The EUR/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.1514

- Précédent Fermer: 1.1421

- % vari. au cours du dernier jour: -0.81 %

The euro is trading around 1.14 against the US dollar. Investors will closely watch April’s fresh Eurozone Manufacturing and Services PMI data. Weak data could hurt the euro. Regarding monetary policy, swaps estimate the chances of a 25 bps ECB rate cut at the June 5 meeting at 93%.

Recommandations de trading

- Niveaux de support: 1.1335, 1.1246, 1.1157, 1.1088, 1.0960

- Niveaux de résistance: 1.1492, 1.1572

The EUR/USD currency pair’s hourly trend is bullish. The euro corrected as expected. However, the correction was deep enough, which led to testing the priority change level 1.1335. Buyers reacted with initiative, showing interest in this level. At the same time, liquidity below the level was captured. Under these market conditions, intraday buying can be considered with a target of up to 1.1492. There are no optimal entry points for selling right now.

Scénario alternatif:if the price breaks the support level of 1.1335 and consolidates below it, the downtrend will likely resume.

Fil d'actualité pour: 2025.04.23

- German Manufacturing PMI (m/m) at 10:30 (GMT+3);

- German Services PMI (m/m) at 10:30 (GMT+3);

- Eurozone Manufacturing PMI (m/m) at 11:00 (GMT+3);

- Eurozone Services PMI (m/m) at 11:00 (GMT+3);

- Eurozone Trade Balance (m/m) at 12:00 (GMT+3);

- US Manufacturing PMI (m/m) at 16:45 (GMT+3);

- US Services PMI (m/m) at 16:45 (GMT+3);

- US New Home Sales (m/m) at 17:00 (GMT+3).

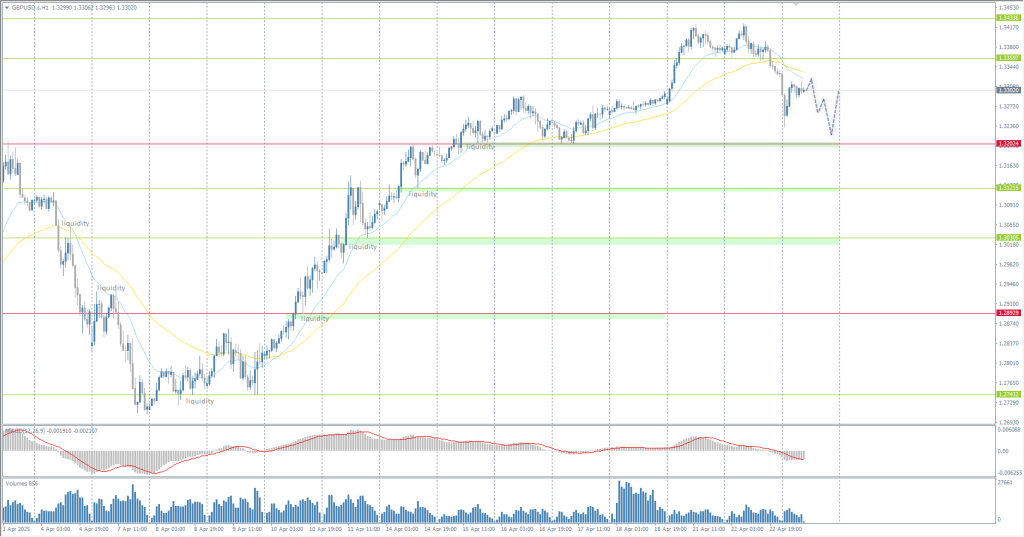

The GBP/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.3367

- Précédent Fermer: 1.3331

- % vari. au cours du dernier jour: -0.27 %

The US Dollar Index fell to a three-year low amid market concerns about the Fed’s independence and economic risks associated with a potential global trade war. Experts say the Bank of England may have more room to support the economy as global trade tensions and household spending weigh on growth. Analysts have raised their bets slightly on a rate cut, and they now estimate a rate easing of 86 basis points by the end of the year, with a fourth rate cut in December becoming increasingly likely.

Recommandations de trading

- Niveaux de support: 1.3202, 1.3121, 1.3030, 1.2891, 1.2743

- Niveaux de résistance: 1.3357, 1.3434

Regarding technical analysis, the currency pair GBP/USD trend on the hourly timeframe is bullish. Following the euro, the British pound also corrected on the US dollar index’s growth. However, unlike the euro, the British pound did not reach the support level. Thus, the scenario with the formation of flat accumulation is probable here. For buy deals, it is better to consider the support level of 1.3203. It is better to evaluate the price reaction to the resistance level at 1.3360 for selling.

Scénario alternatif:if the price breaks the resistance level of 1.3202 and consolidates above it, the uptrend will likely resume.

