The EUR/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.0829

- سابقہ کلوز: 1.0817

- آخری دن میں % chg.: -0.11 %

The euro stabilized near $1.08 as investors assessed key inflation data and awaited retaliatory US tariffs that will take effect on April 2. German consumer price inflation slowed to 2.2% in March 2025, in line with market expectations and the lowest since November 2024. Meanwhile, other flash CPI reports showed that French inflation held at a four-year low of 0.8%, Spanish inflation unexpectedly fell to a five-month low of 2.3%, and Italian inflation rose to a 1.5-year high of 2.0%. Slowing inflationary pressures in the Eurozone, combined with fears of a global trade war, fueled expectations that the European Central Bank will cut interest rates by 65 basis points this year.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.0785, 1.0755, 1.0677, 1.0602, 1.0561, 1.0466

- ریزسٹنس لیولز: 1.0858, 1.0918, 1.0947, 1.0979

The EUR/USD currency pair’s hourly trend is bearish. The price is starting to flat near the EMA lines. The intraday bias remains bullish. Buy trades can be considered from the moving average lines or after a liquidity test below 1.0785. For selling, traders need to estimate the price reaction to the 1.0858 priority shift level.

متبادل حالات:if the price breaks the resistance level of 1.0858 and consolidates above it, the uptrend will likely resume.

نیوز فیڈ برائے: 2025.04.01

- German Manufacturing PMI (m/m) at 10:55 (GMT+3);

- Eurozone Manufacturing PMI (m/m) at 11:00 (GMT+3);

- Eurozone Consumer Price Index (m/m) at 12:00 (GMT+3);

- Eurozone Unemployment Rate (m/m) at 12:00 (GMT+3);

- Eurozone ECB President Lagarde Speaks at 15:30 (GMT+3);

- US ISM Manufacturing PMI (m/m) at 17:00 (GMT+3);

- US JOLTs Job Openings (m/m) at 17:00 (GMT+3).

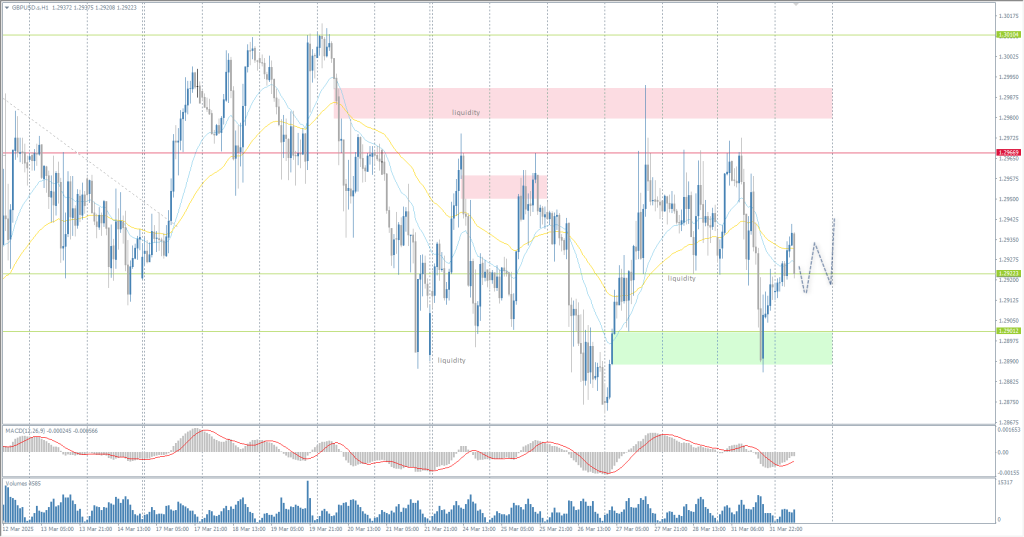

The GBP/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.2936

- سابقہ کلوز: 1.2917

- آخری دن میں % chg.: -0.14 %

In the UK, the government announced several policy changes aimed at rebuilding the public purse, including welfare reforms, departmental spending cuts, and a small package of tax changes. The UK Finance Minister Reeves said UK inflation will average 3.2% in 2025, down from the 2.6% expectations in October. The UK’s annual inflation rate fell to 2.8% in February 2025 from 3% in January. Thus, the Bank of England (BoE) is likely to hold rates until the second half of 2025, and then a cut is simply necessary.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.2922, 1.2873, 1.288, 1.2933, 1.2911, 1.2866, 1.2811

