The EUR/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.1599

- سابقہ کلوز: 1.1640

- آخری دن میں % chg.: +0.35 %

The dollar fell sharply on Wednesday after President Trump appeared to launch another trial balloon regarding the possible dismissal of Fed Chairman Powell. On Tuesday, at a meeting with House Republicans, Trump said he wanted to fire Powell, but later denied this intention after markets reacted negatively. The dollar fell on the Powell news, as a political takeover of the Fed could scare foreign investors and stimulate a flight from dollar-denominated stocks and bonds.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.1616, 1.1589, 1.1518

- ریزسٹنس لیولز: 1.1714, 1.1762, 1.1810, 1.1913

The EUR/USD currency pair’s hourly trend is bearish. Yesterday, amid a surge in volatility following Trump’s statement, the euro jumped sharply to the priority change level of 1.1714, but then the price quickly corrected to 1.1616. A flat period usually follows such volatility. For buy deals, you can consider 1.1616, but with short targets, for example, up to 1.1660. There are no optimal entry points for sales at the moment.

متبادل حالات:if the price breaks through the resistance level of 1.1714 and consolidates above it, the uptrend will likely resume.

نیوز فیڈ برائے: 2025.07.17

- Eurozone Consumer Price Index (m/m) at 12:00 (GMT+3);

- US Retail Sales (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

The GBP/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.3383

- سابقہ کلوز: 1.3421

- آخری دن میں % chg.: +0.28 %

The British pound rose above $1.34 after UK inflation in June came in higher than expected. Core inflation was 3.6%, higher than the expectations of 3.4% and higher than May’s figure. This caused traders to lower their expectations for a rate cut by the Bank of England (BoE). Markets now estimate the probability of a 25 basis point rate cut in August at 80%, with another cut possible before the end of the year. Although inflation is still well above the Bank of England’s 2% target, analysts note that much of the recent increase is due to changes in energy prices, which may ease in the coming months. Attention is now shifting to the UK labor market, which politicians believe is more important.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.3374

- ریزسٹنس لیولز: 1.3485, 1.3532, 1.3619, 1.3680, 1.3712

In terms of technical analysis, the trend on the currency pair GBP/USD is bearish. The British pound showed bullish impulse from the liquidity zone below 1.3374. Currently, the price is forming a flat accumulation near the EMA lines, which complicates the search for good entry points. A retest of 1.3374 cannot be ruled out.

متبادل حالات:if the price breaks through the resistance level of 1.3485 and consolidates above it, the uptrend will likely resume.

نیوز فیڈ برائے: 2025.07.17

- UK Average Earnings Index (m/m) at 09:00 (GMT+3);

- UK Claimant Count Change (m/m) at 09:00 (GMT+3);

- UK Unemployment Rate (m/m) at 09:00 (GMT+3).

The USD/JPY currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 148.86

- سابقہ کلوز: 147.86

- آخری دن میں % chg.: -0.67 %

The Japanese yen fell to 148 per dollar on Thursday as investors reacted to disappointing trade data that heightened fears of a possible technical recession. Japan’s trade surplus narrowed to 153.1 billion yen in June 2025 from 221.3 billion yen a year earlier, well below market expectations of a 353.9 billion yen surplus. Exports fell to 0.5% y/y to 9,162.6 billion yen, marking the second consecutive monthly decline and falling short of expectations. The decline was caused by continued pressure from the US, raising concerns that Japan’s economy could contract again in the second quarter and possibly fall into a technical recession. Imports, on the other hand, rose to 0.2% for the first time in three months, beating expectations of a 1.6% decline. Meanwhile, investors are watching for potential fiscal stimulus ahead of the upper house elections on July 20, amid speculation about increased government spending and a possible reduction in consumption tax to stimulate economic growth.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 147.48, 146.72, 146.13, 145.88, 145.28, 144.18

- ریزسٹنس لیولز: 149.16

From a technical point of view, the medium-term trend of the USD/JPY is bullish. Sellers took the initiative from the resistance level of 149.16, after which the price corrected to 147.48. Here, buyers entered the game, but there was no liquidity capture, which increases the likelihood of a repeat decline. For sell deals, you can consider the intermediate resistance level of 148.64, but with confirmation. There are currently no optimal entry points for buying.

