The EUR/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.0880

- سابقہ کلوز: 1.0922

- آخری دن میں % chg.: +0.38 %

The dollar weakness on Monday supported the euro growth. The euro also received support last Friday when German Chancellor-in-waiting Merz reached an agreement with the Green Party on a fiscal reform package for major investments in infrastructure and defense. Still, the euro’s gains were limited after German bond yields fell due to dovish comments from ECB Vice President Guido, who said service sector inflation is slowing and heading for lower levels. Swaps discount the odds of a 25bp ECB rate cut at the April 17 meeting at 55%.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.0897, 1.0803, 1.0677, 1.0602, 1.0561, 1.0466

- ریزسٹنس لیولز: 1.0937, 1.0979

The EUR/USD currency pair’s hourly trend is bullish. The euro managed to consolidate above the resistance level of 1.0897. Currently, the price is seeking to test liquidity above 1.0937. Intraday, we can look for buying from the EMA lines or the 1.0897 level. There are no optimal entry points for selling right now.

متبادل حالات:if the price breaks through the support level of 1.0803 and consolidates below it, the downtrend will likely resume.

نیوز فیڈ برائے: 2025.03.18

- German ZEW Economic Sentiment (m/m) at 12:00 (GMT+2);

- Eurozone ZEW Economic Sentiment (m/m) at 12:00 (GMT+2);

- Eurozone Trade Balance (m/m) at 12:00 (GMT+2);

- US Building Permits (m/m) at 14:30 (GMT+2);

- US Industrial Production (m/m) at 15:15 (GMT+2).

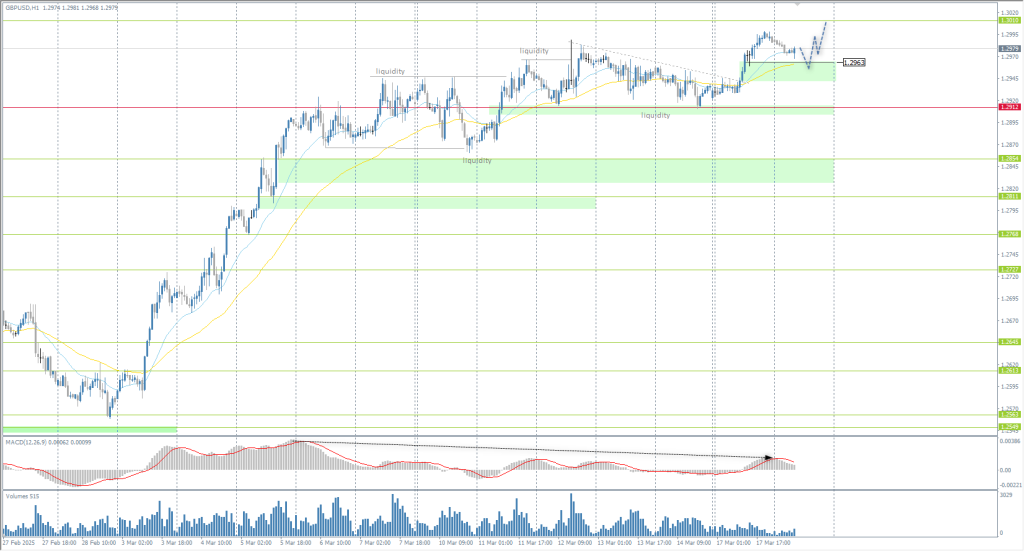

The GBP/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.2923

- سابقہ کلوز: 1.2986

- آخری دن میں % chg.: +0.48 %

The British pound traded at $1.294, just below the four-month low of $1.2966 hit on March 12, as investors awaited the Bank of England’s interest rate decision on Thursday. The Bank of England is expected to keep interest rates unchanged, balancing weak economic growth with lingering inflation risks. In February, the Central Bank lowered rates to 4.5% and cut its 2025 growth expectations to 0.75%, citing concerns over tax hikes and global trade uncertainty. However, persistent inflationary pressures complicate future rate decisions. Investors are also awaiting Chancellor Rachel Reeves’ spring statement on March 26, which will provide an updated economic projections.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.2963, 1.2914, 1.2866, 1.2811, 1.2768, 1.2704, 1.2645

- ریزسٹنس لیولز: 1.3010

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish. The price impulsively jumped from the triangle. Currently, the price is aiming to test the liquidity above 1.3010. It is best to use the EMA lines or the support level at 1.2963 for buying. Selling should be sought from 1.3010, but with confirmation. Note that a so-called SMT divergence is forming between GBP/USD and EUR/USD. This is when the price on one instrument updates the extremum, while the price on the other does not. This is usually a harbinger of a reversal or deep correction.

متبادل حالات:if the price breaks the support level of 1.2860 and consolidates below it, the downtrend will likely resume.

