The EUR/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.1619

- Précédent Fermer: 1.1563

- % vari. au cours du dernier jour: -0.48 %

According to the minutes of the ECB’s September meeting, representatives generally agreed that the current policy remains in line with the medium-term inflation target of 2%. Although some considered inflation risks to be skewed to the downside and a few to the upside, policymakers agreed that the current level of interest rates is sufficiently resilient to withstand potential shocks in the context of two-sided inflation risks. At the same time, participants noted that the eurozone economy remains relatively strong. Still, growth is weak and subject to several risks, with officials expressing concern about rising geopolitical tensions and the potential impact of increased defense spending on fiscal policy. Investors now expect rates to remain unchanged in the near term, with the possibility of a return to tightening in late 2026.

Recommandations de trading

- Niveaux de support: 1.1515

- Niveaux de résistance: 1.1574, 1.1608, 1.1683, 1.1728, 1.1754, 1.1786, 1.1819

The EUR/USD currency pair’s hourly trend is downward. The euro reached 1.1574 and is now trading lower. This level is important because there is a large pool of liquidity below it, which could cause at least a corrective wave. Intraday, consider selling from 1.1574 or 1.1608 to continue the decline. A breakout and consolidation of the price above the trend line and above 1.1608 will open up opportunities for buying.

Scénario alternatif:if the price breaks through the resistance level of 1.1683 and consolidates above it, the upward trend is likely to resume.

Fil d'actualité pour: 2025.10.10

- US Nonfarm Payrolls (m/m) at 15:30 (GMT+3) (Tentative);

- US Unemployment Rate (m/m) at 15:30 (GMT+3) (Tentative);

- US Michigan Consumer Sentiment (m/m) at 17:00 (GMT+3).

The GBP/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.3399

- Précédent Fermer: 1.3305

- % vari. au cours du dernier jour: -0.70 %

The British pound fell to $1.33, a nine-week low, under pressure from a strengthening dollar and concerns ahead of the UK’s November budget. Traders fear that potential tax increases to meet budget targets could put pressure on an already fragile economy and currency. Chancellor of the Exchequer Rachel Reeves, who will present the budget on November 26, is expected to focus on fiscal discipline, possibly through tax increases, repeating her previous move that brought in £25 billion in employer social contributions. Analysts forecast moderate growth for the UK economy through the end of 2025, with inflation rising to 4%, twice the Bank of England’s target. Markets do not expect the next rate cut by the Bank of England until April next year, with a total of two cuts expected by the end of 2026.

Recommandations de trading

- Niveaux de support: 1.3282, 1.3214

- Niveaux de résistance: 1.3315, 1.3333, 1.3389

In terms of technical analysis, the trend on the currency pair GBP/USD is a downtrend. The British pound failed to break the structure after testing liquidity below 1.3389, after which it fell sharply to 1.3282. There has been some closing of previously opened short positions, but it is too early to talk about a reversal. Intraday, consider selling from 1.3315 or 1.3333. There are currently no optimal entry points for buying.

Scénario alternatif:if the price breaks through the resistance level of 1.3419 and consolidates above it, the uptrend is likely to resume.

Aucune nouvelle pour aujourd'hui

The USD/JPY currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 152.67

- Précédent Fermer: 153.03

- % vari. au cours du dernier jour: +0.24 %

On Friday, the Japanese yen traded at an eight-month low of around 153 per dollar and was on track to fall nearly 4% for the week, its sharpest decline since September last year. The currency weakened after Sanako Takai, a proponent of loose fiscal policy, won Japan’s leadership race and became the next prime minister, raising expectations for increased fiscal spending and monetary easing. On Thursday, Takaichi said the Bank of Japan would determine policy independently while coordinating with the government’s goals. She added that she intended to avoid excessive depreciation of the yen, although her comments had little impact on the currency. Markets now see less than a 50% chance of the Bank of Japan raising rates in December, with expectations shifting to March next year. Meanwhile, data showed that producer prices in Japan rose more than expected in September, further complicating the rate outlook.

