The EUR/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.1395

- 前一收盘价: 1.1514

- 过去一天的变化%: +1.04 %

The euro rose to $1.15, its strongest level since November 2021, helped by a weaker dollar amid growing concerns about the Fed’s independence. The changes followed remarks from President Trump and the director of the US National Economic Council, who suggested that Trump was still “studying” firing Fed Chairman Powell. The euro gained more than 5% against the dollar during April as investors increasingly question the dollar’s dominance in the global financial system and turn to the single currency as an alternative.

交易建议

- 支撑价位: 1.1496, 1.1246, 1.1157, 1.1088, 1.0960

- 阻力价位: 1.1572

The EUR/USD currency pair’s hourly trend is bullish. The euro is trading in a sideways phase at the level of EMA lines. The bias remains for the bulls, but the price has reached an important liquidity pool above 1.1479. Given the MACD divergence, there is a high probability of a technical correction. For buying, it is better to use the support level of 1.1496 or EMA lines. For sell deals we can consider the level of 1.1572, but with confirmation in the form of the sellers’ initiative.

选择场景:if the price breaks the support level of 1.1335 and consolidates below it, the downtrend will likely resume.

新闻动态: 2025.04.22

- Eurozone ECB President Lagarde Speaks at 17:00 (GMT+3);

- US Richmond Manufacturing Index (m/m) at 17:00 (GMT+3).

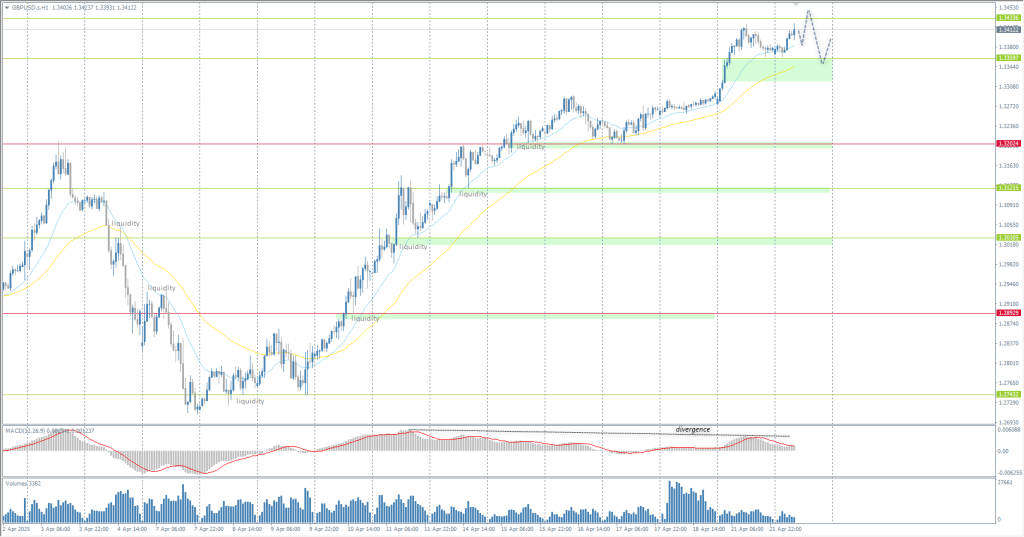

The GBP/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.3276

- 前一收盘价: 1.3378

- 过去一天的变化%: +0.76 %

The British pound rose above $1.33, the highest in seven months, mainly due to the weakening US dollar. This is the longest rise since July 2020. It has risen about 4.5% in that time. This week, the UK will release its preliminary April PMI Index. The index came in at 51.5 in March, the highest reading since last October. The PMI for services reached 52.5 in March, the best reading since August last year.

交易建议

- 支撑价位: 1.3360, 1.3202, 1.3121, 1.3030, 1.2891, 1.2743

- 阻力价位: 1.3434

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly time frame is bullish. The bias also remains behind the bulls. The price seeks to test the liquidity above 1.3434. Given the MACD divergence, a technical correction within the uptrend is possible here. However, for selling, we need to see the sellers’ reaction to liquidity. For buying, we can consider the support level of 1.3360, but also with confirmation.

选择场景:if the price breaks the resistance level of 1.3202 and consolidates above it, the uptrend will likely resume.

