The EUR/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.1616

- قبلی بستن: 1.1631

- % chg. در طول روز گذشته: +0.13 %

The US dollar weakened on Friday after the release of Consumer Price Index data, which was slightly weaker than market expectations, reinforcing investors’ confidence that the Federal Reserve will have more room to cut interest rates in the coming months. Against this backdrop, the EUR/USD exchange rate rose. The euro received additional support from positive macroeconomic data from the Eurozone. The manufacturing PMI rose to 50.0 in October, exceeding the expectations of 49.8. The services PMI rose to 52.6, while analysts had expected a decline to 51.2.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.1621, 1.1600, 1.1543

- سطوح مقاومت: 1.1638, 1.1667, 1.1686, 1.1728

The hourly trend for EUR/USD is bullish. On Friday, the euro jumped to 1.1638, after which the price fluctuated in the range of 1.1621-1.1638. It is important for buyers to keep the price above 1.1621, as an impulsive drop below this level could form a locked balance and lead to a sell-off to 1.1596. However, this scenario is not a priority at the moment, as the intraday bias remains bullish. It is best to consider buying from 1.1621, with confirmation. Consolidation above 1.1640 will open the way for the price to 1.1668.

سناریوی جایگزین:if the price breaks below the 1.1543 support and consolidates, a bearish trend will likely resume.

خوراک خبری برای: 2025.10.27

- German ifo Business Climate (m/m) at 11:00 (GMT+2);

- US Durable Goods Orders (m/m) (tentative).

The GBP/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.3321

- قبلی بستن: 1.3308

- % chg. در طول روز گذشته: -0.09 %

The UK manufacturing PMI rose to 49.6 in October 2025 from 46.2 in September, significantly exceeding market expectations of 46.6. Although the indicator still points to a contraction, it was the least pronounced since October 2024, indicating a slowdown in the decline in the industry. The Business Activity Index in the services sector was 51.1 in October, compared to 50.8 in September, in line with analysts’ expectations. The growth rate was the second weakest since May, reflecting a cautious recovery in business activity in the UK economy. Overall, however, the data points to the first signs of stabilization in the sectors after several months of decline.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.3281

- سطوح مقاومت: 1.3331, 1.3364, 1.3398, 1.3453, 1.3486

Technically, the trend remains bullish. However, the pound looks weaker than the euro. The pound failed to take advantage of the US dollar’s weakness amid a soft inflation report. Sellers are not allowing the price to consolidate above 1.3331. This level can be considered for selling, but with confirmation on intraday timeframes. If the price consolidates above 1.3331, the path to 1.3364 will open up.

سناریوی جایگزین:if the price breaks through the support level of 1.3253 and consolidates below it, the downtrend will likely resume.

برای امروز خبری نیست

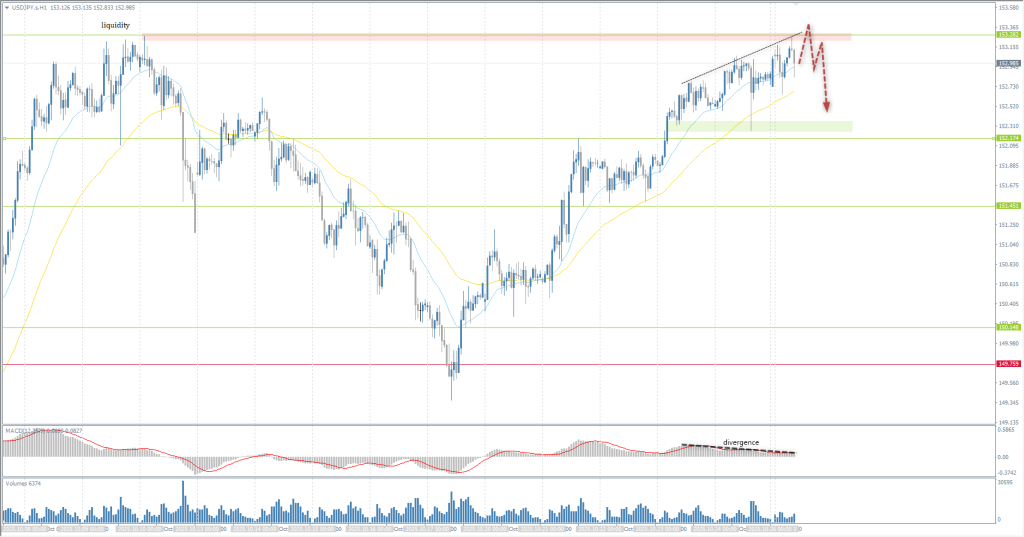

The USD/JPY currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 152.52

- قبلی بستن: 152.82

- % chg. در طول روز گذشته: +0.19 %

The Japanese yen approached its lowest level since February amid expectations of large-scale fiscal stimulus under the new government and uncertainty about the Bank of Japan’s next moves. Since the election of Prime Minister Sanae Takaichi, the yen has weakened significantly as investors price in expectations of expansionary fiscal policy and continued accommodative monetary conditions. Meanwhile, the Bank of Japan, which meets this week, is likely to leave interest rates unchanged, with policymakers expected to discuss the conditions for a possible resumption of the tightening cycle in the future.

توصیه های معاملاتی

- سطوح پشتیبانی: 151.45, 150.15, 149.75

- سطوح مقاومت: 152.15, 153.28, 154.80

The medium-term trend is bullish. The situation has remained virtually unchanged since Friday. The price is still trying to test liquidity above the resistance level of 153.28. The MACD divergence is growing, which increases the likelihood of a corrective movement. There are no optimal entry points for buying right now. For countertrend trades, it is necessary to wait for a false breakout above the level and a reverse impulse as confirmation of the presence of sellers.

سناریوی جایگزین:if the price breaks below 149.75 and consolidates lower, a bearish trend will likely resume.

برای امروز خبری نیست

The XAU/USD currency pair (gold)

شاخص های فنی جفت ارز:

- قبلی باز کن: 4118

- قبلی بستن: 4112

- % chg. در طول روز گذشته: -0.15%

On Monday, gold prices continued to decline, falling by about 1%, as optimism about trade negotiations between the US and China reduced demand for safe-haven assets. After two days of talks in Malaysia, representatives from Washington and Beijing announced that they had reached a preliminary agreement on a number of key issues. This reinforced expectations that US President Donald Trump and Chinese President Xi Jinping would be able to conclude a final trade deal during their meeting in South Korea later this week. Progress in trade talks and expectations of a dovish stance from the Fed boosted risk appetite, leading to profit-taking on gold.

توصیه های معاملاتی

- سطوح پشتیبانی: 4065, 4000, 3946

- سطوح مقاومت: 4162, 4184, 4270, 4379, 4400

Technically, the medium-term trend is bullish. Gold continues to form a wide-volatility flat. The price is compressing into a triangle pattern, which precedes an impulsive movement. While the price remains within the range, it is best to look for buys from the lower border and sells from the upper border. A breakout and consolidation below 4065 could lead to a sharp sell-off to 4000.

سناریوی جایگزین:if the price breaks below support at 3946 and consolidates, a bearish trend will likely resume.

خوراک خبری برای: 2025.10.27

- US Durable Goods Orders (m/m) (tentative).

این مقاله منعکس کننده یک نظر شخصی است و نباید به عنوان یک توصیه سرمایه گذاری و/یا پیشنهاد و/یا درخواست مداوم برای انجام معاملات مالی و/یا تضمین و/یا پیش بینی رویدادهای آتی تفسیر شود.