آج کے لیے کوئی خبر نہیں ہے

The USD/JPY currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 148.47

- سابقہ کلوز: 149.13

- آخری دن میں % chg.: +0.44 %

The Japanese yen fell to 149.5 per USD on Tuesday, hitting its lowest level in almost two weeks, as investors await the upcoming monetary policy decision by the Bank of Japan. The Central Bank is expected to leave interest rates unchanged at 0.5% following Wednesday’s meeting, while also assessing the impact of US policy changes on Japan’s economy. Despite the short-term pause, expectations remain that Japan will raise rates later this year, supported by rising wages and steady inflation, which provide an opportunity for policy normalization.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 149.06, 148.48, 148.17, 147.61, 146.65, 146.00

- ریزسٹنس لیولز: 150.16, 151.29, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair has changed to an upward trend. The Japanese yen is showing even more weakness than the US dollar. And it is not combined with fundamental factors, namely the monetary policy of the US Federal Reserve and the Bank of Japan. Currently, the price is aiming to test liquidity above 150.15. The MACD is indicating divergence. Under such market conditions, buy trades should be considered from the EMA lines or the support level of 149.06. For selling, 150.15 can be considered, but with confirmation.

متبادل حالات:if the price breaks through the support level at 147.43 and consolidates below it, the downtrend will likely resume.

آج کے لیے کوئی خبر نہیں ہے

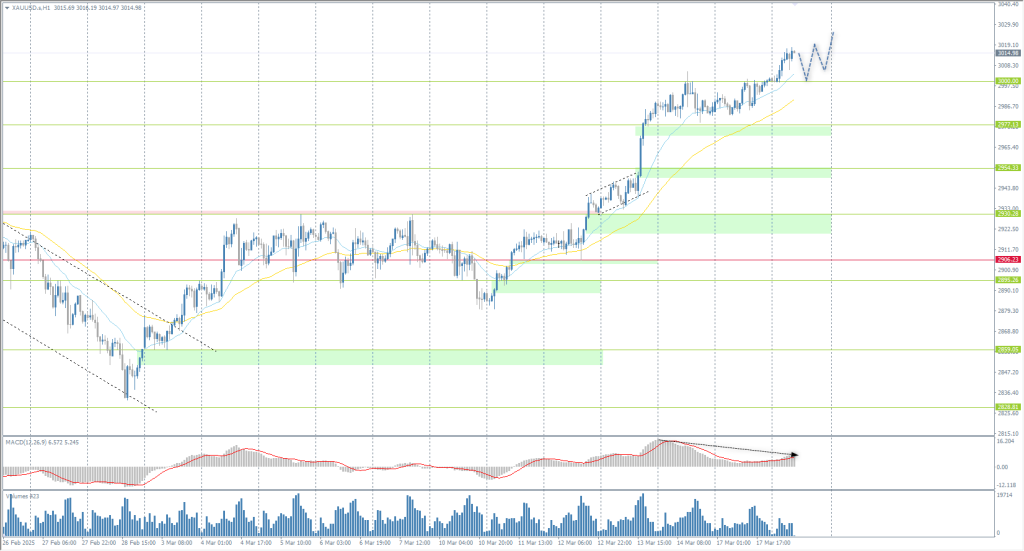

The XAU/USD currency pair (gold)

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 2983

- سابقہ کلوز: 3001

- آخری دن میں % chg.: +0.60 %

Metal prices found support on Monday thanks to a weaker dollar and lower global government bond yields. Additionally, demand for precious metals rose amid heightened geopolitical risks after the US launched strikes against Yemen’s Houthi rebels over the weekend. Gold buying by funds is supporting prices after long gold positions in ETF funds rose to a 17-month high last Friday.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- ریزسٹنس لیولز: 3050, 3100

From the point of view of technical analysis, the trend on the XAU/USD has changed to an uptrend. The price is trading at historical highs. Since there are no counter resistances now, we can only target the psychological levels of 3050, 3100. For buying, we can consider EMA lines or support level 3000, but with confirmation. For selling, there are no optimal entry points now.

متبادل حالات:if the price breaks below the support level 2906, the downtrend will likely resume.

نیوز فیڈ برائے: 2025.03.18

- US Building Permits (m/m) at 14:30 (GMT+2);

- US Industrial Production (m/m) at 15:15 (GMT+2).

یہ آرٹیکل ذاتی رائے کا اظہار ہے اور اس سے مراد سرمایہ کاری کی تجویز اور/یا آفر، اور/یا فائننشل ٹرانزیکشنز کرنے کی مسلسل درخواست، اور/یا کوئی ضمانت، اور/یا مستقبل کے ایونٹس کی پیشگوئی نہیں لینی چاہیے۔