The EUR/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.1640

- سابقہ کلوز: 1.1687

- آخری دن میں % chg.: +0.40 %

The euro reached a weekly high, driven by reduced political risks in France, where Prime Minister Sébastien Lecornu successfully survived two no-confidence votes in the National Assembly, temporarily stabilizing the political landscape. Additional support came from hawkish statements by ECB officials. Governing Council member Pierre Wunsch noted that the likelihood of further rate cuts by the European Central Bank has significantly decreased in recent weeks, reinforcing expectations of a continued tight monetary stance. Derivatives markets now price in only a 2% chance of a 25 bps rate cut at the ECB’s October 30 meeting.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.1681, 1.1642, 1.1618, 1.1600, 1.1543

- ریزسٹنس لیولز: 1.1730, 1.1754, 1.1786, 1.1819

The hourly trend for EUR/USD is bullish. Price is approaching resistance at 1.1730. However, since it has moved away from EMA lines, it’s best to look for buying opportunities after a pullback to EMAs or the nearest support at 1.1681. No optimal entry points for selling are currently available.

متبادل حالات:If the price breaks below the 1.1543 support and consolidates, a bearish trend will likely resume.

نیوز فیڈ برائے: 2025.10.17

- Eurozone Consumer Price Index (m/m) at 12:00 (GMT+3).

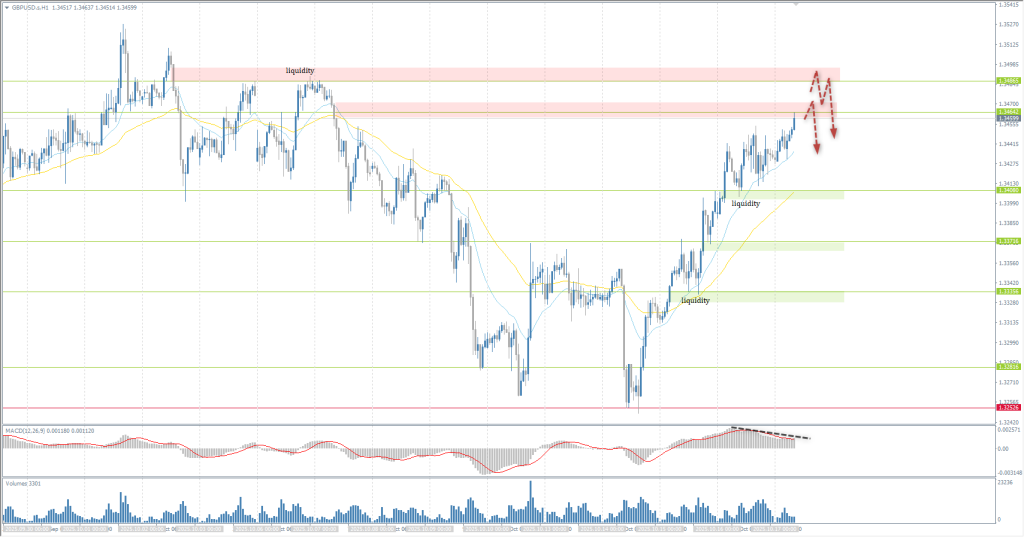

The GBP/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.3391

- سابقہ کلوز: 1.3432

- آخری دن میں % chg.: +0.30 %

The UK economy grew by 0.1% in August after contracting by 0.1% in July, matching expectations and indicating modest Q3 growth. Bank of England Governor Andrew Bailey recently stated that the economy is operating “below potential” and warned of labor market softening. These comments have increased expectations for a 25 bps rate cut by February and another cut in Q3 next year. However, the British pound has yet to react to domestic economic conditions.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.3408, 1.3390, 1.3373, 1.3335, 1.3281

- ریزسٹنس لیولز: 1.3464, 1.3486

Technically, GBP/USD is in an uptrend. Price is rising steadily and is nearing resistance at 1.3464. Given the strong deviation from EMA lines and MACD divergence, early profit-taking may trigger a correction. Selling could be considered at 1.3464 or 1.3486, but only with confirmation from seller reaction. Buying near resistance is not recommended.

متبادل حالات:if the price breaks through the support level of 1.3253 and consolidates below it, the dowtrend will likely resume.

