The EUR/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.0813

- سابقہ کلوز: 1.0800

- آخری دن میں % chg.: -0.12 %

Eurozone private sector activity grew at the fastest pace since August, although this growth did not meet market expectations as the increase in manufacturing output was partially offset by a slowdown in the services sector. Meanwhile, ECB official Cipollone said the case for a rate cut is strengthening as inflation may be slowing faster than expected. His counterpart Stournaras supported this view on Friday, saying that all signs point to a rate cut in April. In addition, ECB spokesman Luis de Guindos also reiterated the view that the Central Bank has room to further reduce borrowing costs. The narrative for the European currency is now to the downside.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.0805, 1.0766, 1.0677, 1.0602, 1.0561, 1.0466

- ریزسٹنس لیولز: 1.0858, 1.0918, 1.0947, 1.0979

The EUR/USD currency pair’s hourly trend has changed to a downtrend. Yesterday, the price consolidated below the level of priority change. At the moment, the price is trading in the demand zone, but sellers do not let the price return beyond the level of 1.0805. Given the MACD divergence, selling here is not recommended. Buying is best considered on intraday timeframes when the price consolidates above 1.0805.

متبادل حالات:if the price breaks the resistance level of 1.0858 and consolidates above it, the uptrend will likely resume.

نیوز فیڈ برائے: 2025.03.25

- Germany Ifo Business Climate (m/m) at 11:00 (GMT+2);

- US New Home Sales (m/m) at 16:00 (GMT+2);

- US CB Consumer Confidence (m/m) at 16:00 (GMT+2).

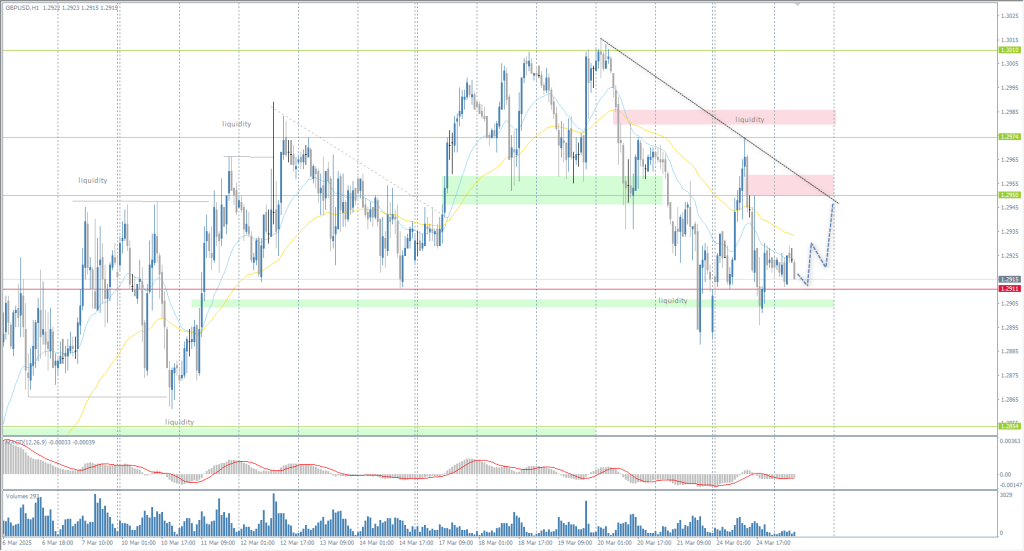

The GBP/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.2893

- سابقہ کلوز: 1.2920

- آخری دن میں % chg.: -0.20 %

The S&P Global Flash UK Manufacturing PMI fell to 44.6 in March 2025 from 46.9 in February, below the expectations of 46.4. The reading marks the sixth consecutive month of deteriorating conditions in the manufacturing sector, bringing the index to its lowest level since late 2023. Manufacturing output fell by the most since October 2023, and there was also a sharp drop in total sales, driven by exports. Weak data and negative for sterling ahead of the inflation report and the publication of the Spring Budget.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.2911, 1.2866, 1.2811, 1.2768, 1.2704, 1.2645

- ریزسٹنس لیولز: 1.2950, 1.3010

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish, but close to change. For the third trading session, sterling is trading at the level of the shift in priority, which increases the probability of a change in the medium-term trend. However, the SMT divergence between EUR/USD and GBP/USD says that selling should be abandoned now. In this scenario, intraday buying can be sought with a target to 1.2950.

متبادل حالات:if the price breaks the support level of 1.2911 and consolidates below it, the downtrend will likely resume.

