The EUR/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.1661

- Précédent Fermer: 1.1641

- % vari. au cours du dernier jour: -0.17 %

On Monday, the euro fell slightly. S&P Global Ratings downgraded France’s sovereign rating from AA- to A+, citing increased risks to fiscal consolidation and continued uncertainty regarding public finances. At the same time, risk appetite improved thanks to signs of easing trade tensions between the US and China. This week, investors are awaiting the release of delayed US inflation data to assess the Fed’s further rate cut trajectory.

Recommandations de trading

- Niveaux de support: 1.1618, 1.1600, 1.1543

- Niveaux de résistance: 1.1642, 1.1681, 1.1728, 1.1754, 1.1786, 1.1819

The hourly trend for EUR/USD is bullish. The price has reached the support level of 1.1642 and is now trading below it, which increases the likelihood of a decline to 1.1610 or lower. To resume buying, we need to see the formation of a « locked balance » below the level (in simple terms, a false breakout) and consolidation above the last reversal point for a change in the price structure or above the EMA lines.

Scénario alternatif:If the price breaks below the 1.1543 support and consolidates, a bearish trend will likely resume.

Fil d'actualité pour: 2025.10.21

- Eurozone ECB President Lagarde Speaks at 14:00 (GMT+3).

The GBP/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.3427

- Précédent Fermer: 1.3404

- % vari. au cours du dernier jour: -0.17 %

The British pound is seeing a decline in trading activity amid expectations of the UK budget announcement on November 26. According to banking experts, the upcoming budget is a key event of the year for British markets. Options continue to signal bearish sentiment towards the pound. On the other hand, it is possible that the budget announcement could trigger a strong rally in the pound sterling.

Recommandations de trading

- Niveaux de support: 1.3371, 1.3335, 1.3281

- Niveaux de résistance: 1.3390, 1.3453, 1.3486

Technically, the trend remains bullish. The pound, like the euro, is undergoing a correction. The price has settled below 1.3390, and the intraday bias remains bearish. For growth to resume, it is necessary to wait for a liquidity test below the support level with confirmation in the form of consolidation above the EMA lines.

Scénario alternatif:if the price breaks through the support level of 1.3253 and consolidates below it, the downtrend will likely resume.

Aucune nouvelle pour aujourd'hui

The USD/JPY currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 150.43

- Précédent Fermer: 150.72

- % vari. au cours du dernier jour: +0.19 %

The Japanese yen is falling for the third day in a row. Investors are awaiting a vote in parliament, which is expected to confirm Sanae Takaichi as Japan’s new prime minister. On the monetary front, Bank of Japan board member Hajime Takata said on Monday that the time for raising rates is « approaching. » However, investors expect the Bank of Japan to keep interest rates unchanged at its meeting next week.

Recommandations de trading

- Niveaux de support: 150.15, 149.75, 148.83, 147.81

- Niveaux de résistance: 151.68, 152.50, 153.28, 154.80

The medium-term trend is bullish. The price is likely to test the resistance level of 151.68. Intraday, you can consider buying trades up to this level. It is best to do this from the EMA lines. There are currently no optimal market conditions for selling trades.

Scénario alternatif:If the price breaks below 149.75 and consolidates lower, a bearish trend will likely resume.

Aucune nouvelle pour aujourd'hui

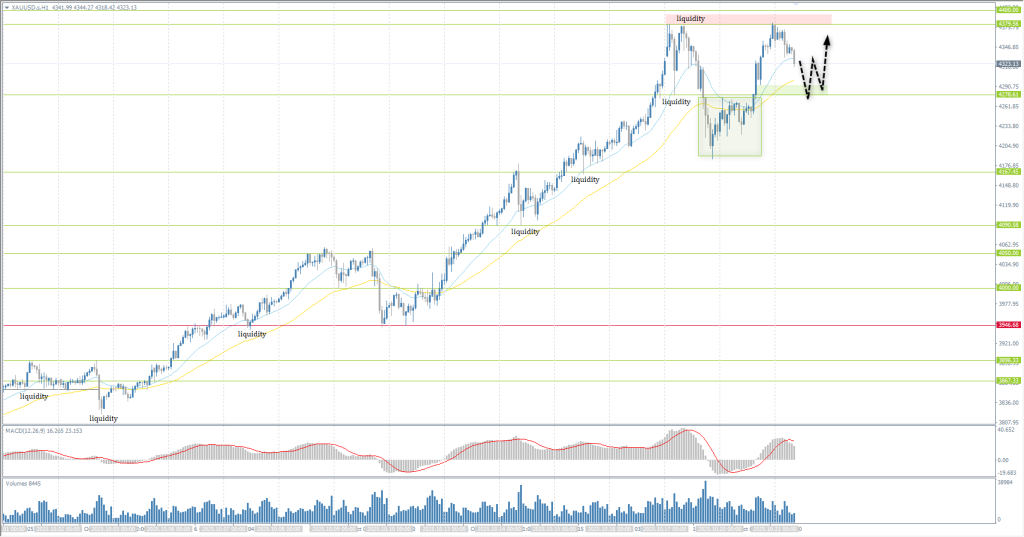

The XAU/USD currency pair (gold)

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 4252

- Précédent Fermer: 4378

- % vari. au cours du dernier jour: +2.96%

Gold hit a new all-time high amid expectations of a Fed rate cut and high demand for safe-haven assets. The US government shutdown remains in effect, and although White House economic adviser Kevin Hassett said in an interview with CNBC that the situation « will probably be resolved this week, » uncertainty remains high. Investors are also closely watching the upcoming negotiations between the US and China. President Donald Trump expressed optimism that the talks could lead to an agreement and called the previously proposed high tariffs on Chinese goods « unsustainable. »

Recommandations de trading

- Niveaux de support: 4278, 4167, 4090, 4050, 4000

- Niveaux de résistance: 4380, 4400, 4500

Technically, the medium-term trend is bullish. Gold resumed its rally, forming a locked balance below the 4278 level. Currently, this accumulation will act as a support area for the price. For buy deals, it is best to use the EMA lines or the 4278 level, but with confirmation on intraday time frames. It is recommended not to buy against impulsive bearish candles. There are no optimal entry points for sell deals at the moment.

Scénario alternatif:If the price breaks below support at 3946 and consolidates, a bearish trend will likely resume.

Aucune nouvelle pour aujourd'hui

Cet article reflète une opinion personnelle et ne doit pas être interprété comme un conseil en investissement, et/ou une offre, et/ou une demande persistante de réalisation d'opérations financières, et/ou une garantie, et/ou une prévision d'événements futurs.