متبادل حالات:if the price breaks through the support level of 146.72 and consolidates below it, the downward trend will likely resume.

نیوز فیڈ برائے: 2025.07.17

- Japan Trade Balance (m/m) at 02:50 (GMT+3).

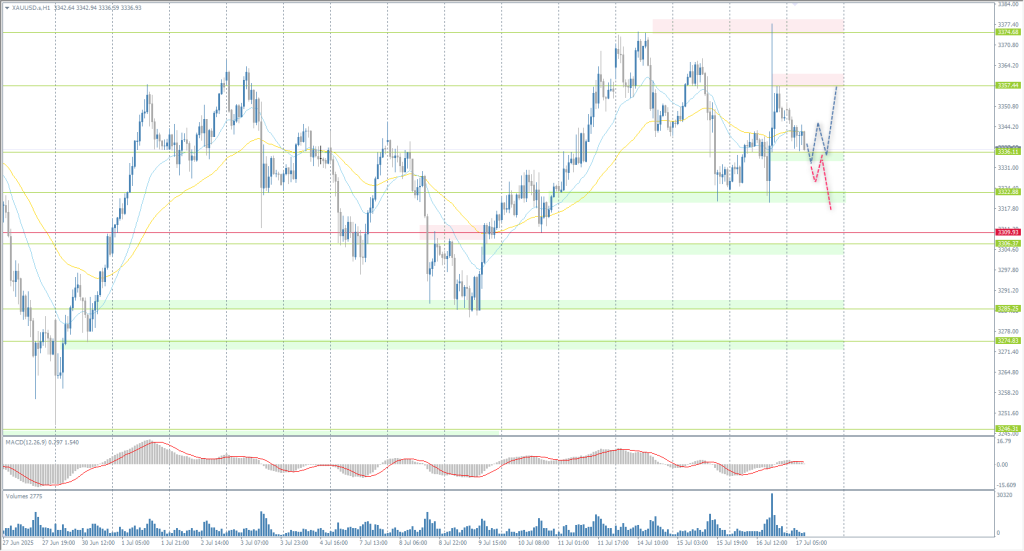

The XAU/USD currency pair (gold)

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 3324

- سابقہ کلوز: 3347

- آخری دن میں % chg.: +0.69 %

On Thursday, gold prices fell to $3,340 per ounce, reversing the previous session’s gains, as the US dollar regained ground after uncertainty over the Federal Reserve chairmanship eased. While there were reports that President Donald Trump was considering removing Fed Chairman Jerome Powell from office, he later denied these claims but reiterated his criticism of interest rate policy. Meanwhile, June data on the US Producer Price Index showed wholesale prices remained stable, suggesting that tariffs may be having less impact on the economy than initially thought.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 3336, 3322, 3309

- ریزسٹنس لیولز: 3357, 3374, 3405, 3444, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. The price is currently forming a wide-range flat with boundaries of 3336–3357. It is important to assess the price action at the 3336 level. If buyers take the initiative here, it will open up opportunities for buying up to 3357. A breakdown and consolidation of the price below 3336 could trigger a sell-off to 3322 and below.

متبادل حالات:if the price breaks through the support level of 3309 and consolidates below it, the downtrend will likely resume.

نیوز فیڈ برائے: 2025.07.17

- US Retail Sales (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3).

یہ آرٹیکل ذاتی رائے کا اظہار ہے اور اس سے مراد سرمایہ کاری کی تجویز اور/یا آفر، اور/یا فائننشل ٹرانزیکشنز کرنے کی مسلسل درخواست، اور/یا کوئی ضمانت، اور/یا مستقبل کے ایونٹس کی پیشگوئی نہیں لینی چاہیے۔