Fil d'actualité pour: 2025.04.23

- UK Manufacturing PMI (m/m) at 11:30 (GMT+3);

- UK Services PMI (m/m) at 11:30 (GMT+3);

- UK BOE Gov Bailey Speaks at 19:30 (GMT+3).

The USD/JPY currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 140.82

- Précédent Fermer: 141.56

- % vari. au cours du dernier jour: +0.53 %

The Japanese yen traded around 142 per dollar on Wednesday after losing more than 1% in the previous session, led by the dollar’s gains amid signs of easing trade tensions between the US and China and easing concerns about the Federal Reserve’s independence. US President Donald Trump boosted investor confidence by saying he has no intention of ousting Federal Reserve Chairman Jerome Powell, reducing uncertainty over the direction of US monetary policy. In Japan, fresh data boosted the domestic market, showing that private sector activity increased in April after contracting in March. The recovery was driven by strong growth in the services sector.

Recommandations de trading

- Niveaux de support: 141.02, 140.18, 139.59

- Niveaux de résistance: 143.08, 144.09

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. Despite the correction, the bias remains behind the bears. Currently, the price is trading near the EMA lines. Possible scenario with the formation of a flat. During the day, we can look for deals to sell to support level 141.02. Traders should refrain from buying at the moment.

Scénario alternatif:if the price breaks through the resistance level at 143.08 and consolidates above it, the uptrend will likely resume.

Fil d'actualité pour: 2025.04.23

- Japan Manufacturing PMI (m/m) at 03:30 (GMT+3);

- Japan Services PMI (m/m) at 03:30 (GMT+3).

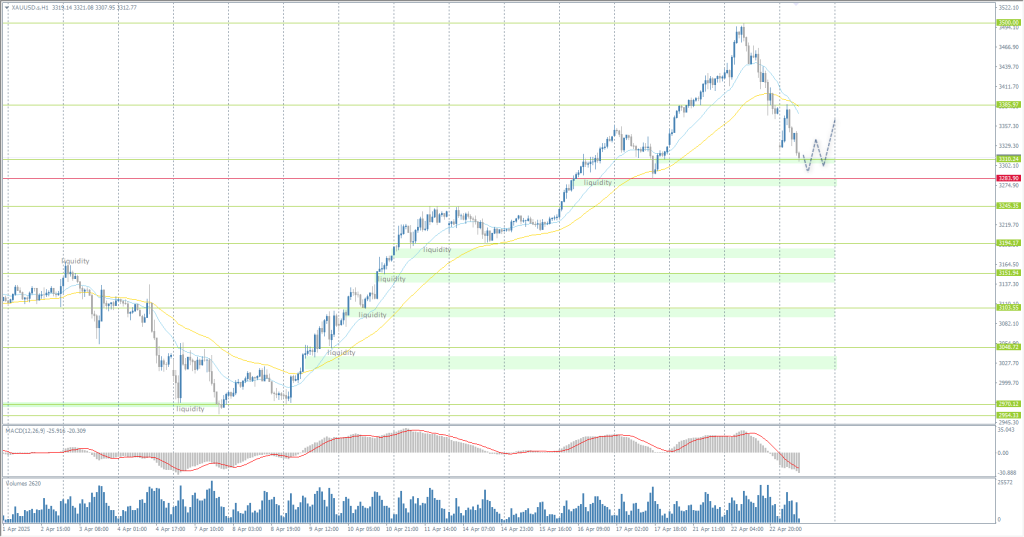

The XAU/USD currency pair (gold)

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 3423

- Précédent Fermer: 3381

- % vari. au cours du dernier jour: -1.24 %

Worries about growing tariffs against China and attempts to impose tariffs on key goods for the US economy made some global investors question the sustainability of the US financial exclusivity and abandon the US Treasuries and the dollar in favor of gold and foreign real money in search of safety. As a result, gold prices are up more than 33% YTD, and the gold/silver ratio is at its highest since 1994, excluding the pandemic.

Recommandations de trading

- Niveaux de support: 3310, 3283, 3245, 3194

- Niveaux de résistance: 3385, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold was corrected as profit-taking. Buyers started to close previously opened positions when the price reached the psychological mark of 3500. But it is too early to talk about a mid-term full reversal. The price has reached the support level 3310, and buyers are reacting here. In this scenario, we can consider buying from 3310 or the 3283 priority change level, but with confirmation in the form of a price reaction. There are no optimal entry points for selling now.

Scénario alternatif:if the price breaks and consolidates below the support level of 3283, the downtrend will likely resume.

Fil d'actualité pour: 2025.04.23

- US Manufacturing PMI (m/m) at 16:45 (GMT+3);

- US Services PMI (m/m) at 16:45 (GMT+3);

- US New Home Sales (m/m) at 17:00 (GMT+3).

Cet article reflète une opinion personnelle et ne doit pas être interprété comme un conseil en investissement, et/ou une offre, et/ou une demande persistante de réalisation d'opérations financières, et/ou une garantie, et/ou une prévision d'événements futurs.