberal Democratic Party (LDP) led by Prime Minister Sanae Takaichi in the Lower House elections – an outcome largely anticipated by the market. This result reinforces expectations of an expansionary fiscal policy, including increased government spending and potential tax concessions. Thus, the current strengthening of the yen appears more corrective, while further currency dynamics will largely depend on the combination of the new government’s fiscal steps, Bank of Japan policy, and official rhetoric regarding the exchange rate.

交易建议

- 支撑价位: 156.24, 155.52, 155.31, 154.57, 154.17, 153.71

- 阻力价位: 157.37, 158.12

The Japanese yen opened with an upside gap and strengthened sharply thereafter; however, the current movement appears more technical than fundamentally justified. There are currently few significant macroeconomic or political factors capable of providing sustained support for the yen, so the current strengthening is perceived as a corrective phase. In this context, a decline in quotes looks like a more attractive scenario for finding buy entry points. Zones near 156.24 and 155.52 are considered key areas of potential demand, though entries are only advisable after confirming signals. Selling opportunities appear limited in the current market structure.

选择场景:- Trend: Up

- Sup: 156.24

- Res: 157.37

- Note: We expect a correction to 156.24 and 155.52 to look for buy trades. There are no optimal entry points for selling.

新闻动态: 2026.02.09

- Japan Average Cash Earnings (m/m) at 01:30 (GMT+2). – JPY (MED)

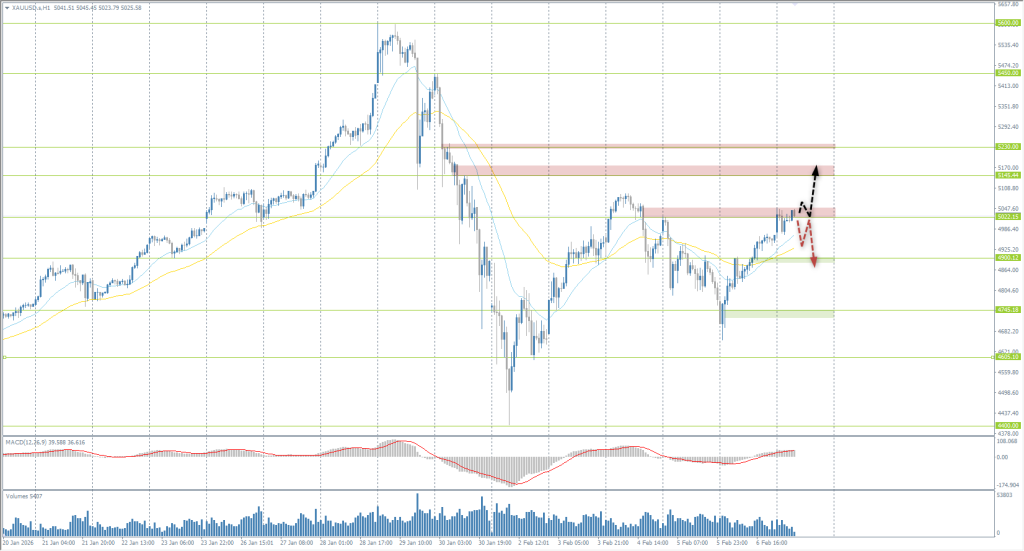

The XAU/USD currency pair (gold)

货币对的技术指标:

- 前一开盘价: 4771

- 前一收盘价: 4968

- 过去一天的变化%: +4.12 %

On Monday, gold prices climbed above $5,000 per ounce, reaching a one-week high. The rally was driven by a weakening US dollar amid expectations of key macroeconomic releases that could clarify the Federal Reserve’s interest rate trajectory. Market focus is centered on the US January Jobs Report (scheduled for Wednesday) and inflation data (slated for Friday). These releases will be critical for assessing the timing and scale of potential Fed easing. Fundamentally, robust institutional demand persists: the People’s Bank of China increased its gold reserves for the 15th consecutive month in January, confirming strategic official-sector support for the metal.

交易建议

- 支撑价位: 4900, 4745, 4605, 4400

- 阻力价位: 5022, 5145, 5230

On Monday, gold opened with a small gap that was quickly closed, after which the price moved toward key resistance near 5022. At this point, the market is in a decision phase, and further movement will depend on the participants’ reaction to this level. A hold above 5050 will indicate buyer readiness to continue the move, opening potential toward 5145. Otherwise, increased seller activity from 5022 could lead to a corrective decline with a near-term target of 4900, where the market may again seek support.

选择场景:- Trend: Neutral

- Sup: 5022

- Res: 4900

- Note: If 5022 is broken intraday, look for buys targeting 5145. Sells should only be considered after evaluating the price reaction to liquidity at 5022.

今天没有新闻

本文仅反映个人观点,不应被视为投资建议和/或要约和/或进行金融交易的持续要求和/或担保和/或对未来事件的预测。