The EUR/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.1744

- Précédent Fermer: 1.1745

- % vari. au cours du dernier jour: +0.01%

Weekly unemployment claims in the U.S. unexpectedly fell by 16,000 to 199,000, hitting a one-month low and indicating a more resilient labor market than expected. Despite this, markets still price in only about a 15% probability of a 25 bps Fed rate cut at the January 27-28 meeting. In a broader perspective, the dollar remains under fundamental pressure due to expectations of approximately 50 bps in Fed rate cuts in 2026, while the ECB is expected to keep rates unchanged. Against this backdrop, EUR/USD fell to a weekly low on Wednesday and ended the session with a slight decline as dollar strength pressured the euro. The prospect of a prolonged conflict between Russia and Ukraine following a lack of progress in recent talks also remains a negative factor for the single currency.

Recommandations de trading

- Niveaux de support: 1.1723, 1.1707, 1.1680, 1.1656, 1.1590, 1.1555, 1.1503

- Niveaux de résistance: 1.1765, 1.1786, 1.1802, 1.1833

A locked balance has formed on EUR/USD near 1.1765. The price is currently heading for a retest of liquidity below 1.1723. The intraday bias favors sellers, so we are considering sales today from the EMA lines, but with confirmation. There are currently no optimal entry points for buys.

Scénario alternatif:- Trend: Neutral

- Sup: 1.1723

- Res: 1.1765

- Note: Consider intraday sales from the EMA lines, but with confirmation. No optimal entry points for buys at this time.

Fil d'actualité pour: 2026.01.02

– Eurozone Manufacturing PMI (m/m) at 11:00 (GMT+2). – EUR (MED)

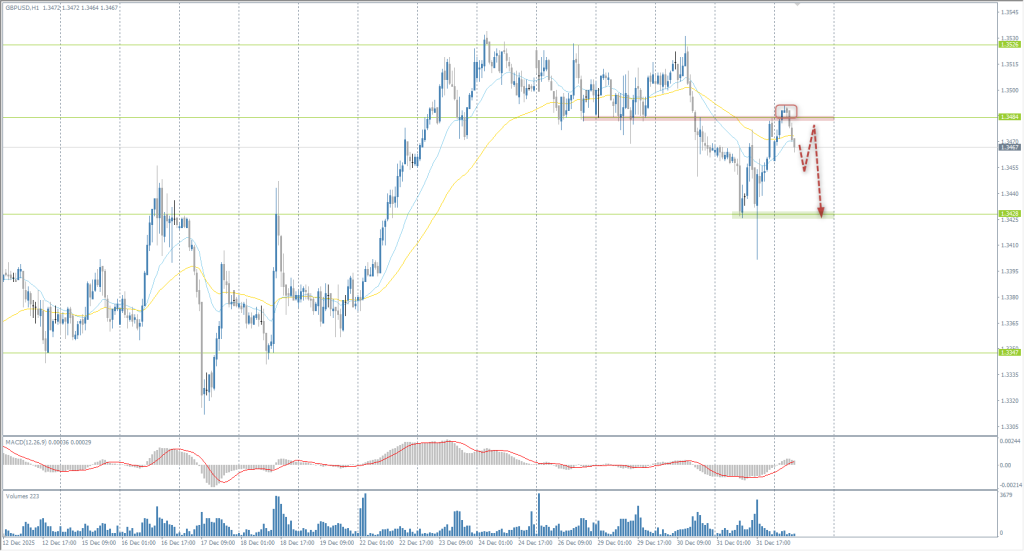

The GBP/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.3464

- Précédent Fermer: 1.3473

- % vari. au cours du dernier jour: +0.07 %

The British Pound ends 2025 near the $1.34 mark, gaining about 7.5% against the US dollar, its best annual result since 2017. The currency was supported by diverging monetary policy expectations: markets are pricing in a more dovish Fed course in 2026 compared to a relatively restrained and cautious approach from the Bank of England, which cut rates four times in 2025 but signaled that further easing could proceed even more slowly. An additional positive factor was the calm autumn budget, which reduced political pressure on the pound in the second half of the year.