今天没有新闻

The USD/JPY currency pair

货币对的技术指标:

- 前一开盘价: 142.08

- 前一收盘价: 140.88

- 过去一天的变化%: -0.85 %

The Japanese yen climbed to 140.5 per dollar on Tuesday, hitting a seven-month high, as investors seek safety amid global trade tensions and growing skepticism about US assets. Domestically, attention shifts to next week’s Bank of Japan meeting. While the Central Bank is expected to keep its benchmark rate unchanged at 0.5%, it may lower its economic growth projections in light of rising external risks, particularly the impact of tariffs imposed by the US on Japan’s export-heavy economy.

交易建议

- 支撑价位: 139.59

- 阻力价位: 140.45, 141.17,142.09, 143.08

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. The bias also remains behind the bears. The price is now aiming to test the liquidity pool below 139.59. Given the MACD divergence, a technical correction is possible here. The resistance level of 140.45 can be used for selling. For buying, we need to see the reaction of buyers to the liquidity below 139.59.

选择场景:if the price breaks through the resistance level at 143.08 and consolidates above it, the uptrend will likely resume.

今天没有新闻

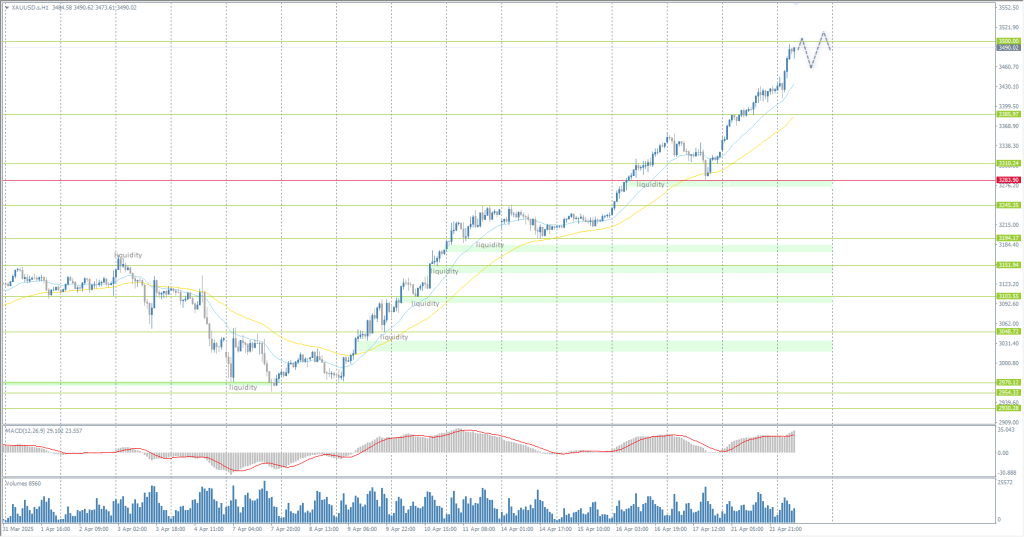

The XAU/USD currency pair (gold)

货币对的技术指标:

- 前一开盘价: 3331

- 前一收盘价: 3424

- 过去一天的变化%: +2.79 %

Gold surpassed $3480 per ounce on Tuesday, setting a new record, driven by risk aversion amid growing economic uncertainty. The US dollar fell to a three-year low after President Trump increased pressure on the Federal Reserve, calling for aggressive rate cuts and reportedly considering the resignation of Fed Chairman Powell. Fears of political interference in monetary policy have undermined confidence in the dollar.

交易建议

- 支撑价位: 3386, 3310, 3283, 3245, 3194

- 阻力价位: 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold continued to rally even in a thin market. This morning, the price rallied towards the psychological level of 3500. Banking experts do not have time to update their expectations on gold, as it is already breaking another maximum level. It is not recommended to sell, as sellers are not observed in the market. To buy, we should wait for a correction to the EMA lines.

选择场景:if the price breaks and consolidates below the support level of 3283, the downtrend will likely resume.

新闻动态: 2025.04.22

- Eurozone ECB President Lagarde Speaks at 17:00 (GMT+3);

- US Richmond Manufacturing Index (m/m) at 17:00 (GMT+3).

本文仅反映个人观点,不应被视为投资建议和/或要约和/或进行金融交易的持续要求和/或担保和/或对未来事件的预测。