آج کے لیے کوئی خبر نہیں ہے

The USD/JPY currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 149.35

- سابقہ کلوز: 150.66

- آخری دن میں % chg.: +0.87 %

The Japanese yen remained near a three-week low on Tuesday as the dollar strengthened amid good economic data from the US and expectations that President Donald Trump may be more selective on tariffs. Meanwhile, Trump’s promise on Monday to impose duties on automobiles, pharmaceuticals, and other industries raised concerns about potential risks to key Japanese exports. Domestically, minutes from the Bank of Japan’s January meeting showed that policymakers remain open to additional interest rate hikes depending on the pace of wage growth and inflation.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 149.51, 148.95, 148.58, 148.25

- ریزسٹنس لیولز: 151.32, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bullish. The yen is aiming to test liquidity above 151.32. There are no strong counter resistances up to this level, so intraday traders should look for buy trades. It is best to use EMA lines to join the trend. There are no optimal entry points for selling right now.

متبادل حالات:if the price breaks through the support level at 149.51 and consolidates below it, the downtrend will likely resume.

نیوز فیڈ برائے: 2025.03.25

- Japan Monetary Policy Meeting Minutes at 01:50 (GMT+2).

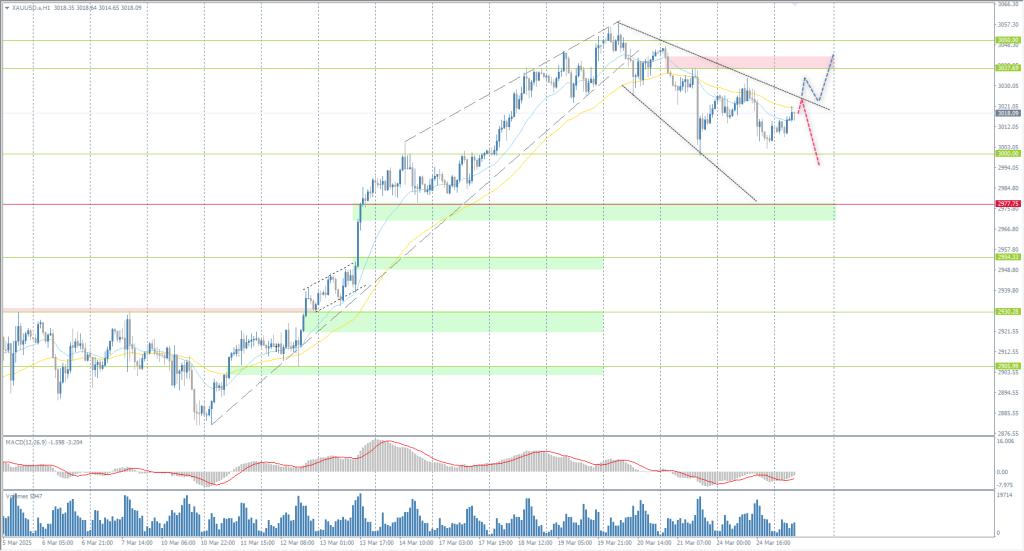

The XAU/USD currency pair (gold)

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 3023

- سابقہ کلوز: 3011

- آخری دن میں % chg.: -0.39 %

Gold climbed above $3010 per ounce on Tuesday after three consecutive sessions of losses, supported by safe-haven demand amid tariff uncertainty. President Donald Trump warned of looming auto tariffs, threatened to impose a 25% levy on buyers of Venezuelan oil, and suggested some countries may be exempt from retaliatory duties that take effect next week. However, price gains may be tempered by Atlanta Federal Reserve President Raphael Bostic’s cautious stance on rate cuts. Bostic said he expects inflation to slow in the coming months and is now considering only a modest 25 basis point rate cut by the end of the year.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- ریزسٹنس لیولز: 3037, 3050, 3100

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Currently, the price is trading at the level of moving averages in the supply zone. It is possible to look for sell deals here but with the appropriate reaction of the sellers. At the moment there is no reaction. If the price can consolidate above the downtrend line, we can consider buying with a target of 3037. On gold, it is best to trade on an "if-then” tactic right now.

متبادل حالات:if the price breaks below the support level 2906, the downtrend will likely resume.

نیوز فیڈ برائے: 2025.03.25

- US New Home Sales (m/m) at 16:00 (GMT+2);

- US CB Consumer Confidence (m/m) at 16:00 (GMT+2).

یہ آرٹیکل ذاتی رائے کا اظہار ہے اور اس سے مراد سرمایہ کاری کی تجویز اور/یا آفر، اور/یا فائننشل ٹرانزیکشنز کرنے کی مسلسل درخواست، اور/یا کوئی ضمانت، اور/یا مستقبل کے ایونٹس کی پیشگوئی نہیں لینی چاہیے۔