The EUR/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.1606

- 前一收盘价: 1.1620

- 过去一天的变化%: +0.14%

German Bund yields rose above 2.75%, their highest since late September, after inflation data came in slightly above prognoses, reinforcing expectations of high ECB rates. Eurozone inflation accelerated to 2.2% versus 2.1% expected, while fresh ECB minutes showed no urgency to ease policy, with markets not expecting rate changes until 2026. Domestically, Germany finally approved the 2026 federal budget, abandoning the “black zero” principle and increasing borrowing to finance major government programs.

交易建议

- 支撑价位: 1.1607, 1.1590, 1.1555, 1.1503

- 阻力价位: 1.1653

The euro corrected yesterday to 1.1590, where buyers stepped in. Price is now aiming to test resistance at 1.1653. Buy trades should be considered from EMA lines, as price has deviated significantly from averages. No optimal sell entries at present.

选择场景:- Trend: U

- Sup: 1.1607

- Res: 1.1656

- Note: Considering buys from EMA lines with confirmation. Profit target: 1.1656.

新闻动态: 2025.12.03

- Eurozone Services PMI (m/m) at 11:00 (GMT+2); – EUR (LOW)

- Eurozone Producer Price Index (m/m) at 12:00 (GMT+2); – EUR (MED)

- US ADP Non-Farm Employment Change (m/m) at 15:15 (GMT+2); – USD (MED)

- US ISM Services PMI (m/m) at 17:00 (GMT+2); – USD (MED)

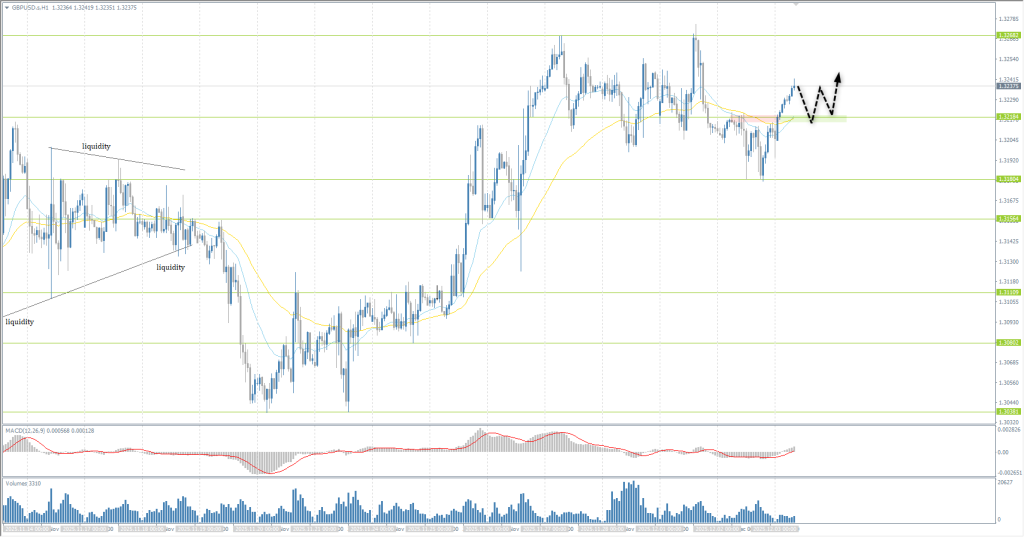

The GBP/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.3212

- 前一收盘价: 1.3210

- 过去一天的变化%: -0.02 %

Sterling is rising less confidently than the euro. Investors remain cautious after BoE Governor Andrew Bailey warned of increased risks to the financial system and possible consequences of a US AI‑company bubble burst for the UK market.

交易建议

- 支撑价位: 1.3218, 1.3156, 1.3111, 1.3080

- 阻力价位: 1.3268

Sterling held above support at 1.3218, and buyers must keep the price above this level. Buy trades can be considered from 1.3218 with intraday confirmation, or from EMA lines. No optimal sell entries at present.

选择场景:- Trend: Up

- Sup: 1.3218

- Res: 1.3268

- Note: Considering buy trades from 1.3218 or EMA lines with confirmation. Profit target: 1.3268.

新闻动态: 2025.12.03

- UK Services PMI (m/m) at 11:30 (GMT+2). – GBP (LOW)

The USD/JPY currency pair

货币对的技术指标:

- 前一开盘价: 155.46

- 前一收盘价: 155.86

- 过去一天的变化%: +0.27 %

On Wednesday, the yen strengthened to 155.5 per USD amid dollar weakness and growing expectations of more aggressive Fed rate cuts. Domestically, support came from persistent expectations that the BoJ may raise rates this month after a series of hawkish signals.

交易建议

- 支撑价位: 155.69, 154.82, 154.41

- 阻力价位: 156.09, 156.40, 157.11, 157.87

Sellers are preventing the price from returning above 156.09, increasing the likelihood of further yen strength. Buyers have built support at 155.69, creating a flat range between these levels. Wait for an impulsive breakout. A close below 155.69 would likely trigger a drop to 154.82. A close above 156.09 would open the path to 157.11.

选择场景:- Trend: Neutral

- Sup: 155.69

- Res: 156.09

- Note: Waiting for an impulsive breakout above 156.09 for buys or below 155.69 for sells.

新闻动态: 2025.12.03

- Japan Services PMI (m/m) at 02:30 (GMT+2). – JPY (LOW)

The XAU/USD currency pair (gold)

货币对的技术指标:

- 前一开盘价: 4230

- 前一收盘价: 4210

- 过去一天的变化%: -0.47%

On Wednesday, gold rose to $4,220/oz, nearing a six‑week high amid growing expectations of a Fed rate cut next week. Weak US economic data raised the probability of such a move to nearly 90%, while speculation about Kevin Hassett’s possible appointment as Fed Chair further reinforced dovish sentiment. Investors await the ADP report and PCE data, which may confirm the easing trajectory. Additional support came from a slight decline in US bond yields.

交易建议

- 支撑价位: 4163, 4145, 4108, 4031, 4007, 3966

- 阻力价位: 4225, 4379

Yesterday, gold corrected to support at 4163, where buyers stepped in. Price then rebounded to resistance at 4225. Intraday, short sell trades can be considered from this level, but only with tight targets, as they go against the main trend. A breakout above 4225 would open the path to 4255.

选择场景:- Trend: Up

- Sup: 4163

- Res: 4225

- Note: Considering buy deals after a breakout above 4225.

新闻动态: 2025.12.03

- US ADP Non-Farm Employment Change (m/m) at 15:15 (GMT+2); – USD (MED)

- US ISM Services PMI (m/m) at 17:00 (GMT+2). – USD (MED)

本文仅反映个人观点,不应被视为投资建议和/或要约和/或进行金融交易的持续要求和/或担保和/或对未来事件的预测。