The EUR/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.0288

- Précédent Fermer: 1.0297

- % vari. au cours du dernier jour: -0.09 %

The minutes of the ECB’s December 11-12 meeting were somewhat dovish as they noted that while there was broad support for a 25 bps rate cut at the meeting, some ECB officials favored a more aggressive 50 bps cut. ECB Governing Council representative Centeno added yesterday that inflation is falling as planned, and Eurozone interest rates will continue on a trajectory, ideally approaching values close to 2%.

Recommandations de trading

- Niveaux de support: 1.0275, 1.0238, 1.0223

- Niveaux de résistance: 1.0360, 1.0382, 1.0403, 1.0425, 1.0447

The EUR/USD currency pair’s hourly trend is bearish but close to change. The situation has not changed compared to yesterday. Captured liquidity above 1.0326 was distributed to the support level of 1.0275. However, the liquidity is not enough to resume the bearish trend. Against this backdrop, a flat accumulation is forming to gather more liquidity. At the moment, the price is expected to rise to 1.0326. The levels of 1.0275 or 1.0239 are worth considering for buying.

Scénario alternatif:if the price breaks the resistance level of 1.0360 and consolidates above it, the uptrend will be resumed with a high probability.

Fil d'actualité pour: 2025.01.17

- US Building Permits (m/m) at 15:30 (GMT+2);

- US Industrial Production (m/m) at 16:15 (GMT+2).

The GBP/USD currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 1.2234

- Précédent Fermer: 1.2241

- % vari. au cours du dernier jour: -0.06 %

UK GDP data showed that the economy grew by only 0.1% in November, below forecasts of 0.2%, and growth in the three months to November stopped. This means the economy will stagnate for a second consecutive quarter unless GDP grows at least 0.07% in December. So far, traders have only envisioned one quarter-point interest rate cut by the Bank of England this year. UK financial markets, especially the bond market, remain under pressure amid growing concerns over the country’s debt levels and the government’s ability to restore public finances by sticking to its budget plans.

Recommandations de trading

- Niveaux de support: 1.2192, 1.2141

- Niveaux de résistance: 1.2262, 1.2322, 1.2371, 1.2455, 1.2507, 1.2540, 1.2568

From the point of view of technical analysis, the trend on the GBP/USD currency pair is bearish. Technically, the British pound looks weaker than the euro. After grabbing liquidity above 1.2262, the price closed sharply below the level, and there is a high probability of distributing this liquidity below 1.2141. Intra-day selling from the moving averages can be looked for. There are no optimal entry points for buying right now.

Scénario alternatif:if the price breaks through the resistance level at 1.2376 and consolidates above it, the uptrend will likely resume.

Fil d'actualité pour: 2025.01.17

- UK Retail Sales (m/m) at 09:00 (GMT+2).

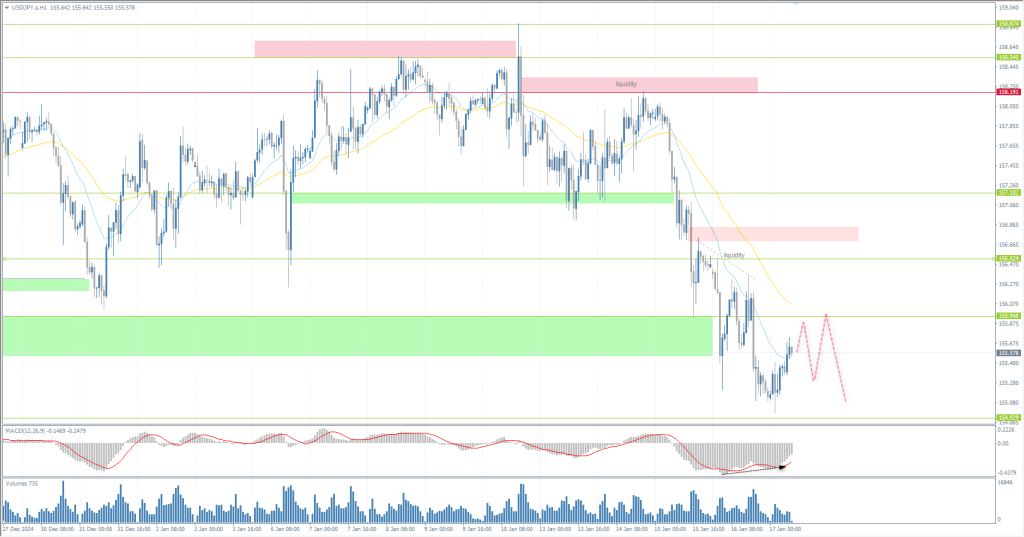

The USD/JPY currency pair

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 156.39

- Précédent Fermer: 155.14

- % vari. au cours du dernier jour: -0.80 %

The Japanese yen continues to strengthen. This is supported by growing speculation that the Bank of Japan may raise interest rates again next week. Bank of Japan Governor Kazuo Ueda and his deputy Ryozo Himino signaled the possibility of a rate hike at the upcoming meeting, with strong inflation and wage data supporting this outlook. Ueda also expressed growing confidence in wage growth, citing positive feedback from various industries.

Recommandations de trading

- Niveaux de support: 154.93, 154.34

- Niveaux de résistance: 155.95, 156.52, 156.74, 157.18, 158.19

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bullish. Currently, the price is trading in the demand zone, which makes it difficult to find entry points to sell. The price will likely form a flat accumulation to accumulate liquidity for further downward movement. It is not excluded that buyers will try to reach the resistance level of 156.52. Considering the MACD divergence, intraday buying can be sought, but up to the nearest targets and with a short-stop loss.

Scénario alternatif:If the price breaks above the resistance at 158.19, the uptrend is likely to resume.

Aucune nouvelle pour aujourd'hui

The XAU/USD currency pair (gold)

Indicateurs techniques de la paire de devises:

- Précédent Ouvrir: 2696

- Précédent Fermer: 2715

- % vari. au cours du dernier jour: +0.70 %

Gold traded at nearly $2,710 per ounce on Friday, near its highest monthly level and posting its third weekly gain. Recent US economic data, including lower-than-expected core inflation and disappointing retail sales data, revived hopes that the Federal Reserve may cut rates more than once this year. The US Fed spokesman Waller fueled that optimism by saying that if economic data weakens, the central bank could go for three or four rate cuts this year. Such measures would increase the attractiveness of the interest-free precious metal.

Recommandations de trading

- Niveaux de support: 2697, 2676, 2666, 2655, 2636, 2622, 2603, 2570

- Niveaux de résistance: 2726

From the point of view of technical analysis, the trend on the XAU/USD has changed to an uptrend. The price is aiming to test liquidity above 2726 (December high). Divergence on several timeframes indicates that the strength of buyers is weakening. Under such market conditions, earlier opened purchases should be closed, and it is too late to open new ones. And conditions have not yet formed for selling.

Scénario alternatif:if the price breaks below the support level of 2656, the downtrend is likely to resume.

Fil d'actualité pour: 2025.01.17

- US Building Permits (m/m) at 15:30 (GMT+2);

- US Industrial Production (m/m) at 16:15 (GMT+2).

Cet article reflète une opinion personnelle et ne doit pas être interprété comme un conseil en investissement, et/ou une offre, et/ou une demande persistante de réalisation d'opérations financières, et/ou une garantie, et/ou une prévision d'événements futurs.