The EUR/USD currency pair

Indicateurs techniques de la paire de devises:

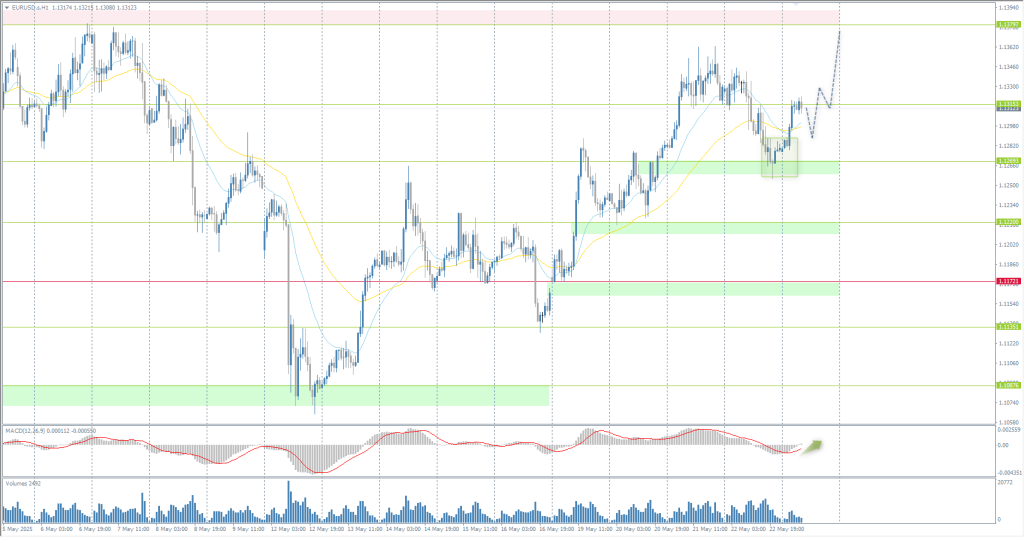

- Précédent Ouvrir: 1.1326

- Précédent Fermer: 1.1280

- % vari. au cours du dernier jour: -0.40 %

The latest ECB minutes showed that the European Central Bank’s fight against inflation is nearing its final stage, but trade tensions could weigh on prices in the short term. In contrast, a prolonged trade war could lead to higher inflation in the long term, according to the minutes of the ECB’s April 16-17 meeting. While recent trade disputes and US tariffs are expected to weigh on economic growth, ECB officials still see a clear path to price stability as disinflationary bias will prevail in the short term.

Recommandations de trading

- Niveaux de support: 1.1269, 1.1220, 1.1170, 1.1135, 1.1088, 1.1017, 1.0902

- Niveaux de résistance: 1.1315, 1.1379, 1.1440

The EUR/USD currency pair’s hourly trend has changed upward. The euro declined within the technical correction to the support level of 1.1269. Here, the buyers again showed initiative. Buying trades can be considered from the EMA lines or the 1.1269 level but with confirmation. There are no optimal entry points for selling now.

Scénario alternatif:if the price breaks the support level of 1.1172 and consolidates below it, the downtrend will be resumed with a high probability.

Fil d'actualité pour: 2025.05.23

- German GDP (m/m) at 09:00 (GMT+3);

- US New Home Sales (m/m) at 17:00 (GMT+3).

The GBP/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.3415

- Précédent Fermer: 1.3418

- % vari. au cours du dernier jour: +0.02 %

The CBI Industrial Trends Survey showed that the overall UK order book balance fell to 30 in May 2025 from 26 in April and fell short of market expectations of 25. This is the lowest level since January, indicating a continued weakening in manufacturing sentiment amid rising domestic business costs and uncertainty over US tariffs.

Recommandations de trading

- Niveaux de support: 1.3434, 1.3382, 1.3333, 1.3291, 1.3121

- Niveaux de résistance: 1.3500

Regarding technical analysis, the trend on the currency pair GBP/USD on the hourly is bullish. The British pound continues to grow steadily. At the moment, a divergence has formed on the MACD, indicating a possible correction. For buying, it is best to consider the EMA lines or the support level of 1.3434. There are no optimal entry points for selling right now.

Scénario alternatif:if the price breaks the support level of 1.3291 and consolidates below it, the downtrend will likely resume.

Fil d'actualité pour: 2025.05.23

- UK Retail Sales (m/m) at 09:00 (GMT+3).

The USD/JPY currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 143.63

- Précédent Fermer: 144.00

- % vari. au cours du dernier jour: +0.26 %

Japan’s core inflation accelerated more than expected to 3.5%, the highest in two years. This reinforces expectations that the Bank of Japan will continue to tighten monetary policy in response to sustained inflationary pressures. Meanwhile, the core inflation rate remained unchanged at 3.6%. The yen also benefited from the general weakening of the dollar amid concerns about the outlook for US fiscal policy.

Recommandations de trading

- Niveaux de support: 143.01

- Niveaux de résistance: 144.10, 144.80, 145.46, 146.36, 148.28, 150.47

From a technical point of view, the medium-term trend of the USD/JPY is bearish. The price corrected to the resistance level of 144.10, where sellers reacted again. Currently, the price again aims at the demand zone below the support level of 143.01. For selling, we can consider the EMA lines or the resistance level of 144.11, but with confirmation. For buying, there are no optimal entry points right now.

Scénario alternatif:if the price breaks the resistance level of 145.51 and consolidates above it, the uptrend will be resumed with a high probability.

Fil d'actualité pour: 2025.05.23

- Japan National Core CPI (m/m) at 02:30 (GMT+3).

The XAU/USD currency pair (gold)

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 3319

- Précédent Fermer: 3295

- % vari. au cours du dernier jour: -0.72 %

Gold prices fell nearly 1% to $3,290 an ounce, breaking a three-day winning streak, as traders booked profits and a strengthening US dollar weighed on sentiment. The rising dollar has reduced gold’s appeal as a safe haven, although concerns over US fiscal policy support long-term demand. Moody’s recently downgraded the US sovereign credit rating by one notch, citing a $36 trillion debt load. Market participants are also wary of the possibility of even larger deficits if President Trump’s proposed tax cut bill is passed. The bill is moving forward in Congress, raising concerns about increased debt-financed spending.

Recommandations de trading

- Niveaux de support: 3320, 3251, 3204, 3151, 3103, 3049

- Niveaux de résistance: 3347, 3370

From the point of view of technical analysis, the trend on the XAU/USD is bullish. The price corrected yesterday to the dynamic EMA lines, where the buyers took the initiative. Currently, the price seeks to test liquidity above the resistance level of 3347. For buying, the 3320 support level or EMA lines can be considered. There are no optimal entry points for selling.

Scénario alternatif:if the price breaks and consolidates below the support level of 3204, the downtrend will likely resume.

Fil d'actualité pour: 2025.05.23

- US New Home Sales (m/m) at 17:00 (GMT+3).

Cet article reflète une opinion personnelle et ne doit pas être interprété comme un conseil en investissement, et/ou une offre, et/ou une demande persistante de réalisation d'opérations financières, et/ou une garantie, et/ou une prévision d'événements futurs.