The EUR/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.0480

- Prev. Close: 1.0468

- % chg. over the last day: -0.11 %

Eurozone consumer price inflation in January 2025 was confirmed at 2.5%, the highest since July 2024, mainly due to a sharp acceleration in energy prices (1.9% vs. 0.1% in December). Meanwhile, non-energy industrial goods inflation remained flat at 0.5%. The core inflation rate, which excludes volatile food and energy prices, remained unchanged at 2.7% for the fifth consecutive month, the lowest level since early 2022.

Trading recommendations

- Support levels: 1.0460, 1.0449, 1.0409

- Resistance levels: 1.0485, 1.0537

The EUR/USD currency pair’s hourly trend is bearish. The euro corrected to 1.0460, where buyers tried to resume growth. However, sellers managed to form a resistance zone above 1.0485, which led to the formation of flat accumulation. Currently, it is best to wait for the price to exit the accumulation. A consolidation above 1.0485 will open the price way up to 1.0537. A price consolidation below 1.0460 will open the price path to 1.0409.

Alternative scenario:if the price breaks the support level of 1.0409 and consolidates below it, the downtrend will likely resume.

News feed for: 2025.02.25

- German Ifo Business Climate (m/m) at 11:00 (GMT+2);

- Eurozone Consumer Price Index (m/m) at 12:00 (GMT+2).

The GBP/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.2633

- Prev. Close: 1.2624

- % chg. over the last day: -0.07 %

According to global macro models and analysts’ expectations, the UK interest rate will be 4.50% by the end of this quarter. In the long term, the UK interest rate will be at 3.00% in 2026 and 2.50% in 2027. According to global macro models and analysts’ expectations, the British pound will be trading at 1.23 (2.4% below the current price) by the end of this quarter. In the long term, the pound is expected to trade at 1.21 in 12 months (4.1% below the current price).

Trading recommendations

- Support levels: 1.2632, 1.2581, 1.2553

- Resistance levels: 1.2655, 1.2704

From the point of view of technical analysis, the trend on the GBP/USD currency pair is bullish. The British pound is forming a flat accumulation between the levels of 1.2632-1.2655. Traders are best to wait for the price to leave the accumulation. A price consolidation above 1.2655 will open the way for the price to 1.2704. A price consolidation below 1.2632 will open the price path to 1.2581.

Alternative scenario:if the price breaks the support level of 1.2577 and consolidates below it, the downtrend will likely resume.

No news for today

The USD/JPY currency pair

Technical indicators of the currency pair:

- Prev. Open: 149.30

- Prev. Close: 149.73

- % chg. over the last day: +0.29 %

The Japanese yen traded near 149.5 per dollar on Tuesday, holding near its highest level in the last 12 weeks, supported by strong expectations that the Bank of Japan will continue to raise interest rates this year after an unexpected rise in inflation in the fourth quarter. Investors are now focused on a series of key economic reports due out on Friday, including industrial production, retail sales, and inflation data in Tokyo, which could provide further guidance on the central bank’s monetary policy.

Trading recommendations

- Support levels: 149.34, 148.91

- Resistance levels: 150.31, 150.75, 151.50, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. Currently, the price has corrected to the resistance level at 150.31, where sellers took the initiative. Now, the price is trading at the support level of 149.34. This level has already been tested 2 times, which increases the probability of breakdown and further price decline. There are no optimal entry points for buying now.

Alternative scenario:if the price breaks above the resistance at 150.74, the uptrend will likely resume.

No news for today

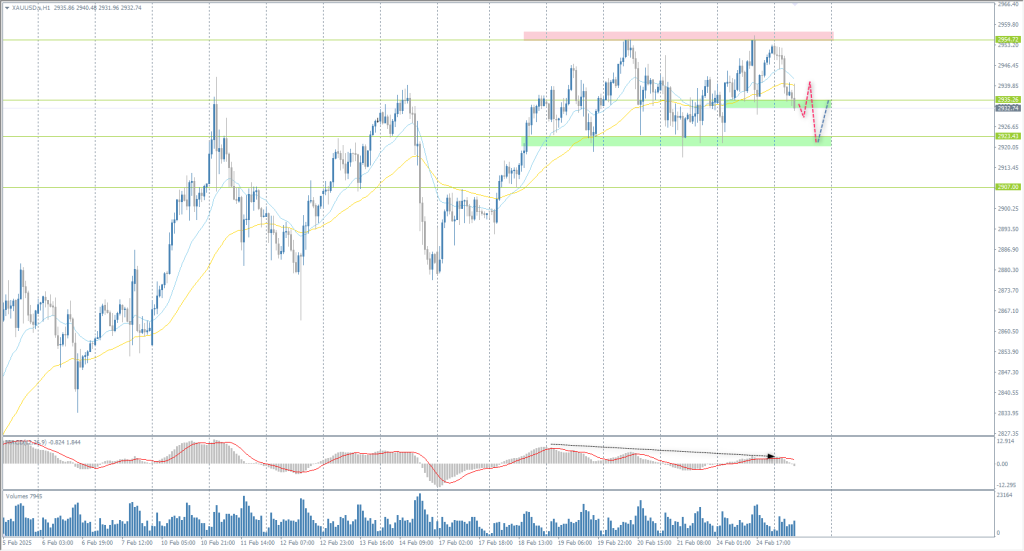

The XAU/USD currency pair (gold)

Technical indicators of the currency pair:

- Prev. Open: 2934

- Prev. Close: 2952

- % chg. over the last day: +0.61 %

Gold is holding near $2,940 per ounce, near record highs, as demand for safe-haven gold rose amid concerns over US President Donald Trump’s tariff plans. Trump’s latest measures expanded duties on lumber and forest products, adding to previously announced tariffs on imported cars, semiconductors and pharmaceuticals, adding to fears of inflation and escalating trade tensions. Investor appetite is also reflected in the rising holdings of the SPDR Gold Trust, the world’s largest gold-backed ETF, which reached 904.38 tons, the highest since August 2023.

Trading recommendations

- Support levels: 2935, 2923, 2907

- Resistance levels: 2954, 3000

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold is forming a broad flat accumulation with the boundaries of 2923-2954. Buying should be sought from the lower flat boundary, but only with confirmation, as the MACD divergence on higher time frames indicates a deeper correction in gold. In case of a breakdown of 2923, the price will open the way to 2907.

Alternative scenario:if the price breaks below the support level of 2892, the downtrend will likely resume.

No news for today

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.