The EUR/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.1281

- Précédent Fermer: 1.1329

- % vari. au cours du dernier jour: +0.42 %

The euro climbed above $1.13, reaching its strongest level since May 6, helped by a general weakening of the US dollar amid growing concerns over the US budget outlook. Debate surrounding the proposed US tax cut bill has heightened fears that the budget deficit could widen faster than previously thought, following the recent downgrade of the US credit rating by Moody’s. In Europe, the ECB’s May 2025 Financial Stability Review highlights growing concerns about the financial stability of the Eurozone, pointing to escalating geopolitical tensions and ongoing policy uncertainty.

Recommandations de trading

- Niveaux de support: 1.1320, 1.1276, 1.1220, 1.1170, 1.1135, 1.1088, 1.1017, 1.0902

- Niveaux de résistance: 1.1379, 1.1440

The EUR/USD currency pair’s hourly trend has changed to an upward trend. The price has consolidated above the level of 1.1320 and now this level acts as support for the uptrend. Further price growth up to 1.1379 is expected. However, if the price impulsively consolidates below 1.1320, it will cause a correction to 1.1276.

Scénario alternatif:if the price breaks the support level of 1.1172 and consolidates below it, the downtrend will likely resume.

Fil d'actualité pour: 2025.05.22

- Eurozone German Manufacturing PMI (m/m) at 10:30 (GMT+3);

- Eurozone German Services PMI (m/m) at 10:30 (GMT+3);

- Eurozone Manufacturing PMI (m/m) at 11:00 (GMT+3);

- Eurozone Services PMI (m/m) at 11:00 (GMT+3);

- Eurozone German ifo Business Climate (m/m) at 11:00 (GMT+3);

- Eurozone ECB Monetary Policy Meeting Accounts at 14:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US Manufacturing PMI (m/m) at 16:45 (GMT+3);

- US Services PMI (m/m) at 16:45 (GMT+3);

- US Existing Home Sales (m/m) at 17:00 (GMT+3).

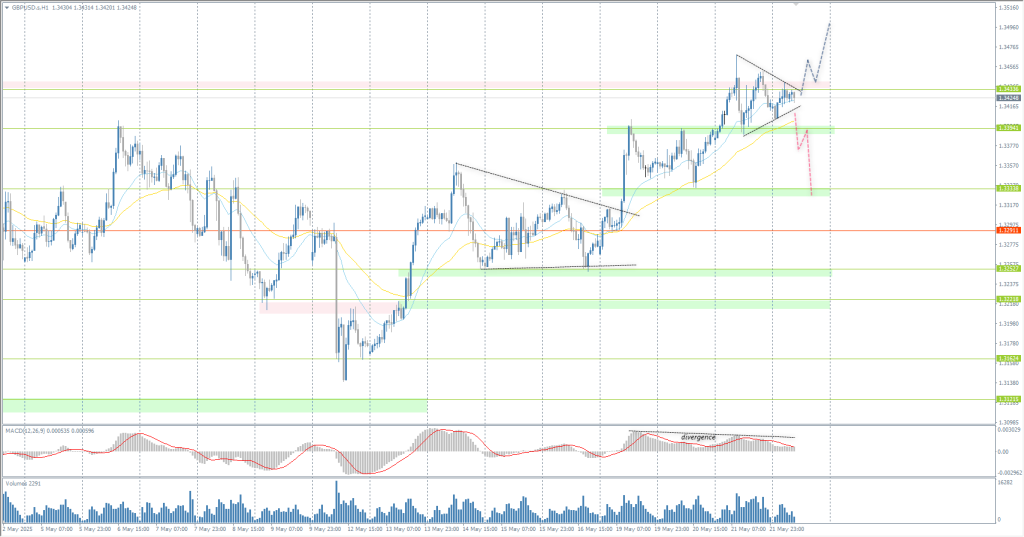

The GBP/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.3383

- Précédent Fermer: 1.3419

- % vari. au cours du dernier jour: +0.27 %

The British pound weakened earlier gains and stabilized around $1.34 after briefly reaching $1.3469 — the strongest level since February 2022 — following the release of better-than-expected UK inflation data. Annual inflation accelerated to 3.5% in April, reaching its highest level since January 2024 and beating both the market expectations of 3.3% and the Bank of England’s 3.4% expectations. Services inflation rose to 5.4% from 4.7%, pointing to continued underlying price pressures. In response, market expectations for further easing have shifted, with only one additional 25 basis point rate cut before the end of the year now priced in, and the probability of an August cut reduced to 40% from 60%.