Recommandations de trading

- Niveaux de support: 1.3428, 1.3347, 1.3354, 1.3292, 1.3268, 1.3156

- Niveaux de résistance: 1.3484, 1.3526, 1.3586

The situation is very similar to the Euro. A locked balance has formed above the 1.3484 level. As long as the price remains below 1.3484, the intraday bias favors sellers. Traders may consider sell trades from the EMA lines down to the 1.3428 level. There are currently no optimal entry points for buys.

Scénario alternatif:- Trend: Neutral

- Sup: 1.3428

- Res: 1.3484

- Note: Consider sell trades from the EMA lines down to the 1.3428 support level. No optimal entry points for buys at this time.

Fil d'actualité pour: 2026.01.02

– UK Manufacturing PMI (m/m) at 11:30 (GMT+2). – GBP (MED)

The USD/JPY currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 156.33

- Précédent Fermer: 156.66

- % vari. au cours du dernier jour: +0.21 %

On Friday, the Japanese Yen stabilized near 156.6 per dollar after two days of decline, remaining close to ten-month lows, which has again fueled talk of possible currency intervention. Authorities previously curbed Yen weakness with verbal signals; Finance Minister Katayama emphasized readiness to act against sharp exchange rate fluctuations. Pressure is also mounting from the business community, calling on the government to more actively counter currency weakness and support its appreciation.

Recommandations de trading

- Niveaux de support: 156.53, 156.00, 155.69, 154.92, 154.41, 154.17

- Niveaux de résistance: 156.99, 157.78, 159.47

The Japanese Yen is weakening against the dollar again. The price has reached the 156.99 resistance level, where price action needs to be assessed. A breakout and consolidation above this level will open the path toward 157.78. However, if sellers are active and react to 156.99, the price will correct to 156.53.

Scénario alternatif:- Trend: Neutral

- Sup: 156.53

- Res: 156.71

- Note: Looking for sell deals from 156.99, but with confirmation. A breakout of 156.99 will open the path to 157.78.

Aucune nouvelle pour aujourd'hui

The XAU/USD currency pair (gold)

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 4342

- Précédent Fermer: 4318

- % vari. au cours du dernier jour: -0.55%

On the first trading day of 2026, gold rose toward the $4,360 per ounce mark. The market was supported by the December FOMC minutes, which indicated the Fed’s readiness to ease policy if inflation continues to slow, despite internal disagreements on timing and scale. The geopolitical backdrop also remains tense: the US has increased pressure on Venezuelan oil trade, and during the New Year holidays, Russia resumed strikes on Ukraine, including energy facilities and Black Sea ports, which continues to support demand for gold as a safe-haven asset.

Recommandations de trading

- Niveaux de support: 4329, 4294

- Niveaux de résistance: 4400, 4441, 4500, 4550

A locked balance has formed on gold below 4329. The liquidity formed within this balance is now being distributed above the resistance levels. Therefore, the intraday bias is currently favoring buyers. Intraday, buy trades can be considered from the EMA lines or from the 4329 support level. The profit target is the 4400 level, where buy trades can be sought provided there is a reaction from sellers.

Scénario alternatif:- Trend: Neutral

- Sup: 4329

- Res: 4400

- Note: Intraday, buy trades can be considered from the EMA lines or the 4329 support level. Profit target is 4400.

Aucune nouvelle pour aujourd'hui

Indicateurs techniques de la paire de devises:

Recommandations de trading

Aucune nouvelle pour aujourd'hui

Cet article reflète une opinion personnelle et ne doit pas être interprété comme un conseil en investissement, et/ou une offre, et/ou une demande persistante de réalisation d'opérations financières, et/ou une garantie, et/ou une prévision d'événements futurs.