آج کے لیے کوئی خبر نہیں ہے

The USD/JPY currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 151.03

- سابقہ کلوز: 150.41

- آخری دن میں % chg.: -0.41 %

The Japanese yen strengthened to a 1.5-week high against the US dollar on Thursday. The rise was driven by hawkish remarks from Bank of Japan board member Tatsuhiko Tamura, who called for rate hikes amid rising inflation risks. BoJ Governor Kazuo Ueda also signaled readiness to raise rates if confidence in economic growth continues to build. However, the yen has faced pressure from political uncertainty. After failed talks between LDP leader Sanae Takaichi and Komeito’s Natsuo Yamaguchi, the ruling coalition collapsed, complicating budget and legislative approvals.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 149.75, 148.83, 147.81

- ریزسٹنس لیولز: 150.51, 151.18, 151.68, 152.50, 153.28, 154.80

Technically, USD/JPY remains in a medium-term uptrend but is close to a reversal. The price is testing the key level at 149.75, where price action should be closely monitored. If buyers respond, and considering MACD divergence, buying opportunities up to 150.51 may emerge. A break and consolidation below 149.75 opens the path to 148.83.

متبادل حالات:If the price breaks below 149.75 and consolidates lower, a bearish trend will likely resume.

آج کے لیے کوئی خبر نہیں ہے

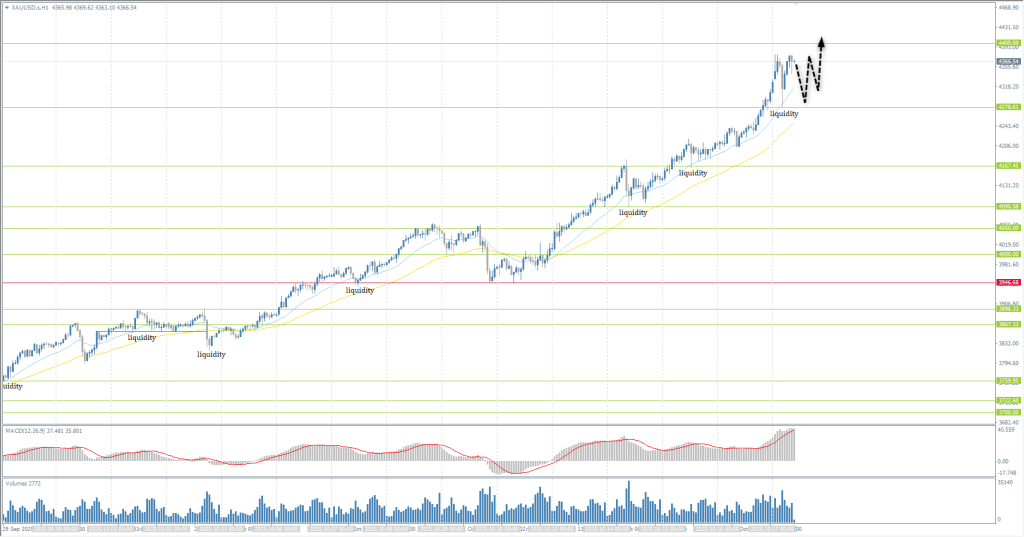

The XAU/USD currency pair (gold)

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 4210

- سابقہ کلوز: 4327

- آخری دن میں % chg.: +2.78%

Escalating trade tensions between the US and China, along with the ongoing US government shutdown, continue to drive demand for precious metals as safe havens. Yesterday, gold and silver hit new all-time highs. Gold rose for the fourth consecutive session, breaking above $4350/oz. It has now climbed for nine straight weeks, an unprecedented streak.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 4278, 4167, 4090, 4050, 4000, 3944, 3896, 3867, 3820, 3800

- ریزسٹنس لیولز: 4400, 4500

Technically, XAU/USD is in a strong medium-term uptrend. Gold is in a powerful bullish rally. Any corrections are quickly bought up within an hour, and the upward momentum resumes. Selling at all-time highs is not advisable, especially with no signs of reversal. Buying on pullbacks or using EMA lines as dynamic support is recommended.

متبادل حالات:If the price breaks below support at 3946 and consolidates, a bearish trend will likely resume.

آج کے لیے کوئی خبر نہیں ہے

یہ آرٹیکل ذاتی رائے کا اظہار ہے اور اس سے مراد سرمایہ کاری کی تجویز اور/یا آفر، اور/یا فائننشل ٹرانزیکشنز کرنے کی مسلسل درخواست، اور/یا کوئی ضمانت، اور/یا مستقبل کے ایونٹس کی پیشگوئی نہیں لینی چاہیے۔