The EUR/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.0789

- 前一收盘价: 1.0852

- 过去一天的变化%: +0.58 %

The euro jumped to 1.0950 USD on Thursday, even as US President Donald Trump imposed 20% tariffs on all imports from the European Union. The currency also benefited from a weaker US dollar as the imposition of tariffs marked a significant escalation in the global trade conflict and raised concerns about economic growth. With inflationary pressures easing and global trade tensions escalating, market expectations that the European Central Bank may cut interest rates by 65 bps this year have intensified.

交易建议

- 支撑价位: 1.0879, 1.0805, 1.0785

- 阻力价位: 1.0952, 1.0979

The EUR/USD currency pair’s hourly trend has changed to bullish. The euro has sharply strengthened on the backdrop of a falling Dollar Index. The price consolidated above the EMA lines and reached the resistance level of 1.0953. After the liquidity test above, the price is likely to flatten or partially correct, as there is now an abnormal deviation from the average values. Buying at such prices is not recommended. Selling can be considered after a test of 1.0953, but with confirmation.

选择场景:if the price breaks the support level of 1.0805 and consolidates below it, the downtrend will likely resume.

新闻动态: 2025.04.03

- German Services (m/m) PMI at 10:55 (GMT+3);

- Eurozone Services (m/m) PMI at 11:00 (GMT+3);

- Eurozone Producer Price Index (m/m) at 12:00 (GMT+3);

- Eurozone ECB Monetary Policy Meeting Accounts at 14:30 (GMT+3);

- US Trade Balance (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US ISM Services PMI (m/m) at 17:00 (GMT+3);

The GBP/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.2919

- 前一收盘价: 1.3007

- 过去一天的变化%: +0.68 %

The British pound jumped to 1.31 on Thursday, after Trump imposed sweeping tariffs. The UK is subject to a blanket tariff of 10% on imports. UK officials have not yet reacted to the tariffs, but the pound sterling strengthened to a 5-month high.

交易建议

- 支撑价位: 1.3025, 1.2953, 1.2901, 1.2884

- 阻力价位: 1.3176

From the point of view of technical analysis, the trend on the GBP/USD currency has changed to bullish. The price has consolidated above the priority change level, but it has strongly deviated from the EMA lines, which increases the probability of a technical correction. It is not recommended to buy now. Selling can be looked at intraday, but only with confirmation in the change of market structure and with a short stop losses.

选择场景:if the price breaks the support level of 1.2884 and consolidates below it, the downtrend will likely resume.

新闻动态: 2025.04.03

- UK Services PMI (m/m) at 11:30 (GMT+3).

The USD/JPY currency pair

货币对的技术指标:

- 前一开盘价: 149.56

- 前一收盘价: 149.27

- 过去一天的变化%: -0.19 %

The Japanese yen rose to 147 per dollar on Thursday, hitting a three-week high, as investors sought safe-haven assets after US President Donald Trump announced sweeping retaliatory tariffs, heightening fears of the start of a devastating global trade war. Trump imposed an additional 34% tariffs on China, bringing the total level of duties on that country’s goods to 54%. Other major economies hit with high tariffs include the EU (20%), Japan (24%), and India (26%), as well as a base tariff of 10% on imports from all countries. Earlier this week, Bank of Japan Governor Kazuo Ueda warned that new US tariffs could significantly impact global trade and economic growth.

交易建议

- 支撑价位: 147.41, 146.65, 146.00

- 阻力价位: 148.41, 149.16, 150.27

From a technical point of view, the medium-term trend of the USD/JPY currency pair has changed to a downtrend. The yen strengthened to a one-month high. However, the price has deviated strongly from the EMA midlines, which increases the probability of a technical correction. Buying can be considered intraday from the support lines at 147.41 or 146.65. There are no optimal entry points for selling right now.

选择场景:if the price breaks through the resistance level at 150.27 and consolidates above it, the uptrend will likely resume.

新闻动态: 2025.04.03

- Japan Services PMI (m/m) at 03:30 (GMT+3).

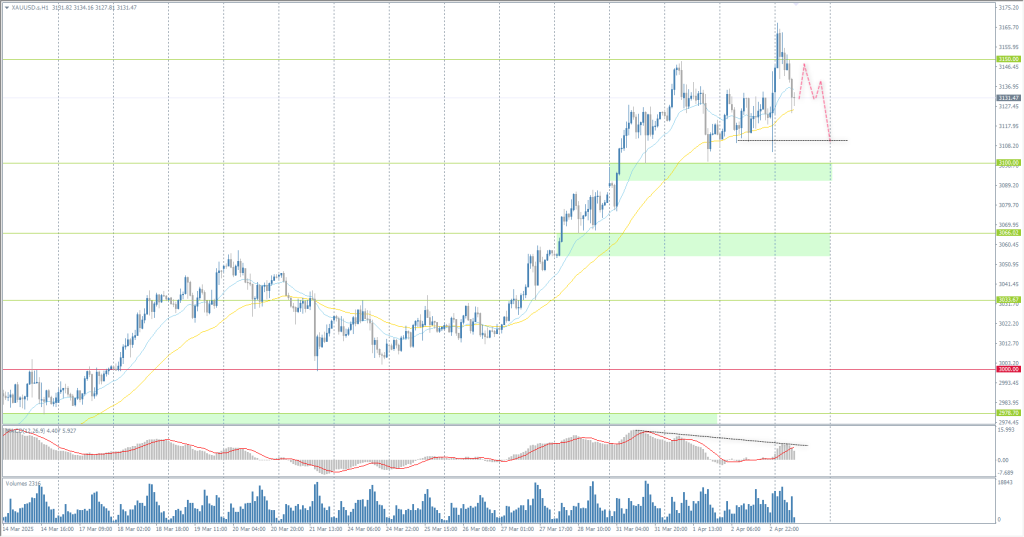

The XAU/USD currency pair (gold)

货币对的技术指标:

- 前一开盘价: 3114

- 前一收盘价: 3134

- 过去一天的变化%: +0.64 %

Gold rose to $3164 per ounce, hitting a new record high, as risk aversion increased after President Trump’s tariff announcement following the outbreak of the global trade war. Weak US jobs data and a disappointing industrial production report shifted investors’ attention to Friday’s Non-Farm Payrolls data for further insight into the Fed’s policy outlook.

交易建议

- 支撑价位: 3100, 3057, 3037,3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- 阻力价位: 3150, 3200

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold rallied sharply amid the introduction of massive tariffs, but after a liquidity test above 3150, then corrected sharply to the EMA lines. Intraday bearish bias prevails, and a fall to the 3100 support level is not ruled out. Buying should be considered from 3100, or if a sharp bullish reaction follows from the EMA lines. Selling is not recommended here.

选择场景:if the price breaks below the support level of 3000, the downtrend will likely resume.

新闻动态: 2025.04.03

- US Trade Balance (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US ISM Services PMI (m/m) at 17:00 (GMT+3);

本文仅反映个人观点,不应被视为投资建议和/或要约和/或进行金融交易的持续要求和/或担保和/或对未来事件的预测。