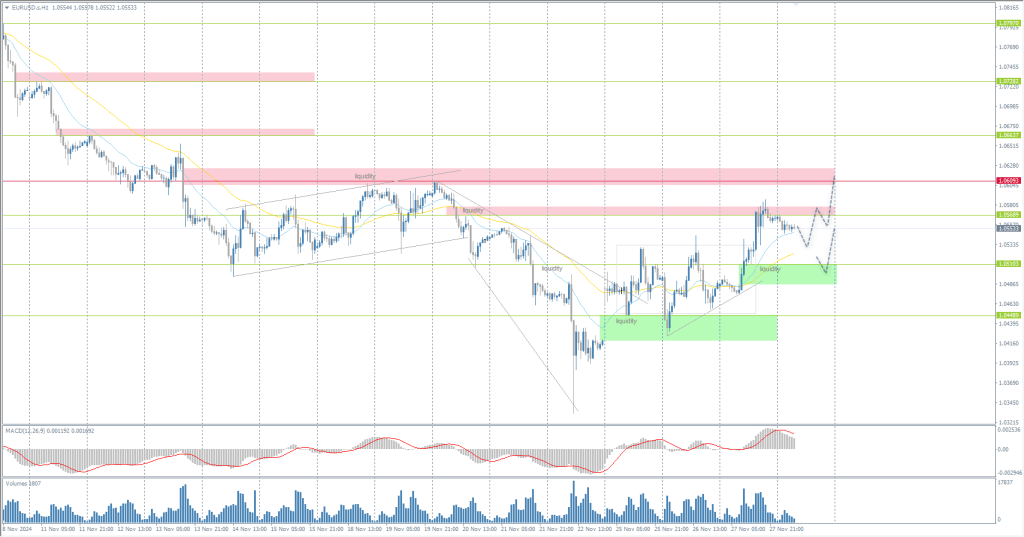

The EUR/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.0484

- Précédent Fermer: 1.0565

- % vari. au cours du dernier jour: +0.77 %

The euro rose above $1.051 after ECB official Isabel Schnabel warned against excessive rate cuts. She warned that borrowing costs are close to neutral and excessive easing could deplete policy space, prompting markets to lower expectations for ECB rate cuts through 2025. Controversy over the ECB’s approach is intensifying as inflation approaches the 2% target amid the Eurozone’s economic problems.

Recommandations de trading

- Niveaux de support: 1.0510, 1.0470, 1.0449, 1.0233

- Niveaux de résistance: 1.0568, 1.0609, 1.0654, 1.0714

The EUR/USD currency pair’s hourly trend is bearish. Yesterday, the euro broke through the resistance level of 1.0510 and reached the next resistance level of 1.0569, where some position fixation was observed ahead of Thanksgiving and Black Friday. As the intraday bias remains bullish, intraday traders are best advised to focus on buying. The most favorable level is 1.0510. Selling can be sought after a liquidity test above 1.0609.

Scénario alternatif:if the price breaks the resistance level of 1.0609 and consolidates above it, the uptrend will likely resume.

Fil d'actualité pour: 2024.11.28

- German GfK German Consumer Climate (m/m) at 11:30 (GMT+2);

- US PCE Price Index (m/m) at 15:30 (GMT+2);

- US GDP (q/q) at 15:30 (GMT+2);

- US Durable Goods Orders (m/m) at 15:30 (GMT+2);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+2);

- US Chicago PMI (m/m) at 16:45 (GMT+2).

