The EUR/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.0949

- Précédent Fermer: 1.1199

- % vari. au cours du dernier jour: +2.28 %

The euro continued to rally, rising above $1.13 for the first time since late July 2024 after the European Union announced a 90-day suspension of new tariffs on the US to allow for trade talks. While this helped ease fears of a slowing global economy and rising inflation, it also introduced new uncertainty that could persist for months. On the monetary policy front, money markets adjusted their expectations for a European Central Bank rate cut, pricing in the ECB’s deposit facility rate at 1.8% by December, up from 1.65% on Wednesday and down from 1.9% the previous week. The probability of an April rate cut also fell to 90%, down from the full price just a day earlier.

Recommandations de trading

- Niveaux de support: 1.1157, 1.1088, 1.0960

- Niveaux de résistance: 1.1275, 1.1496

The EUR/USD currency pair’s hourly trend is bullish. The euro strengthened sharply yesterday, breaking through all counter-resistance levels. Currently, the price is trading near the resistance level of 1.1275, but the reaction of sellers is weak, which increases the probability of further growth. However, it should be noted that the price has strongly deviated from the EMA moving lines, so the growth may be limited. It is recommended that the EMA lines or the support level of 1.1157 be considered for buying. There are no optimal entry points for selling right now.

Scénario alternatif:if the price breaks the support level of 1.0960 and consolidates below it, the downtrend will likely resume.

Fil d'actualité pour: 2025.04.11

- US Producer Price Index (m/m) at 15:30 (GMT+3);

- US Michigan Consumer Sentiment (m/m) at 17:00 (GMT+3).

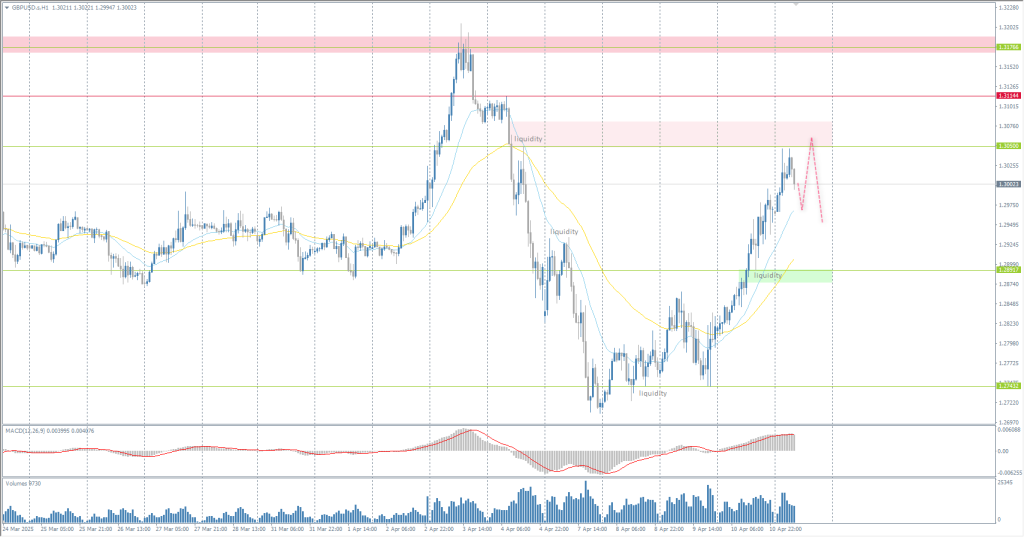

The GBP/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.2814

- Précédent Fermer: 1.2970

- % vari. au cours du dernier jour: +1.21 %

The British pound rose to $1.277, extending gains for a third session, as the US Dollar weakened amid confusion over US trade policy. President Trump announced a 90-day pause in imposing new tariffs on most countries but raised tariffs on China to 145%, easing fears of a full-blown trade war but keeping risks elevated. Markets remain volatile, prompting traders to revise their forecasts for UK interest rates. Odds of a Bank of England rate cut this year have been reduced, and markets now estimate a rate easing of 66 basis points, down from 79 yesterday.

Recommandations de trading

- Niveaux de support: 1.2891, 1.2743

- Niveaux de résistance: 1.3050, 1.3114, 1.3176

From the technical analysis point of view, the trend on the GBP/USD currency is bearish, but it is close to changing. Sterling strengthened sharply yesterday and reached the resistance level of 1.3050. If there is a sellers’ reaction, we can consider selling. For buying, waiting for a wave of decline to the EMA lines or to the support level of 1.2891 is better.

Scénario alternatif:if the price breaks the resistance level of 1.3114 and consolidates above it, the uptrend will likely resume.

Fil d'actualité pour: 2025.04.11

- UK GDP (m/m) at 09:00 (GMT+3);

- UK Industrial Production (m/m) at 09:00 (GMT+3);

- UK Manufacturing Production (m/m) at 09:00 (GMT+3);

- UK Trade Balance (m/m) at 09:00 (GMT+3).

