The EUR/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.1663

- سابقہ کلوز: 1.1601

- آخری دن میں % chg.: -0.53 %

The EUR/USD pair fell yesterday due to the strengthening of the dollar. The euro was also weakened by a 1.7 bps decline in 10-year bond yields on Tuesday, which narrowed the euro’s interest rate differential with 10-year T-note yields, which rose by 5.0 bps. The July ZEW Expectations Index in Germany rose by 5.2 points to 52.7 from 47.5 in June, which was stronger than the expected growth to 50.4. The Eurozone industrial production report for May was 1.7% MoM and 3.7% YoY, which was stronger than market expectations of 1.0% MoM and 2.2% YoY. Swaps estimate the probability of an ECB rate cut of 25 bps at the July 24 meeting at 2%.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.1589, 1.1518

- ریزسٹنس لیولز: 1.1660, 1.1714, 1.1762, 1.1810, 1.1913

The EUR/USD currency pair’s hourly trend has changed to downward. The price has consolidated below the priority change level and is now trading below the EMA lines. Currently, there is a partial fixation of sales. However, the price has not reached the liquidity zone below 1.1589 and has not formed a false breakdown, which increases the likelihood of a further decline. For sell deals, it is best to use the EMA lines or the resistance level of 1.1660. There are no optimal entry points for purchases.

متبادل حالات:if the price breaks through the resistance level of 1.1714 and consolidates above it, the uptrend will likely resume.

نیوز فیڈ برائے: 2025.07.16

- Eurozone Trade Balance (m/m) at 12:00 (GMT+3);

- US Producer Price Index (m/m) at 15:30 (GMT+3);

- US Industrial Production (m/m) at 16:15 (GMT+3);

The GBP/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.3423

- سابقہ کلوز: 1.3384

- آخری دن میں % chg.: -0.29 %

Today, the UK will publish its inflation report for June. This release could play a key role in shaping short-term expectations regarding the Bank of England’s (BoE) policy, especially given that markets are increasingly leaning towards a rate cut at the upcoming meeting. Core inflation is expected to rise slightly from 3.4% to 3.5% y/y. Core inflation, excluding food and energy, is expected to increase from 3.5% to 3.6% y/y. Upward pressure on prices is partly explained by higher utility taxes, which are seen as a temporary inflationary force rather than a sign of broad-based price growth. If inflation surprises on the upside, the pound could see a short-term rebound as traders reassess the need for monetary policy easing. However, given the transitory nature of inflationary factors and broader economic weakness, any strengthening of the pound is likely to be limited and short-lived.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.3410, 1.3388

- ریزسٹنس لیولز: 1.3471, 1.3532, 1.3619, 1.3680, 1.3712, 1.3752, 1.3770, 1.4000

In terms of technical analysis, the trend on the currency pair GBP/USD is bearish. The British pound continues to weaken against the US dollar. The price is now trying to test liquidity below the 1.3374 level. Sell trades can be sought from the EMA lines or from the 1.3471 resistance level. Buys can be considered from 1.3374, but only if buyers take the initiative (false breakdown + impulse reaction).

متبادل حالات:if the price breaks through the resistance level of 1.3619 and consolidates above it, the uptrend will likely resume.

نیوز فیڈ برائے: 2025.07.16

- UK Consumer Price Index (m/m) at 09:00 (GMT+3).

