The EUR/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.1616

- Đóng trước đó: 1.1631

- % thay đổi 24 giờ qua: +0.13 %

The US dollar weakened on Friday after the release of Consumer Price Index data, which was slightly weaker than market expectations, reinforcing investors’ confidence that the Federal Reserve will have more room to cut interest rates in the coming months. Against this backdrop, the EUR/USD exchange rate rose. The euro received additional support from positive macroeconomic data from the Eurozone. The manufacturing PMI rose to 50.0 in October, exceeding the expectations of 49.8. The services PMI rose to 52.6, while analysts had expected a decline to 51.2.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.1621, 1.1600, 1.1543

- Mức kháng cự: 1.1638, 1.1667, 1.1686, 1.1728

The hourly trend for EUR/USD is bullish. On Friday, the euro jumped to 1.1638, after which the price fluctuated in the range of 1.1621-1.1638. It is important for buyers to keep the price above 1.1621, as an impulsive drop below this level could form a locked balance and lead to a sell-off to 1.1596. However, this scenario is not a priority at the moment, as the intraday bias remains bullish. It is best to consider buying from 1.1621, with confirmation. Consolidation above 1.1640 will open the way for the price to 1.1668.

Kịch bản thay thế:if the price breaks below the 1.1543 support and consolidates, a bearish trend will likely resume.

Tin tức cập nhật cho: 2025.10.27

- German ifo Business Climate (m/m) at 11:00 (GMT+2);

- US Durable Goods Orders (m/m) (tentative).

The GBP/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.3321

- Đóng trước đó: 1.3308

- % thay đổi 24 giờ qua: -0.09 %

The UK manufacturing PMI rose to 49.6 in October 2025 from 46.2 in September, significantly exceeding market expectations of 46.6. Although the indicator still points to a contraction, it was the least pronounced since October 2024, indicating a slowdown in the decline in the industry. The Business Activity Index in the services sector was 51.1 in October, compared to 50.8 in September, in line with analysts’ expectations. The growth rate was the second weakest since May, reflecting a cautious recovery in business activity in the UK economy. Overall, however, the data points to the first signs of stabilization in the sectors after several months of decline.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.3281

- Mức kháng cự: 1.3331, 1.3364, 1.3398, 1.3453, 1.3486

Technically, the trend remains bullish. However, the pound looks weaker than the euro. The pound failed to take advantage of the US dollar’s weakness amid a soft inflation report. Sellers are not allowing the price to consolidate above 1.3331. This level can be considered for selling, but with confirmation on intraday timeframes. If the price consolidates above 1.3331, the path to 1.3364 will open up.

Kịch bản thay thế:if the price breaks through the support level of 1.3253 and consolidates below it, the downtrend will likely resume.

Không có tin tức cho ngày hôm nay

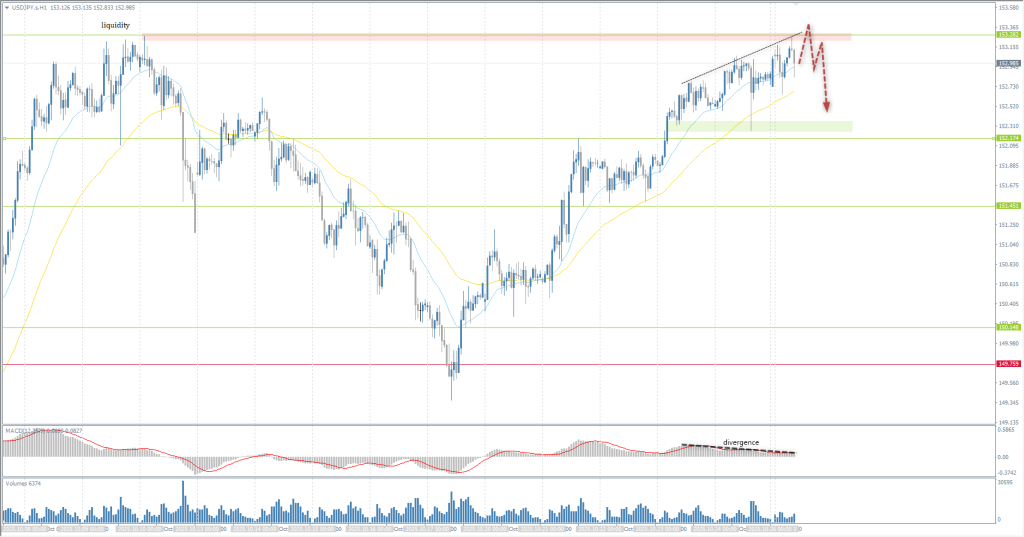

The USD/JPY currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 152.52

- Đóng trước đó: 152.82

- % thay đổi 24 giờ qua: +0.19 %

The Japanese yen approached its lowest level since February amid expectations of large-scale fiscal stimulus under the new government and uncertainty about the Bank of Japan’s next moves. Since the election of Prime Minister Sanae Takaichi, the yen has weakened significantly as investors price in expectations of expansionary fiscal policy and continued accommodative monetary conditions. Meanwhile, the Bank of Japan, which meets this week, is likely to leave interest rates unchanged, with policymakers expected to discuss the conditions for a possible resumption of the tightening cycle in the future.

Khuyến nghị giao dịch

- Mức hỗ trợ: 151.45, 150.15, 149.75

- Mức kháng cự: 152.15, 153.28, 154.80

The medium-term trend is bullish. The situation has remained virtually unchanged since Friday. The price is still trying to test liquidity above the resistance level of 153.28. The MACD divergence is growing, which increases the likelihood of a corrective movement. There are no optimal entry points for buying right now. For countertrend trades, it is necessary to wait for a false breakout above the level and a reverse impulse as confirmation of the presence of sellers.

Kịch bản thay thế:if the price breaks below 149.75 and consolidates lower, a bearish trend will likely resume.

Không có tin tức cho ngày hôm nay

The XAU/USD currency pair (gold)

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 4118

- Đóng trước đó: 4112

- % thay đổi 24 giờ qua: -0.15%

On Monday, gold prices continued to decline, falling by about 1%, as optimism about trade negotiations between the US and China reduced demand for safe-haven assets. After two days of talks in Malaysia, representatives from Washington and Beijing announced that they had reached a preliminary agreement on a number of key issues. This reinforced expectations that US President Donald Trump and Chinese President Xi Jinping would be able to conclude a final trade deal during their meeting in South Korea later this week. Progress in trade talks and expectations of a dovish stance from the Fed boosted risk appetite, leading to profit-taking on gold.

Khuyến nghị giao dịch

- Mức hỗ trợ: 4065, 4000, 3946

- Mức kháng cự: 4162, 4184, 4270, 4379, 4400

Technically, the medium-term trend is bullish. Gold continues to form a wide-volatility flat. The price is compressing into a triangle pattern, which precedes an impulsive movement. While the price remains within the range, it is best to look for buys from the lower border and sells from the upper border. A breakout and consolidation below 4065 could lead to a sharp sell-off to 4000.

Kịch bản thay thế:if the price breaks below support at 3946 and consolidates, a bearish trend will likely resume.

Tin tức cập nhật cho: 2025.10.27

- US Durable Goods Orders (m/m) (tentative).

Bài viết này phản ánh quan điểm cá nhân và không nên được hiểu là lời khuyên và/hoặc đề nghị đầu tư và/hoặc hối thúc thực hiện các giao dịch tài chính và/hoặc bảo đảm và/hoặc dự báo về các sự kiện trong tương lai.