US government shutdown occurs when Congress and the White House fail to agree on a budget or temporary funding in time. This leads to the partial closure of government institutions. Such events invariably impact financial markets – sometimes sharply, and sometimes paradoxically mildly.

History and Duration of Past Shutdowns

| Period | Period | Duration | Brief Reason |

| 30.09-13.10.1977 | J. Carter | 12 days | Disagreement over funding abortions in public hospitals |

| 30.09–18.10.1978 | Carter | 18 days | Disputes over defense spending |

| 20.11-23.11.1981 | R. Reagan | 2 days | Taxes and budget cuts |

| 09.10-13.10.1984 | Reagan | 2 days | Funding for education and civil programs |

| 16.12-18.12.1995 | B. Clinton | 5 days | Conflict over budget cuts |

| 16.12.1995-06.01.1996 | Clinton | 21 days | Longest in the 90s, over Medicare, education, and taxes |

| 01.10-17.10.2013 | B. Obama | 16 days | Disputes surrounding Obamacare |

| 20.01-23.01.2018 | Trump | 3 days | Immigration policy |

| 22.12.2018-25.01.2019 | Trump | 35 days | Dispute over funding the wall on the border with Mexico |

| 01.10.2025-12.11.2025 | Trump | 43 days |

Longest in history |

Let’s examine the behavior observed in the S&P 500 stock index and Gold, and the reaction of these instruments after the shutdown concludes.

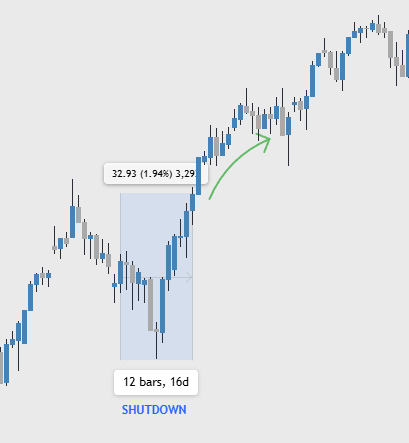

- Shutdown 01.10-17.10.2013 (16 days)

S&P500 (US500)

Market Reaction:

- During the shutdown: The S&P 500 Index showed a rise of +1.94%.

- After the shutdown: A confident rise in the index

Gold (XAU/USD)

Market Reaction:

- During the shutdown: The price of Gold saw a decline of -3.47%.

- After the shutdown: A price recovery is typically observed.

- Shutdown 22.12.2018–25.01.2019 (35days)

S&P500

Market Reaction:

- During the shutdown: The price of the index showed a confident increase of +10.82%.

- After the shutdown: Continued growth is expected.

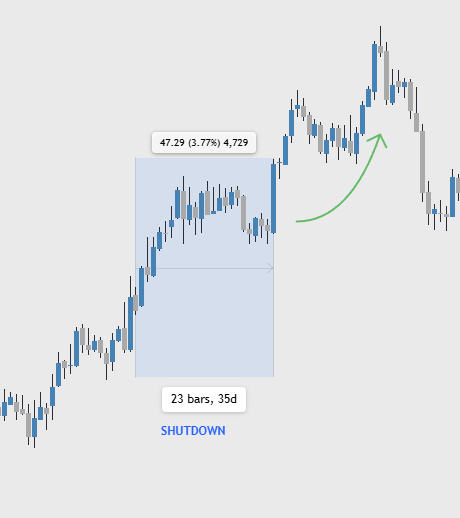

Gold (XAU/USD)

Market Reaction:

- During the shutdown: The Gold price showed an increase of +3.77%

- After the shutdown: Continued growth is expected.

Key takeaways for investors

The main lessons to be learned are:

- A prolonged shutdown means that political “promises” can drag on – this is a risk factor for investors, but everyone knows the shutdown will end sooner or later, so panic is absent.

- Statistics show that stock indices tend to rise during shutdowns, likely due to the anticipation of their conclusion. Overall, the S&P 500 Index has demonstrated positive returns during more than half of all government shutdowns since 1976, with the average return during these periods being slightly positive.

- The market reaction often reflects the overall state of the economy and central bank policy, rather than the government shutdown itself. However, the delay of economic data (employment reports, inflation figures) during a shutdown can complicate policy decision-making for the Federal Reserve and thus increase short-term volatility (the VIX index often rises).

- Gold usually acts as a reliable safe-haven asset during periods of political and economic uncertainty, especially during prolonged government closures. Given the uncertainty, gold, silver, platinum, and bonds should serve as a useful “hedge” during such a period, though statistics show that this does not always work.

- But statistics unequivocally demonstrate confident growth in both stock indices and gold after the shutdown ends. This indicates that for investors, shutdowns are political crises, not economic ones. Therefore, the market withstands them calmly and often rises after their resolution.

| Question | Answer |

| Should one sell stocks due to a shutdown? | Historically – no. The market recovers and often grows. |

| Is it advisable to buy on the dips? | Yes, this has worked in almost all cases. |

| Should one enter gold during times of political risk? | Yes, gold behaves stably and more often rises after a shutdown ends. |

| Does a shutdown pose a long-term risk? | No, the effect is almost always short-term. |

2025 United States Federal Government Shutdown: The Current Impasse

The last shutdown began on October 1, 2025, after appropriations bills or temporary funding were not passed.

Causes: Disputes between Congress and President Donald Trump regarding government funding, healthcare insurance, and expenditures on defense and foreign aid.

After a record-breaking 43-day partial shutdown of the US federal government, President Donald Trump signed a bill on November 13, 2025 to extend funding for several government agencies, bringing an end to the longest shutdown in the nation’s history.

The legislation provides funding for only a limited number of departments, including the Department of Agriculture, the Department of Veterans Affairs, legislative branch entities, and military construction programs. Funding for all other federal agencies has been extended only until January 30, 2026, leaving open the possibility of another government shutdown early next year.

While signing the bill at the White House, President Trump stated that “the federal government is returning to normal operations” and once again blamed the Democratic Party for the shutdown. According to the president, the opposition’s actions “caused tremendous harm to the country” – notably resulting in the cancellation or delay of more than 20,000 flights and leaving over a million federal employees and contractors without pay.

The White House estimates that the economic damage from the shutdown could reach up to $1.5 trillion, with a precise calculation expected to take several months.

Analysts note that while the current agreement temporarily eases budgetary tensions, the structural conflict between Republicans and Democrats over spending and debt remains unresolved. This creates a risk of another funding crisis by the end of January if Congress fails to pass a comprehensive budget.