The EUR/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.1192

- 前一收盘价: 1.1355

- 过去一天的变化%: +1.46 %

On Friday, the Dollar Index fell more than 1% to 99.2, the lowest level in almost three years, as investors continued to exit US assets. Escalating trade tensions and growing concerns about the broader economic fallout, especially for the US, weighed heavily on sentiment. The dollar weakened mostly against the euro and yen, and fell to a 14-year low against the Swiss franc. The euro continued its rally, breaking above $1.14 for the first time since late January 2022.

交易建议

- 支撑价位: 1.1275, 1.1157, 1.1088, 1.0960

- 阻力价位: 1.1496

The EUR/USD currency pair’s hourly trend is bullish. The euro has consolidated above 1.1275, which opened space for growth up to 1.1496. It is recommended to consider the EMA lines or the support level of 1.1275 for buying. There are no optimal entry points for selling now. Most likely, when reaching 1.1500, fixation of previously opened positions will take place, which will lead to a correction wave and formation of a broadly volatile flat.

选择场景:if the price breaks the support level of 1.0960 and consolidates below it, the downtrend will likely resume.

今天没有新闻

The GBP/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.2967

- 前一收盘价: 1.3079

- 过去一天的变化%: +0.86 %

The British pound rose above $1.31, approaching a six-month high of $1.32 on April 3, after UK GDP surprised with a 0.5% growth rate in February, five times the expected pace. All major sectors contributed, with higher factory output hinting at stockpiling ahead of Trump’s aggressive new tariff measures. The good data has caused traders to slightly lower expectations of an imminent Bank of England rate cut, although three-quarter-point rate cuts are still priced in for 2025. Sterling also benefited from a weaker dollar as investors reacted to the intensifying trade war between the US and China.

交易建议

- 支撑价位: 1.3030, 1.2891, 1.2743

- 阻力价位: 1.3114, 1.3176

From the point of view of technical analysis, the trend on the GBP/USD currency is bearish, but it will change soon. Sterling is sticking to the 1.3114 priority change level. Volumes are declining, and sellers’ reaction to each new test is weaker than the previous one. Such price action increases the probability of further price growth to 1.3176. It is better to consider buy trades from the EMA lines or from the support level of 1.3030. For sales, it is worth looking at the resistance zone above 1.3176, but with confirmation.

选择场景:if the price breaks the resistance level of 1.3114 and consolidates above it, the uptrend will likely resume.

今天没有新闻

The USD/JPY currency pair

货币对的技术指标:

- 前一开盘价: 144.49

- 前一收盘价: 143.51

- 过去一天的变化%: -0.68 %

The Japanese yen strengthened to 142.2 against the US dollar, reaching its highest level since late September 2024, as escalating trade tensions between Washington and Beijing caused widespread dollar weakness and fueled demand for safe-haven assets. A simultaneous sell-off in US Treasuries, which are generally considered a hedge against uncertainty, has further boosted the yen. Meanwhile, markets are also keeping a close eye on trade talks between the US and Japan. Tokyo currently enjoys preferential tariffs of 10%, and Tokyo is pushing for more favorable terms in the negotiations.

交易建议

- 支撑价位: 142.21, 141.63, 140.45

- 阻力价位: 144.15, 145.14, 147.14

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. The yen reached the support level of 142.20, where buyers showed a moderate reaction. This led to the formation of a flat with the boundaries 142.21–144.15. According to the flat rules, it is better to sell from the upper boundary and buy from the lower one. However, for buyers, it is worth considering that the liquidity pool is below 141.63, which increases the probability of a test of this level.

选择场景:if the price breaks through the resistance level at 147.14 and consolidates above it, the uptrend will likely resume.

新闻动态: 2025.04.14

- Japan Industrial Production (m/m) at 07:30 (GMT+3).

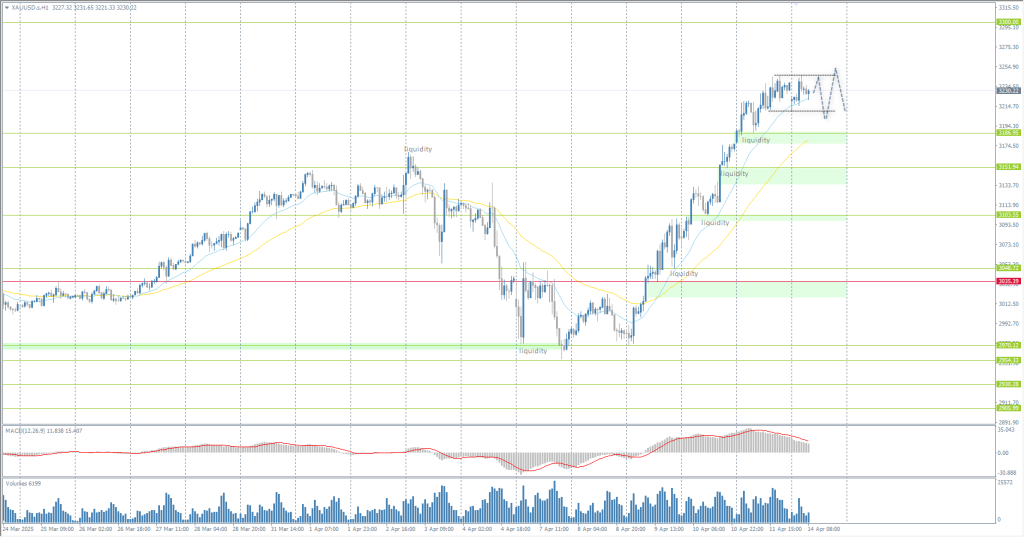

The XAU/USD currency pair (gold)

货币对的技术指标:

- 前一开盘价: 3177

- 前一收盘价: 3238

- 过去一天的变化%: +1.92 %

Gold climbed above $3250 per ounce on Friday, a new record, thanks to a weaker US dollar and increased demand for safe-haven commodities after the trade war between the US and China further escalated. China raised its tariffs against the US to 125% from April 12 and said it would ignore further US retaliatory measures after a series of tariff hikes by the White House to 145%. The current measures are set to affect about $700 billion in goods exchanged annually between the world’s largest economies, weakening risk assets tied to global growth and supporting the flow of funds to safe-haven countries.

交易建议

- 支撑价位: 3186, 3152, 3103, 3048, 3035

- 阻力价位: 3300

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold strengthened sharply on Friday, reaching new historical highs and exceeding all bank expectations that were heard before. The price is now starting to flatten near the EMA lines to accumulate liquidity. It is worth considering the EMA lines or the support level of 3186 for buying. Selling should not be rushed, as we need to see liquidity capture with the sellers’ reaction for a reversal.

选择场景:if the price breaks and consolidates below the support level of 3035, the downtrend will likely resume.

今天没有新闻

本文仅反映个人观点,不应被视为投资建议和/或要约和/或进行金融交易的持续要求和/或担保和/或对未来事件的预测。