The EUR/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.0480

- 前一收盘价: 1.0468

- 过去一天的变化%: -0.11 %

Eurozone consumer price inflation in January 2025 was confirmed at 2.5%, the highest since July 2024, mainly due to a sharp acceleration in energy prices (1.9% vs. 0.1% in December). Meanwhile, non-energy industrial goods inflation remained flat at 0.5%. The core inflation rate, which excludes volatile food and energy prices, remained unchanged at 2.7% for the fifth consecutive month, the lowest level since early 2022.

交易建议

- 支撑价位: 1.0460, 1.0449, 1.0409

- 阻力价位: 1.0485, 1.0537

The EUR/USD currency pair’s hourly trend is bearish. The euro corrected to 1.0460, where buyers tried to resume growth. However, sellers managed to form a resistance zone above 1.0485, which led to the formation of flat accumulation. Currently, it is best to wait for the price to exit the accumulation. A consolidation above 1.0485 will open the price way up to 1.0537. A price consolidation below 1.0460 will open the price path to 1.0409.

选择场景:if the price breaks the support level of 1.0409 and consolidates below it, the downtrend will likely resume.

新闻动态: 2025.02.25

- German Ifo Business Climate (m/m) at 11:00 (GMT+2);

- Eurozone Consumer Price Index (m/m) at 12:00 (GMT+2).

The GBP/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.2633

- 前一收盘价: 1.2624

- 过去一天的变化%: -0.07 %

According to global macro models and analysts’ expectations, the UK interest rate will be 4.50% by the end of this quarter. In the long term, the UK interest rate will be at 3.00% in 2026 and 2.50% in 2027. According to global macro models and analysts’ expectations, the British pound will be trading at 1.23 (2.4% below the current price) by the end of this quarter. In the long term, the pound is expected to trade at 1.21 in 12 months (4.1% below the current price).

交易建议

- 支撑价位: 1.2632, 1.2581, 1.2553

- 阻力价位: 1.2655, 1.2704

From the point of view of technical analysis, the trend on the GBP/USD currency pair is bullish. The British pound is forming a flat accumulation between the levels of 1.2632-1.2655. Traders are best to wait for the price to leave the accumulation. A price consolidation above 1.2655 will open the way for the price to 1.2704. A price consolidation below 1.2632 will open the price path to 1.2581.

选择场景:if the price breaks the support level of 1.2577 and consolidates below it, the downtrend will likely resume.

今天没有新闻

The USD/JPY currency pair

货币对的技术指标:

- 前一开盘价: 149.30

- 前一收盘价: 149.73

- 过去一天的变化%: +0.29 %

The Japanese yen traded near 149.5 per dollar on Tuesday, holding near its highest level in the last 12 weeks, supported by strong expectations that the Bank of Japan will continue to raise interest rates this year after an unexpected rise in inflation in the fourth quarter. Investors are now focused on a series of key economic reports due out on Friday, including industrial production, retail sales, and inflation data in Tokyo, which could provide further guidance on the central bank’s monetary policy.

交易建议

- 支撑价位: 149.34, 148.91

- 阻力价位: 150.31, 150.75, 151.50, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. Currently, the price has corrected to the resistance level at 150.31, where sellers took the initiative. Now, the price is trading at the support level of 149.34. This level has already been tested 2 times, which increases the probability of breakdown and further price decline. There are no optimal entry points for buying now.

选择场景:if the price breaks above the resistance at 150.74, the uptrend will likely resume.

今天没有新闻

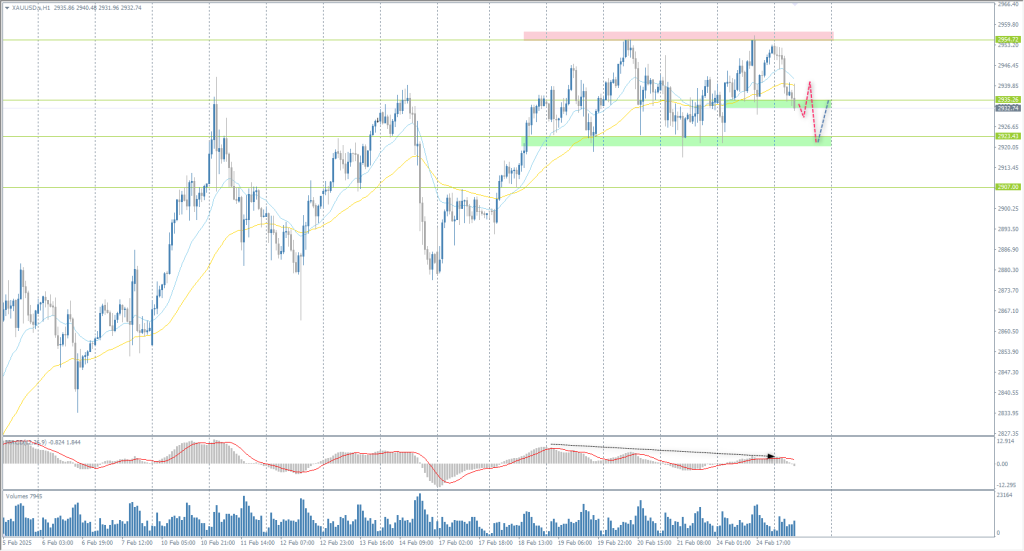

The XAU/USD currency pair (gold)

货币对的技术指标:

- 前一开盘价: 2934

- 前一收盘价: 2952

- 过去一天的变化%: +0.61 %

Gold is holding near $2,940 per ounce, near record highs, as demand for safe-haven gold rose amid concerns over US President Donald Trump’s tariff plans. Trump’s latest measures expanded duties on lumber and forest products, adding to previously announced tariffs on imported cars, semiconductors and pharmaceuticals, adding to fears of inflation and escalating trade tensions. Investor appetite is also reflected in the rising holdings of the SPDR Gold Trust, the world’s largest gold-backed ETF, which reached 904.38 tons, the highest since August 2023.

交易建议

- 支撑价位: 2935, 2923, 2907

- 阻力价位: 2954, 3000

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold is forming a broad flat accumulation with the boundaries of 2923-2954. Buying should be sought from the lower flat boundary, but only with confirmation, as the MACD divergence on higher time frames indicates a deeper correction in gold. In case of a breakdown of 2923, the price will open the way to 2907.

选择场景:if the price breaks below the support level of 2892, the downtrend will likely resume.

今天没有新闻

本文仅反映个人观点,不应被视为投资建议和/或要约和/或进行金融交易的持续要求和/或担保和/或对未来事件的预测。