Recommandations de trading

- Niveaux de support: 152.60, 151.31, 149.95, 148.83, 147.81

- Niveaux de résistance: 154.80

From a technical point of view, the medium-term trend of the USD/JPY is bullish. The Japanese yen has been trading near the 152.60 level. A flat accumulation is forming. Yesterday’s false breakdown downwards and subsequent consolidation above opened the way for further growth to 154.80. Consolidation below 152.60 will cancel the growth scenario and likely trigger a sell-off to 151.31.

Scénario alternatif:if the price breaks through the support level of 147.05 and consolidates below it, the downtrend is likely to resume.

Fil d'actualité pour: 2025.10.10

- Japan Producer Price Index (m/m) at 02:50 (GMT+3).

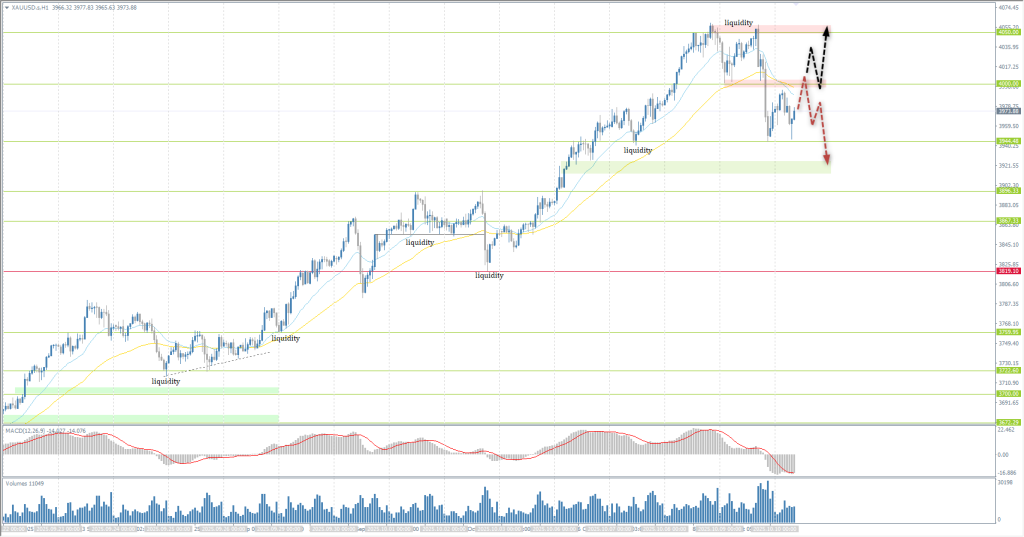

The XAU/USD currency pair (gold)

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 4044

- Précédent Fermer: 3973

- % vari. au cours du dernier jour: -1.78%

On Thursday, gold retreated from a new milestone of $4,000 amid a strengthening US dollar and profit-taking by investors following news that Israel and Hamas had agreed on the first phase of a ceasefire plan. New York Fed President John Williams said he was open to another rate cut, although concerns about rising inflation could complicate such a decision. This echoed the minutes of the latest FOMC meeting, which showed that policymakers see growing risks to the labor market but remain cautious about sustained inflation. Meanwhile, the US government shutdown, now in its second week, has delayed the release of key data and continues to fuel market uncertainty.

Recommandations de trading

- Niveaux de support: 3944, 3896, 3867, 3820, 3800

- Niveaux de résistance: 4000, 4050, 4100

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold corrected sharply yesterday amid profit-taking from the 4050 level. Market conditions indicate that the correction is not yet complete and that gold is likely to test liquidity below 3944. Intraday, you can look for sell deals from 4000, but with confirmation, as these will be countertrend trades. A buying scenario is only likely if the price of bullion consolidates above 4000 again.

Scénario alternatif:if the price breaks the support level of 3819 and consolidates below it, the downtrend will likely resume.

Fil d'actualité pour: 2025.10.10

- US Nonfarm Payrolls (m/m) at 15:30 (GMT+3) (Tentative);

- US Unemployment Rate (m/m) at 15:30 (GMT+3) (Tentative);

- US Michigan Consumer Sentiment (m/m) at 17:00 (GMT+3).

Cet article reflète une opinion personnelle et ne doit pas être interprété comme un conseil en investissement, et/ou une offre, et/ou une demande persistante de réalisation d'opérations financières, et/ou une garantie, et/ou une prévision d'événements futurs.