Recommandations de trading

- Niveaux de support: 1.3382, 1.3333, 1.3291, 1.3121

- Niveaux de résistance: 1.3434

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly is bullish. The British pound continues to grow steadily. At the moment, a divergence has formed on the MACD indicator, indicating a possible correction. For buy deals, it is best to consider the EMA lines, or the support level of 1.3394. Selling can be considered if the price from the narrowing triangle of the impulse closes below 1.3394. In such a case, a path to 1.3333 will be opened for the price.

Scénario alternatif:if the price breaks the support level of 1.3291 and consolidates below it, the downtrend will likely resume.

Fil d'actualité pour: 2025.05.22

- UK Manufacturing PMI (m/m) at 11:30 (GMT+3);

- UK Services PMI (m/m) at 11:30 (GMT+3).

The USD/JPY currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 144.48

- Précédent Fermer: 143.66

- % vari. au cours du dernier jour: -0.57 %

The Bank of Japan (BoJ) will revise its plan to reduce Japanese government bond (JGB) purchases at its June 2025 meeting and set new guidelines in April 2026 in an effort to provide clarity on long-term policy, BoJ board spokesman Noguchi said in a statement. Seeing no need for major changes now, Noguchi emphasized the importance of a gradual, stability-oriented approach to balance sheet reduction. He noted that the Central Bank has plenty of time to normalize policy. On GDP, Noguchi said Japan’s economy is steadily recovering, although inflation remains elevated due to rising food prices and a weaker yen, which has exacerbated the import cost carry over.

Recommandations de trading

- Niveaux de support: 143.01

- Niveaux de résistance: 144.10, 144.80, 145.46, 146.36, 148.28, 150.47

From a technical point of view, the medium-term trend of the USD/JPY is bearish. Currently, the price is aiming at the demand zone below the support level of 143.01. For sell deals, we can consider the EMA lines or the resistance level of 144.11, but with confirmation. The MACD divergence indicates weakness, so there is a high probability of a corrective bounce from the 143.01 support level.

Scénario alternatif:if the price breaks the resistance level of 147.12 and consolidates above it, the uptrend will likely resume.

Fil d'actualité pour: 2025.05.22

- Japan Manufacturing PMI (m/m) at 03:30 (GMT+3);

- Japan Services PMI (m/m) at 03:30 (GMT+3).

The XAU/USD currency pair (gold)

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 3291

- Précédent Fermer: 3315

- % vari. au cours du dernier jour: +0.73 %

Gold rose to $3340 an ounce on Thursday, hitting a near two-week high for the fourth consecutive session, as investors sought safe-haven assets amid growing concerns over the US budget outlook. Risk sentiment eased after the release of the proposed US federal budget, which could further increase the already large deficit, and the recent downgrade of the US credit rating.

Recommandations de trading

- Niveaux de support: 3320, 3251, 3204, 3151, 3103, 3049

- Niveaux de résistance: 3347, 3370

From the point of view of technical analysis, the trend on the XAU/USD is bullish. The price has consolidated above the dynamic EMA lines and above the priority shift level. The support level of 3320 supports the upward movement. A break of this level may trigger a strong sell-off to 3251. However, as long as the price is above this level, the price will tend to test the resistance level of 3347 and 3370.

Scénario alternatif:if the price breaks and consolidates below the support level of 3204, the downtrend will likely resume.

Fil d'actualité pour: 2025.05.22

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US Manufacturing PMI (m/m) at 16:45 (GMT+3);

- US Services PMI (m/m) at 16:45 (GMT+3);

- US Existing Home Sales (m/m) at 17:00 (GMT+3).

Cet article reflète une opinion personnelle et ne doit pas être interprété comme un conseil en investissement, et/ou une offre, et/ou une demande persistante de réalisation d'opérations financières, et/ou une garantie, et/ou une prévision d'événements futurs.