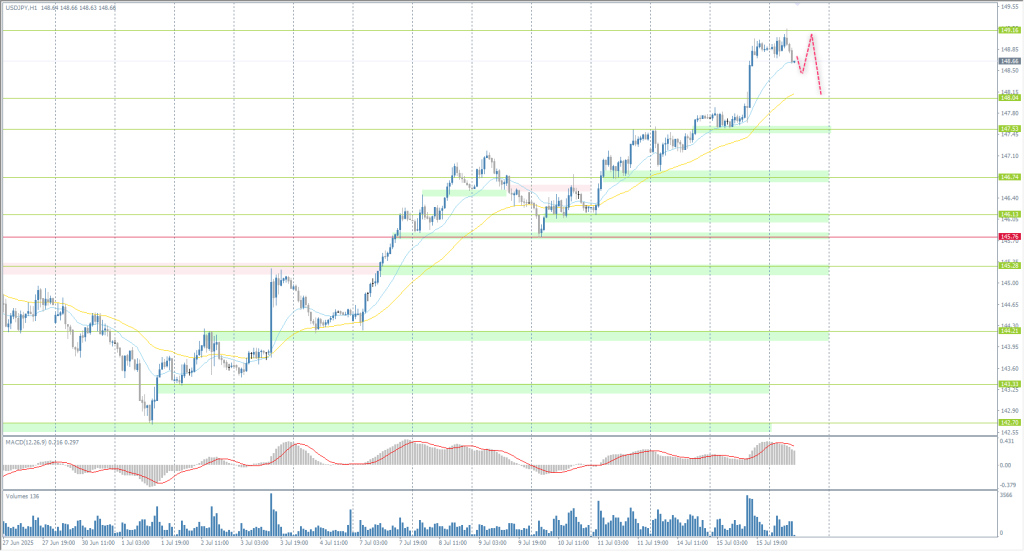

The USD/JPY currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 147.72

- سابقہ کلوز: 148.86

- آخری دن میں % chg.: +0.77 %

On Wednesday, the Japanese yen fell to 149 per dollar, its lowest level since early April, as the US dollar strengthened after the release of an inflation report that dampened expectations of an imminent rate cut by the Federal Reserve. On the domestic front, sentiment among Japanese manufacturers improved slightly in July, helped by a revival in the semiconductor sector. However, concerns remain about the potential impact of US tariffs. Markets are now focusing on upcoming trade and inflation data in Japan, which may provide further insight into the local impact of tariff threats.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 148.04, 147.53, 146.80, 146.13, 145.88, 145.28, 144.18

- ریزسٹنس لیولز: 149.16

From a technical point of view, the medium-term trend of the USD/JPY is bullish. The Japanese yen has reached the resistance level of 149.16. Given the MACD divergence, previously opened trades will be closed here, which will lead to a corrective movement or the formation of a flat. For sell deals, you can consider 149.16, but with a short stop loss, as this will be a countertrend trade. For buy deals, consider the support level of 148.04 or 147.53, but also with confirmation.

متبادل حالات:if the price breaks through the support level of 146.13 and consolidates below it, the downward trend will likely resume.

آج کے لیے کوئی خبر نہیں ہے

The XAU/USD currency pair (gold)

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 3344

- سابقہ کلوز: 3325

- آخری دن میں % chg.: -0.57 %

On Wednesday, gold prices rose to around $3330 per ounce after a two-day decline, as investors assessed rising inflation in the US and current trade events. The June Consumer Price Index rose at its fastest pace in five months, suggesting that tariffs may be starting to have an impact on inflationary pressures. President Trump called for lower rates, but Fed officials were cautious, citing inflation risks. Meanwhile, trade issues continue to simmer after Trump announced 19% tariffs on Indonesian goods and said additional tariff notices would be sent to smaller countries. In addition, the World Gold Council reported net gold purchases by central banks of 20 tons in May, led by Kazakhstan, Turkey, Poland, and Singapore.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 3345, 3322, 3309

- ریزسٹنس لیولز: 3365, 3393, 3405, 3444, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Yesterday, the price corrected to the support level of 3322, where buyers took the initiative. Currently, the price has reached the resistance level of 3342, and it is important to assess the price action here. A breakout and consolidation above 3342 will open the way for the price to the downward trend line or to the liquidity pocket above 3365. If sellers react to 3342, there may be another sell-off to 3322 or below.

متبادل حالات:if the price breaks through the support level of 3309 and consolidates below it, the downtrend will likely resume.

نیوز فیڈ برائے: 2025.07.16

- US Producer Price Index (m/m) at 15:30 (GMT+3);

- US Industrial Production (m/m) at 16:15 (GMT+3).

یہ آرٹیکل ذاتی رائے کا اظہار ہے اور اس سے مراد سرمایہ کاری کی تجویز اور/یا آفر، اور/یا فائننشل ٹرانزیکشنز کرنے کی مسلسل درخواست، اور/یا کوئی ضمانت، اور/یا مستقبل کے ایونٹس کی پیشگوئی نہیں لینی چاہیے۔