The EUR/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.1606

- Prev. Close: 1.1620

- % chg. over the last day: +0.14%

German Bund yields rose above 2.75%, their highest since late September, after inflation data came in slightly above prognoses, reinforcing expectations of high ECB rates. Eurozone inflation accelerated to 2.2% versus 2.1% expected, while fresh ECB minutes showed no urgency to ease policy, with markets not expecting rate changes until 2026. Domestically, Germany finally approved the 2026 federal budget, abandoning the “black zero” principle and increasing borrowing to finance major government programs.

Trading recommendations

- Support levels: 1.1607, 1.1590, 1.1555, 1.1503

- Resistance levels: 1.1653

The euro corrected yesterday to 1.1590, where buyers stepped in. Price is now aiming to test resistance at 1.1653. Buy trades should be considered from EMA lines, as price has deviated significantly from averages. No optimal sell entries at present.

Alternative scenario:- Trend: U

- Sup: 1.1607

- Res: 1.1656

- Note: Considering buys from EMA lines with confirmation. Profit target: 1.1656.

News feed for: 2025.12.03

- Eurozone Services PMI (m/m) at 11:00 (GMT+2); – EUR (LOW)

- Eurozone Producer Price Index (m/m) at 12:00 (GMT+2); – EUR (MED)

- US ADP Non-Farm Employment Change (m/m) at 15:15 (GMT+2); – USD (MED)

- US ISM Services PMI (m/m) at 17:00 (GMT+2); – USD (MED)

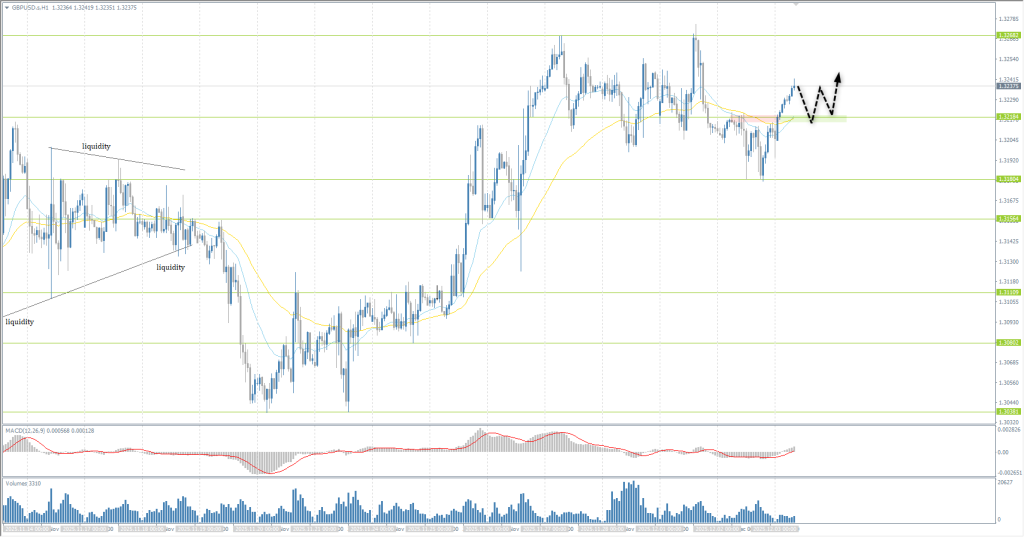

The GBP/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.3212

- Prev. Close: 1.3210

- % chg. over the last day: -0.02 %

Sterling is rising less confidently than the euro. Investors remain cautious after BoE Governor Andrew Bailey warned of increased risks to the financial system and possible consequences of a US AI‑company bubble burst for the UK market.

Trading recommendations

- Support levels: 1.3218, 1.3156, 1.3111, 1.3080

- Resistance levels: 1.3268

Sterling held above support at 1.3218, and buyers must keep the price above this level. Buy trades can be considered from 1.3218 with intraday confirmation, or from EMA lines. No optimal sell entries at present.

Alternative scenario:- Trend: Up

- Sup: 1.3218

- Res: 1.3268

- Note: Considering buy trades from 1.3218 or EMA lines with confirmation. Profit target: 1.3268.

News feed for: 2025.12.03

- UK Services PMI (m/m) at 11:30 (GMT+2). – GBP (LOW)

The USD/JPY currency pair

Technical indicators of the currency pair:

- Prev. Open: 155.46

- Prev. Close: 155.86

- % chg. over the last day: +0.27 %

On Wednesday, the yen strengthened to 155.5 per USD amid dollar weakness and growing expectations of more aggressive Fed rate cuts. Domestically, support came from persistent expectations that the BoJ may raise rates this month after a series of hawkish signals.

Trading recommendations

- Support levels: 155.69, 154.82, 154.41

- Resistance levels: 156.09, 156.40, 157.11, 157.87

Sellers are preventing the price from returning above 156.09, increasing the likelihood of further yen strength. Buyers have built support at 155.69, creating a flat range between these levels. Wait for an impulsive breakout. A close below 155.69 would likely trigger a drop to 154.82. A close above 156.09 would open the path to 157.11.

Alternative scenario:- Trend: Neutral

- Sup: 155.69

- Res: 156.09

- Note: Waiting for an impulsive breakout above 156.09 for buys or below 155.69 for sells.

News feed for: 2025.12.03

- Japan Services PMI (m/m) at 02:30 (GMT+2). – JPY (LOW)

The XAU/USD currency pair (gold)

Technical indicators of the currency pair:

- Prev. Open: 4230

- Prev. Close: 4210

- % chg. over the last day: -0.47%

On Wednesday, gold rose to $4,220/oz, nearing a six‑week high amid growing expectations of a Fed rate cut next week. Weak US economic data raised the probability of such a move to nearly 90%, while speculation about Kevin Hassett’s possible appointment as Fed Chair further reinforced dovish sentiment. Investors await the ADP report and PCE data, which may confirm the easing trajectory. Additional support came from a slight decline in US bond yields.

Trading recommendations

- Support levels: 4163, 4145, 4108, 4031, 4007, 3966

- Resistance levels: 4225, 4379

Yesterday, gold corrected to support at 4163, where buyers stepped in. Price then rebounded to resistance at 4225. Intraday, short sell trades can be considered from this level, but only with tight targets, as they go against the main trend. A breakout above 4225 would open the path to 4255.

Alternative scenario:- Trend: Up

- Sup: 4163

- Res: 4225

- Note: Considering buy deals after a breakout above 4225.

News feed for: 2025.12.03

- US ADP Non-Farm Employment Change (m/m) at 15:15 (GMT+2); – USD (MED)

- US ISM Services PMI (m/m) at 17:00 (GMT+2). – USD (MED)

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.