The EUR/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.1768

- Précédent Fermer: 1.1748

- % vari. au cours du dernier jour: -0.17%

The FOMC meeting minutes from December 9-10 were perceived by the market as neutral to moderately « hawkish, » providing short-term support to the dollar. A number of Committee members spoke in favor of maintaining rates at current levels for some time, pointing to risks of entrenched elevated inflation and concerns that further rate cuts, while price indicators remain high, could be seen as a weakening commitment to the 2% inflation target. At the same time, some FOMC representatives allowed for the possibility of further policy easing provided inflation continues to slow. Markets currently price the probability of a 25 bps rate cut at the January 27-28 meeting at only 16%.

Recommandations de trading

- Niveaux de support: 1.1738, 1.1707, 1.1680, 1.1656, 1.1590, 1.1555, 1.1503

- Niveaux de résistance: 1.1754, 1.1786, 1.1802, 1.1833

The euro has consolidated below 1.1754, shaking the stability of the bullish trend. The price has now reached the 1.1738 support level, but buyer reaction here is weak. It is crucial for buyers to hold this level; otherwise, a price consolidation below 1.1738 could trigger a sell-off toward 1.1707. To consider buys, initiative from buyers is required, which is currently absent.

Scénario alternatif:- Trend: Neutral

- Sup: 1.173

- Res: 1.1754

- Note: A price consolidation below 1.1738 could trigger a sell-off toward 1.1707.

Aucune nouvelle pour aujourd'hui

The GBP/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.3505

- Précédent Fermer: 1.3466

- % vari. au cours du dernier jour: -0.29 %

Looking ahead to 2026, the Federal Reserve is likely to gradually ease its policy, with the keyword being « gradually. » The Bank of England will likely also be forced to ease its policy, and markets are already anticipating rate cuts. The rate differential generally remains moderately favorable for the dollar, especially given that the US economy is likely to continue outperforming expectations, which may come as a surprise to some investors. An optimistic scenario for the pound assumes persistent inflation in the UK, which would delay BoE easing, while the Fed cuts rates faster than projections.

Recommandations de trading

- Niveaux de support: 1.3445, 1.3347, 1.3354, 1.3292, 1.3268, 1.3156

- Niveaux de résistance: 1.3473, 1.3526, 1.3586

The price has consolidated below the 1.3473 support level. The intraday bias favors sellers. For sales, the 1.3473 level can be considered with a target of 1.3445. A price consolidation below 1.3445 could cause a strong sell-off of the British currency. There are currently no optimal entry points for buys due to a lack of initiative.

Scénario alternatif:- Trend: Neutral

- Sup: 1.3445

- Res: 1.3473

- Note: For sell deals, the 1.3473 level can be considered with a target of 1.3445. No optimal entry points for buys currently.

Aucune nouvelle pour aujourd'hui

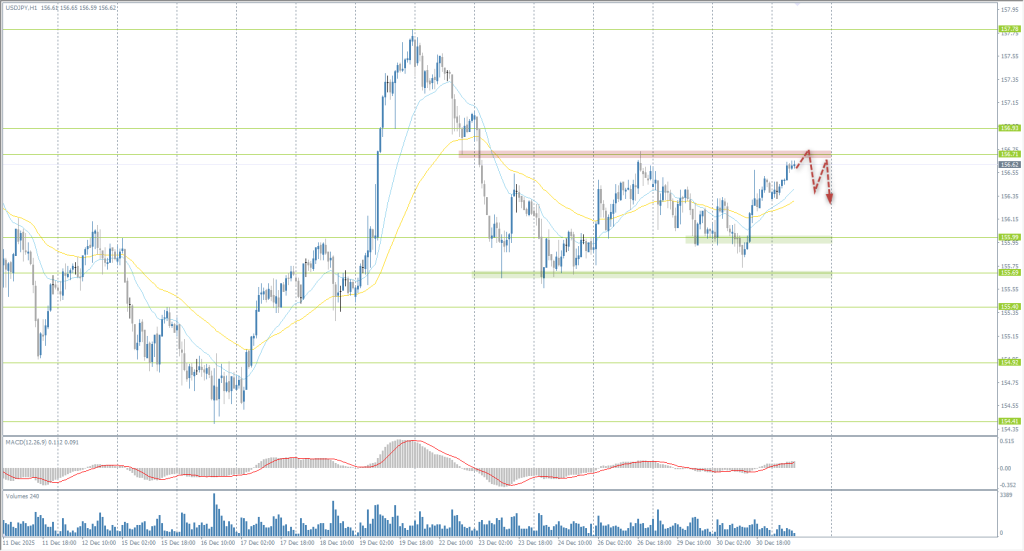

The USD/JPY currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 156.03

- Précédent Fermer: 156.38

- % vari. au cours du dernier jour: +0.22 %

On Tuesday, the yen was under pressure amid a strengthening dollar and rising US Treasury yields. Increasing yields reduced the attractiveness of the yen as a low-yielding currency, intensifying capital outflows and supporting the pair’s upward movement. At the same time, the yen’s weakness was partially limited by the positive backdrop formed after the Bank of Japan meeting on December 19. At that time, several officials indicated that real interest rates in the country remain extremely low, maintaining the likelihood of further policy tightening. Nevertheless, markets still price in only about a 1% probability of a rate hike at the upcoming BoJ meeting on January 23, which has yet to provide the yen with sustainable support.

Recommandations de trading

- Niveaux de support: 156.00, 155.69, 154.92, 154.41, 154.17

- Niveaux de résistance: 156.71, 157.78, 159.47

The Japanese yen failed to reach the 155.69 support level. The price sharply consolidated above 156 and is now heading toward the 156.71 resistance level. Sales can be considered here, but with confirmation. A breakout of 156.71 will open the path to 156.93, where sell deals can also be considered.

Scénario alternatif:- Trend: Neutral

- Sup: 156.00

- Res: 156.71

- Note: Looking for sell deals from 156.71, but with confirmation. A breakout of 156.71 will open the path to 156.93, where sales can also be considered.

Aucune nouvelle pour aujourd'hui

The XAU/USD currency pair (gold)

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 4335

- Précédent Fermer: 4336

- % vari. au cours du dernier jour: +0.02%

On the last trading day of 2025, gold declined to a level near $4,300 per ounce amid profit-taking; however, the metal is still ending the year with its strongest growth in over 40 years. Over the year, the price of gold has risen by approximately 66%, with momentum intensifying in late April following the introduction of global tariffs by the Donald Trump administration. The market was supported by geopolitical uncertainty, falling US interest rates, active central bank purchases, and steady inflows into gold ETFs.

Recommandations de trading

- Niveaux de support: 4309, 4294

- Niveaux de résistance: 4375, 4400, 4441, 4500, 4550

Gold tested liquidity below the 4329 and 4294 support levels. Following this, the price rose impulsively and is currently trading near 4329. A locked balance of sellers has already formed below this level, so a price consolidation above 4329 will open the path to 4400. There are currently no optimal entry points for sales.

Scénario alternatif:- Trend: Neutral

- Sup: 4294

- Res: 4329

- Note: A price consolidation above 4329 will open the path to 4400. There are currently no optimal entry points for sales.

Aucune nouvelle pour aujourd'hui

Cet article reflète une opinion personnelle et ne doit pas être interprété comme un conseil en investissement, et/ou une offre, et/ou une demande persistante de réalisation d'opérations financières, et/ou une garantie, et/ou une prévision d'événements futurs.