The USD/JPY currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 147.76

- Précédent Fermer: 144.44

- % vari. au cours du dernier jour: -2.29 %

The Japanese yen strengthened to 144 per dollar on Friday, hitting a six-month high. Growing concerns about the US economy triggered a weaker dollar and increased demand for other safe-haven assets. Traditionally seen as a hedge against uncertainty, a parallel sell-off in US Treasuries helped the yen rise further. Meanwhile, markets are closely monitoring the evolving trade relationship between the US and Japan. Tokyo is currently subject to a reduced 10% tariff rate from the US and is seeking more favorable terms in ongoing negotiations.

Recommandations de trading

- Niveaux de support: 142.87, 142.21, 140.45

- Niveaux de résistance: 144.00, 145.14, 147.14

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. The yen reached the support level of 142.87, where buyers showed a reaction. Considering the MACD divergence, we should expect a corrective upward movement. It is best to consider the resistance levels of 144.00 and 145.14 for selling, provided the sellers react. There are no optimal entry points for buying now.

Scénario alternatif:if the price breaks through the resistance level at 147.14 and consolidates above it, the uptrend will likely resume.

Aucune nouvelle pour aujourd'hui

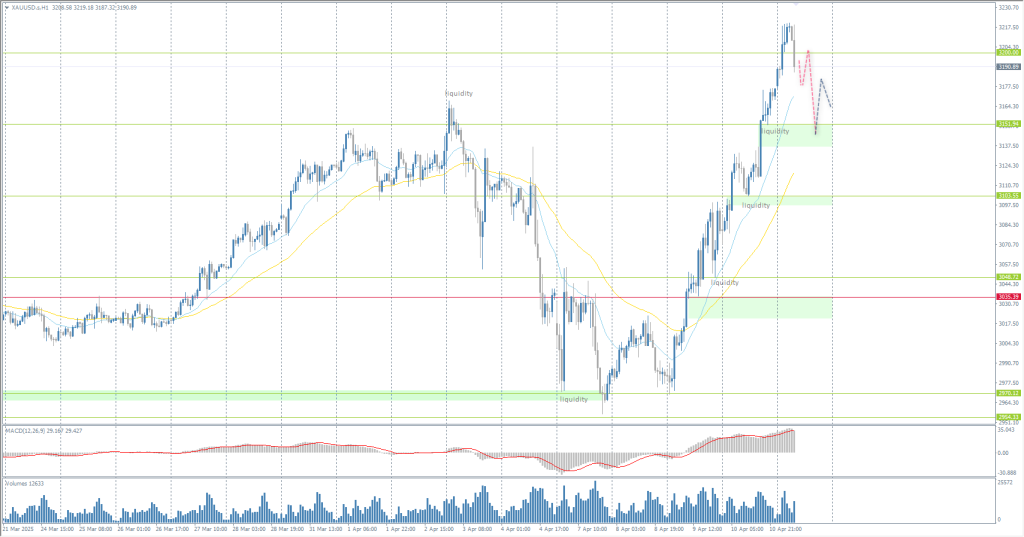

The XAU/USD currency pair (gold)

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 3081

- Précédent Fermer: 3176

- % vari. au cours du dernier jour: +3.08 %

Gold surpassed the $3,200 per ounce mark on Friday, setting a new record, helped by a weaker US dollar and rising safe-haven demand amid escalating trade tensions between the US and China. On Thursday, the US clarified that tariffs on Chinese imports rose to 145%, with the new 125% duties added to the earlier 20% duties. That overshadowed a 90-day pause announced by Trump on raising tariffs on most other countries, as the escalating trade dispute between the two largest economies raised concerns about the possible economic impact. Meanwhile, the US consumer prices unexpectedly fell in March, leading traders to bet that the Fed will resume rate cuts in June and possibly cut rates by a full percentage point by the end of the year.

Recommandations de trading

- Niveaux de support: 3151, 3103, 3048, 3035

- Niveaux de résistance: 3200

From the point of view of technical analysis, the trend on the XAU/USD is bullish again. Gold strengthened sharply yesterday and continued its growth in the Asian session, reaching historical levels and exceeding all bank forecasts that were heard before. It is not recommended to buy at such values, as the price has deviated from the average values. Selling should not be rushed either, as for a reversal, it is necessary to see liquidity capture plus sellers’ reaction. And if the reaction is present now, there was no liquidity capture, which increases the probability of growth continuation. EMA lines or 3151 support level should be considered for buying.

Scénario alternatif:if the price breaks and consolidates below the support level of 3035, the downtrend will likely resume.

Fil d'actualité pour: 2025.04.11

- US Producer Price Index (m/m) at 15:30 (GMT+3);

- US Michigan Consumer Sentiment (m/m) at 17:00 (GMT+3).

Cet article reflète une opinion personnelle et ne doit pas être interprété comme un conseil en investissement, et/ou une offre, et/ou une demande persistante de réalisation d'opérations financières, et/ou une garantie, et/ou une prévision d'événements futurs.