The EUR/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.1318

- سابقہ کلوز: 1.1349

- آخری دن میں % chg.: +0.27 %

German 10-year bond yields are holding at 2.5%, the lowest since March 4, as investors weigh the latest developments in US trade policy and await the European Central Bank’s interest rate decision on Thursday. On the monetary policy front, the ECB is widely expected to cut the rate by 25 basis points. Market participants will be watching the Central Bank’s comments closely to see how officials assess the impact of trade tensions on the Eurozone economy and the future trajectory of interest rates.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.1246, 1.1157, 1.1088, 1.0960

- ریزسٹنس لیولز: 1.1496

The EUR/USD currency pair’s hourly trend is bullish. The euro is trading on the EMA lines and forms a flat accumulation in the form of a narrowing triangle. For buying, it is recommended to consider a breakout of the descending line of the pattern. For selling, a breakdown of the ascending line of the triangle can be seen. The probability of an upside breakout is higher as the price has not reached the key liquidity pool above 1.1496.

متبادل حالات:if the price breaks the support level of 1.0960 and consolidates below it, the downtrend will likely resume.

نیوز فیڈ برائے: 2025.04.15

- German ZEW Economic Sentiment (m/m) at 12:00 (GMT+3);

- Eurozone ZEW Economic Sentiment (m/m) at 12:00 (GMT+3);

- Eurozone Industrial Production (m/m) at 12:00 (GMT+3).

The GBP/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.3091

- سابقہ کلوز: 1.3189

- آخری دن میں % chg.: +0.75 %

The British pound climbed above $1.317, the highest in six months, thanks to the weakening US dollar amid confusion over US trade policy. Markets reacted to President Trump’s temporary tariff relief on smartphones and computers from China, although new duties on semiconductors and possibly phones are expected soon. The uncertainty put pressure on the dollar, which favored sterling. Despite the pound’s strength, traders still expect a 75bp cut in the Bank of England rate this year. Now, the focus will shift to the upcoming employment and inflation data.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.3121, 1.3030, 1.2891, 1.2743

- ریزسٹنس لیولز: 1.3207, 1.3290

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly time frame has changed to an upward trend. Sterling has consolidated above the priority change level, but it has reached a large pool of liquidity above 1.3207. Fixation of previously opened purchases is likely here. Given the MACD divergence, the price may correct to 1.3121. There are no optimal entry points for buying now.

متبادل حالات:if the price breaks the resistance level of 1.3114 and consolidates above it, the uptrend will likely resume.

نیوز فیڈ برائے: 2025.04.15

- UK Average Earnings Index (m/m) at 09:00 (GMT+3);

- UK Claimant Count Change (m/m) at 09:00 (GMT+3);

- UK Unemployment Rate (m/m) at 09:00 (GMT+3).

The USD/JPY currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 143.91

- سابقہ کلوز: 143.02

- آخری دن میں % chg.: -0.62 %

The Japanese yen traded below 143 per dollar on Tuesday, retreating from recent highs as a rebound in risk appetite dampened demand for the safe-haven currency. The change in sentiment followed US President Donald Trump’s decision to exempt key technology goods from recently imposed retaliatory tariffs, as well as reports of a possible pause in the imposition of 25% duties on auto imports. Despite the improved tone, markets remained cautious after the US Commerce Department launched a national security investigation into imports of semiconductors and pharmaceuticals, industries that are closely intertwined with Asian supply chains. Investors are also keeping a close eye on upcoming trade talks between Washington and Tokyo.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 142.21, 141.61, 140.45

- ریزسٹنس لیولز: 144.08, 145.14, 147.14

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. The situation has not changed much compared to yesterday. The yen reached the support level of 142.20, where the buyers showed a moderate reaction. This led to the formation of a flat with the boundaries 142.21–144.08. According to the flat rules, it is better to sell from the upper boundary and buy from the lower one. However, for buyers, it is worth considering that the liquidity pool is below 141.61, which increases the probability of a test of this level.

متبادل حالات:if the price breaks through the resistance level at 147.14 and consolidates above it, the uptrend will likely resume.

آج کے لیے کوئی خبر نہیں ہے

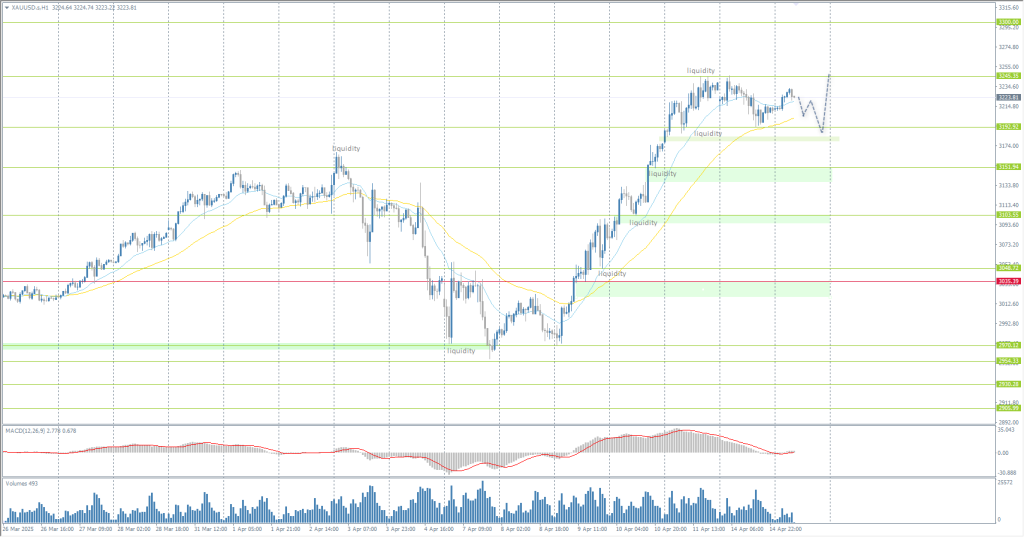

The XAU/USD currency pair (gold)

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 3220

- سابقہ کلوز: 3211

- آخری دن میں % chg.: -0.28 %

Gold is trading above $3220 per ounce on Tuesday. Uncertainty over President Donald Trump’s tariff plans continues to drive safe-haven gold demand. Having temporarily exempted technology goods from retaliatory tariffs, Trump is now considering a 25% tariff exemption for the auto industry. However, on Monday, the administration launched a national security investigation into pharmaceutical and semiconductor imports, potentially paving the way for new tariffs. The precious metal was also supported by speeches from Federal Reserve officials, who said on Monday that interest rates may have to be cut soon if Trump’s sweeping tariffs remain in place.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 3192, 3152, 3103, 3048, 3035

- ریزسٹنس لیولز: 3245, 3300

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold is forming a flat liquidity accumulation near the EMA lines. It is worth considering the EMA lines or the support level of 3192 for buying. Selling should not be rushed, as we need to see liquidity capture with sellers’ reaction for a reversal. The nearest resistance level is 3245.

متبادل حالات:if the price breaks and consolidates below the support level of 3035, the downtrend will likely resume.

آج کے لیے کوئی خبر نہیں ہے

یہ آرٹیکل ذاتی رائے کا اظہار ہے اور اس سے مراد سرمایہ کاری کی تجویز اور/یا آفر، اور/یا فائننشل ٹرانزیکشنز کرنے کی مسلسل درخواست، اور/یا کوئی ضمانت، اور/یا مستقبل کے ایونٹس کی پیشگوئی نہیں لینی چاہیے۔