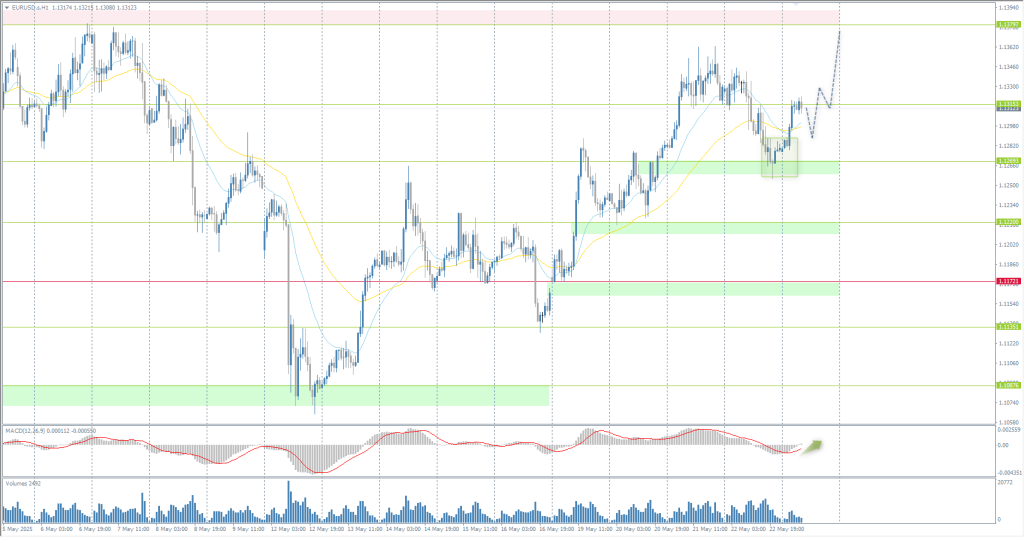

The EUR/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.1326

- 前一收盘价: 1.1280

- 过去一天的变化%: -0.40 %

The latest ECB minutes showed that the European Central Bank’s fight against inflation is nearing its final stage, but trade tensions could weigh on prices in the short term. In contrast, a prolonged trade war could lead to higher inflation in the long term, according to the minutes of the ECB’s April 16-17 meeting. While recent trade disputes and US tariffs are expected to weigh on economic growth, ECB officials still see a clear path to price stability as disinflationary bias will prevail in the short term.

交易建议

- 支撑价位: 1.1269, 1.1220, 1.1170, 1.1135, 1.1088, 1.1017, 1.0902

- 阻力价位: 1.1315, 1.1379, 1.1440

The EUR/USD currency pair’s hourly trend has changed upward. The euro declined within the technical correction to the support level of 1.1269. Here, the buyers again showed initiative. Buying trades can be considered from the EMA lines or the 1.1269 level but with confirmation. There are no optimal entry points for selling now.

选择场景:if the price breaks the support level of 1.1172 and consolidates below it, the downtrend will be resumed with a high probability.

新闻动态: 2025.05.23

- German GDP (m/m) at 09:00 (GMT+3);

- US New Home Sales (m/m) at 17:00 (GMT+3).

The GBP/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.3415

- 前一收盘价: 1.3418

- 过去一天的变化%: +0.02 %

The CBI Industrial Trends Survey showed that the overall UK order book balance fell to 30 in May 2025 from 26 in April and fell short of market expectations of 25. This is the lowest level since January, indicating a continued weakening in manufacturing sentiment amid rising domestic business costs and uncertainty over US tariffs.

交易建议

- 支撑价位: 1.3434, 1.3382, 1.3333, 1.3291, 1.3121

- 阻力价位: 1.3500

Regarding technical analysis, the trend on the currency pair GBP/USD on the hourly is bullish. The British pound continues to grow steadily. At the moment, a divergence has formed on the MACD, indicating a possible correction. For buying, it is best to consider the EMA lines or the support level of 1.3434. There are no optimal entry points for selling right now.

选择场景:if the price breaks the support level of 1.3291 and consolidates below it, the downtrend will likely resume.

新闻动态: 2025.05.23

- UK Retail Sales (m/m) at 09:00 (GMT+3).

The USD/JPY currency pair

货币对的技术指标:

- 前一开盘价: 143.63

- 前一收盘价: 144.00

- 过去一天的变化%: +0.26 %

Japan’s core inflation accelerated more than expected to 3.5%, the highest in two years. This reinforces expectations that the Bank of Japan will continue to tighten monetary policy in response to sustained inflationary pressures. Meanwhile, the core inflation rate remained unchanged at 3.6%. The yen also benefited from the general weakening of the dollar amid concerns about the outlook for US fiscal policy.

交易建议

- 支撑价位: 143.01

- 阻力价位: 144.10, 144.80, 145.46, 146.36, 148.28, 150.47

From a technical point of view, the medium-term trend of the USD/JPY is bearish. The price corrected to the resistance level of 144.10, where sellers reacted again. Currently, the price again aims at the demand zone below the support level of 143.01. For selling, we can consider the EMA lines or the resistance level of 144.11, but with confirmation. For buying, there are no optimal entry points right now.

选择场景:if the price breaks the resistance level of 145.51 and consolidates above it, the uptrend will be resumed with a high probability.

新闻动态: 2025.05.23

- Japan National Core CPI (m/m) at 02:30 (GMT+3).

The XAU/USD currency pair (gold)

货币对的技术指标:

- 前一开盘价: 3319

- 前一收盘价: 3295

- 过去一天的变化%: -0.72 %

Gold prices fell nearly 1% to $3,290 an ounce, breaking a three-day winning streak, as traders booked profits and a strengthening US dollar weighed on sentiment. The rising dollar has reduced gold’s appeal as a safe haven, although concerns over US fiscal policy support long-term demand. Moody’s recently downgraded the US sovereign credit rating by one notch, citing a $36 trillion debt load. Market participants are also wary of the possibility of even larger deficits if President Trump’s proposed tax cut bill is passed. The bill is moving forward in Congress, raising concerns about increased debt-financed spending.

交易建议

- 支撑价位: 3320, 3251, 3204, 3151, 3103, 3049

- 阻力价位: 3347, 3370

From the point of view of technical analysis, the trend on the XAU/USD is bullish. The price corrected yesterday to the dynamic EMA lines, where the buyers took the initiative. Currently, the price seeks to test liquidity above the resistance level of 3347. For buying, the 3320 support level or EMA lines can be considered. There are no optimal entry points for selling.

选择场景:if the price breaks and consolidates below the support level of 3204, the downtrend will likely resume.

新闻动态: 2025.05.23

- US New Home Sales (m/m) at 17:00 (GMT+3).

本文仅反映个人观点,不应被视为投资建议和/或要约和/或进行金融交易的持续要求和/或担保和/或对未来事件的预测。