- ریزسٹنس لیولز: 1.2966, 1.3010

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish, but close to change. Yesterday, the price tested the liquidity below 1.2901 and now seeks to distribute this liquidity above 1.2966. Buying trades can be considered from 1.2922 or 1.2901, but with confirmation. There are no optimal entry points for selling right now.

متبادل حالات:if the price breaks through the resistance level of 1.2966 and consolidates above it, the uptrend will likely resume.

نیوز فیڈ برائے: 2025.04.01

- UK Manufacturing PMI (m/m) at 11:30 (GMT+3).

The USD/JPY currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 149.79

- سابقہ کلوز: 149.95

- آخری دن میں % chg.: +0.10 %

The unemployment rate in Japan unexpectedly declined to 2.4% in February from 2.5% in the previous month. However, business sentiment weakened in the first quarter, reflecting growing concerns about the potential impact of US tariffs on Japan’s export-oriented economy. The latest economic data adds to uncertainty about the prospects for further interest rate hikes by the Bank of Japan.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 149.55, 149.15, 148.60, 148.25

- ریزسٹنس لیولز: 150.10, 151.02, 151.32, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bullish, but close to a shift. The yen weakened yesterday for fundamental reasons. Currently, the price is aiming to test the liquidity above 150.10, where a sharp reaction of sellers is expected. In such a scenario, traders can look for selling here. Buyers are trying to build the support level at 149.55, but the level remains weak.

متبادل حالات:if the price breaks through the support level at 148.60 and consolidates below it, the downtrend will likely resume.

نیوز فیڈ برائے: 2025.04.01

- Japan Unemployment Rate (m/m) at 02:30 (GMT+3);

- Japan Tankan Large Manufacturers Index (q/q) at 02:50 (GMT+3);

- Japan Tankan Large Non-Manufacturers Index (q/q) at 02:50 (GMT+3);

- Japan Manufacturing PMI (m/m) at 03:30 (GMT+3).

The XAU/USD currency pair (gold)

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 3088

- سابقہ کلوز: 3124

- آخری دن میں % chg.: +1.16 %

Gold jumped to a record near $3,140 an ounce on Tuesday as investors rushed into the safe-haven asset ahead of President Donald Trump’s imposition of tariffs, heightening fears of a global trade war. Trump has said the retaliatory tariffs, which take effect Wednesday, will apply to all countries, not just a small group of 10 to 15 countries.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 3100, 3057, 3037,3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- ریزسٹنس لیولز: 3150, 3200

From the point of view of technical analysis, the trend on the XAU/USD is bullish. The situation has not changed much. Gold continues to rise. The price is already above all bank projections, and the fundamental picture continues to favor the strengthening of the yellow metal. It is not recommended to sell here. You can buy from the EMA lines or from the intermediate support level of 3130.

متبادل حالات:if the price breaks below the support level of 3000, the downtrend will likely resume.

نیوز فیڈ برائے: 2025.04.01

- US ISM Manufacturing PMI (m/m) at 17:00 (GMT+3);

- US JOLTs Job Openings (m/m) at 17:00 (GMT+3).

یہ آرٹیکل ذاتی رائے کا اظہار ہے اور اس سے مراد سرمایہ کاری کی تجویز اور/یا آفر، اور/یا فائننشل ٹرانزیکشنز کرنے کی مسلسل درخواست، اور/یا کوئی ضمانت، اور/یا مستقبل کے ایونٹس کی پیشگوئی نہیں لینی چاہیے۔