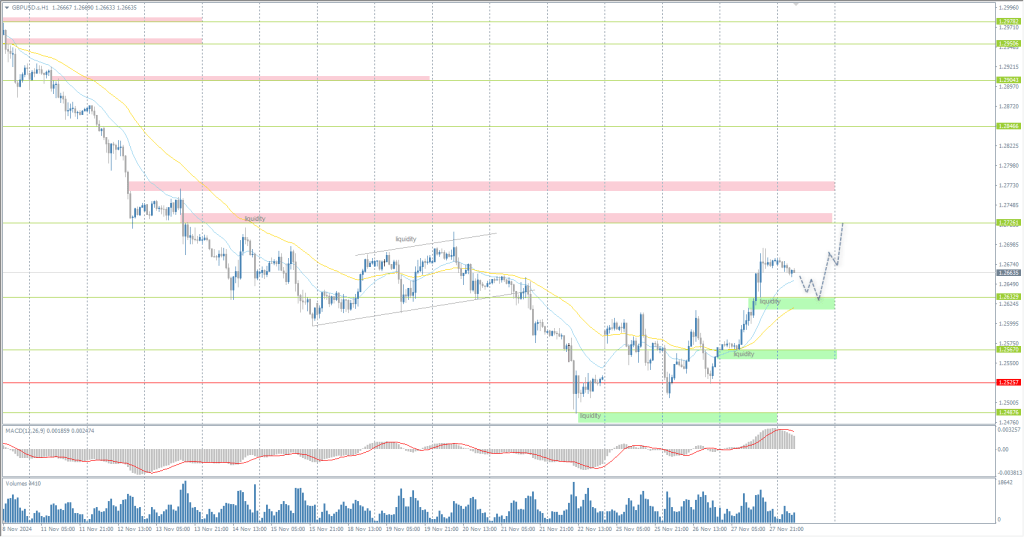

The GBP/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.2568

- Précédent Fermer: 1.2679

- % vari. au cours du dernier jour: +0.88 %

The British pound sterling strengthened and approached $1.26, after falling to six-month lows earlier this month, although investors remain cautious and assessing the potential consequences of a second Donald Trump administration. Trump doubled down on his threats to raise tariffs, mentioning tariff hikes of 10% for China and 25% for Mexico and Canada. Meanwhile, disappointing UK economic data raised the stakes for a Bank of England rate cut.

Recommandations de trading

- Niveaux de support: 1.2633, 1.2567, 1.2487

- Niveaux de résistance: 1.2726, 1.2766, 1.2878, 1.2905, 1.2982, 1.3023

From the point of view of technical analysis, the trend on the GBP/USD currency pair has changed to an upward trend. Buyers managed to consolidate above the priority level change. Intraday, we can now look for buying from 1.2633, subject to the reaction of the buying side. The profit target is 1.2726. There are no optimal entry points for selling now.

Scénario alternatif:if the price breaks the support level at 1.2526 and consolidates below it, the downtrend is likely to resume.

Fil d'actualité pour: 2024.11.28

There is no news feed for today.

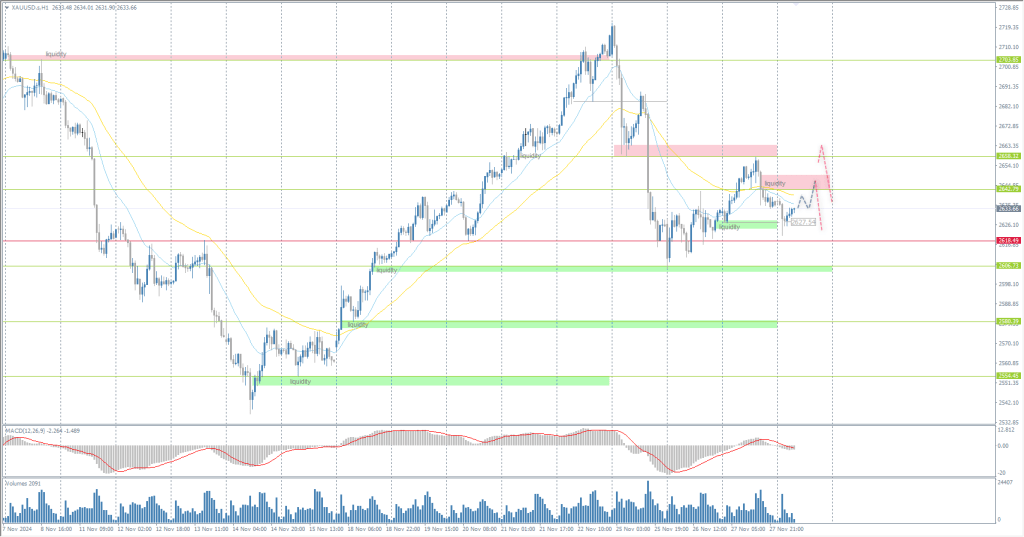

The XAU/USD currency pair (gold)

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 2632

- Précédent Fermer: 2636

- % vari. au cours du dernier jour: +0.15 %

Gold rose to $2,640 per ounce on Wednesday, extending gains from the previous session as investors digested fresh economic data. Core PCE prices failed to beat expectations in October, tempering market hopes that the US Federal Reserve would cut rates once again in December. However, the new data also indicated some resilience in the economy, limiting the need to reduce borrowing costs next year. Personal income exceeded expectations, spending remained steady, and jobless claims remained at multi-month lows.

Recommandations de trading

- Niveaux de support: 2628, 2618, 2580, 2559, 2471

- Niveaux de résistance: 2642, 2658, 2704, 2708, 2733, 2749

From the point of view of technical analysis, the trend on the XAU/USD is bullish, but close to change. Price is starting to form a flat accumulation. Taking into account that today is Thanksgiving Day in the United States (a banking holiday) and tomorrow is Black Friday (a short trading day), we should expect a decrease in liquidity, and the price will probably remain in the trading range until the end of the week. There are no optimal entry points for buying right now. For selling, 2642 can be considered, subject to the reaction of the selling side.

Scénario alternatif:if the price breaks and consolidates below the support level of 2618, the downtrend will likely resume.

Fil d'actualité pour: 2024.11.28

There is no news feed for today.

Cet article reflète une opinion personnelle et ne doit pas être interprété comme un conseil en investissement, et/ou une offre, et/ou une demande persistante de réalisation d'opérations financières, et/ou une garantie, et/ou une prévision d'événements futurs.