The EUR/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.1617

- Précédent Fermer: 1.1670

- % vari. au cours du dernier jour: +0.45%

German bond yields are holding near 2.75%, the highest level since late September, as strong business activity and inflation data in the Eurozone reduce the likelihood of an imminent ECB rate cut. The rise in the Composite PMI to 52.8 indicates the best pace of private sector expansion since May 2023, and inflation at 2.2% came in slightly above expectations. Amid the ECB’s more « hawkish » tone, markets still expect rates to remain unchanged until at least 2026. Against this backdrop, the euro climbed above $1.165, reaching its highest level since mid-October.

Recommandations de trading

- Niveaux de support: 1.1653, 1.1607, 1.1590, 1.1555, 1.1503

- Niveaux de résistance: 1.1672, 1.1728

The euro consolidated above 1.1653 and reached the resistance level of 1.1672. The price is currently ranging between these levels. Buy trades can be considered from 1.1653, as the lower boundary of the range, but with confirmation and a tight stop-loss. An impulsive break and consolidation below 1.1653 could trigger a sell-off to 1.1607.

Scénario alternatif:- Trend: Up

- Sup: 1.1653

- Res: 1.1672

- Note: Сonsidering buying from 1.1653, but with confirmation. Price consolidation below will trigger a sell-off.

Fil d'actualité pour: 2025.12.04

- Eurozone Retail Sales (m/m) at 12:00 (GMT+2); – EUR (MED)

- US Initial Jobless Claims (w/w) at 15:30 (GMT+2). – USD (MED)

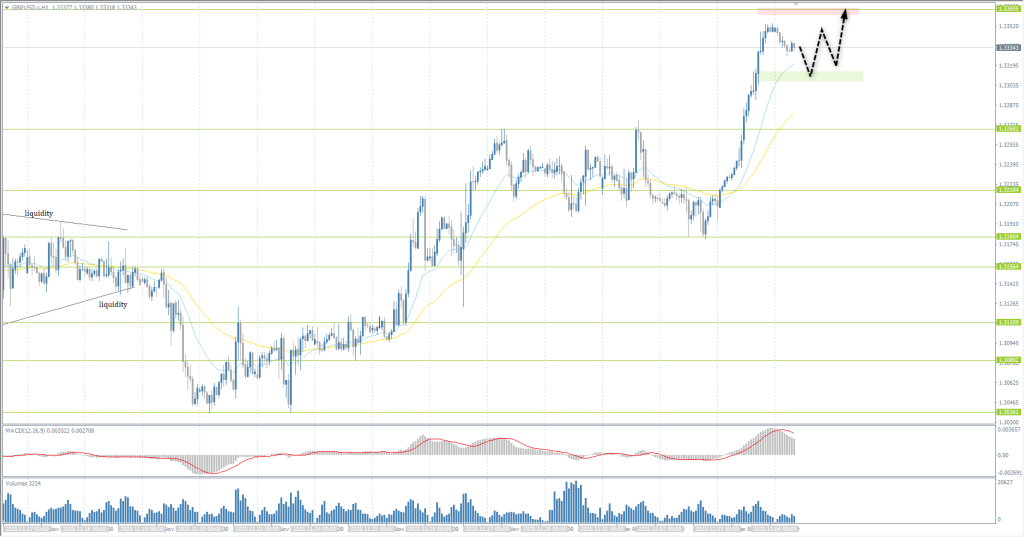

The GBP/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.3210

- Précédent Fermer: 1.3351

- % vari. au cours du dernier jour: +1.07 %

The pound strengthened to $1.33, nearly a month high, supported by a stronger-than-expected Services PMI and a weakening dollar ahead of the Fed meeting. Revised data showed growth in the private sector, although employment is contracting, and services inflation is slowing to a minimum since 2021. The expected Bank of England rate cut in December may be a pause in further policy easing, while the US moves towards a more prolonged series of rate cuts, supporting demand for the pound.

Recommandations de trading

- Niveaux de support: 1.3268, 1.3218, 1.3156, 1.3111, 1.3080

- Niveaux de résistance: 1.3365

The British pound consolidated above the resistance level of 1.3268 and is now heading towards the resistance level of 1.3365. The price has deviated significantly from the moving averages (EMAs), making buying here late. For buy deals, it is ideal to wait for a correction to the EMA lines. For sales, 1.3268 can be considered, but with confirmation in the form of seller initiative.

Scénario alternatif:- Trend: Up

- Sup: 1.3268

- Res: 1.3365

- Note: Considering buy deals from the EMA lines, but with confirmation. Profit target is 1.3365.

Aucune nouvelle pour aujourd'hui

The USD/JPY currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 155.81

- Précédent Fermer: 155.20

- % vari. au cours du dernier jour: -0.39 %

The yen strengthened to 155 per dollar, a two-week high, amid expectations of an imminent Bank of Japan rate hike. Ueda confirmed confidence in the economic outlook and a readiness to consider policy tightening, while authorities emphasize coordination with the government. The currency is further supported by the weakening dollar following weak US employment data, and increased expectations of a Fed rate cut as early as next week.

Recommandations de trading

- Niveaux de support: 154.82, 154.41

- Niveaux de résistance: 155.50, 156.09, 156.40, 157.11, 157.87

Yesterday, the price tested the resistance level of 156.08, followed by a decline below 155.50. It is crucial for sellers to hold the price below 155.50 for the yen to strengthen further. Intraday, sell trades can be considered from 155.50, but with a tight stop-loss. The profit target is 154.82. If the price impulsively consolidates above 155.50, a repeat rise to 156.09 and the formation of a wide trading range should be expected.

Scénario alternatif:- Trend: Neutral

- Sup: 154.82

- Res: 155.50

- Note: Considering sell trades from 155.50, but with a tight stop-loss. Profit target is 154.82.

Aucune nouvelle pour aujourd'hui

The XAU/USD currency pair (gold)

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 4210

- Précédent Fermer: 4206

- % vari. au cours du dernier jour: -0.10%

Gold fell to $4,180 per ounce, remaining near six-week highs, as the market is almost certain of a Fed rate cut as early as next week. The sharp drop in employment according to ADP data reinforced expectations of policy easing, raising the probability of a rate cut to 90%. Investors are awaiting PCE data on Friday for confirmation of inflationary trends, while quotes are additionally supported by persistent geopolitical uncertainty.

Recommandations de trading

- Niveaux de support: 4163, 4145, 4108, 4031, 4007, 3966

- Niveaux de résistance: 4197, 4225, 4379

Gold failed to consolidate above the resistance level of 4225. Sellers were active in this zone, leading to a price drop to 4197. Moreover, in the Asian session, the price impulsively consolidated below 4197, and the path to 4163 is now open again. Intraday traders should consider the resistance level of 4197, but with confirmation. A re-consolidation of the price above 4197 will open the path for growth to 4225.

Scénario alternatif:- Trend: Up

- Sup: 4163

- Res: 4197

- Note: Looking for sales from 4197, but with confirmation. A re-consolidation of the price above 4197 will open the path for growth to 4225.

Fil d'actualité pour: 2025.12.04

- US Initial Jobless Claims (w/w) at 15:30 (GMT+2). – USD (MED)

Cet article reflète une opinion personnelle et ne doit pas être interprété comme un conseil en investissement, et/ou une offre, et/ou une demande persistante de réalisation d'opérations financières, et/ou une garantie, et/ou une prévision d'événements futurs.