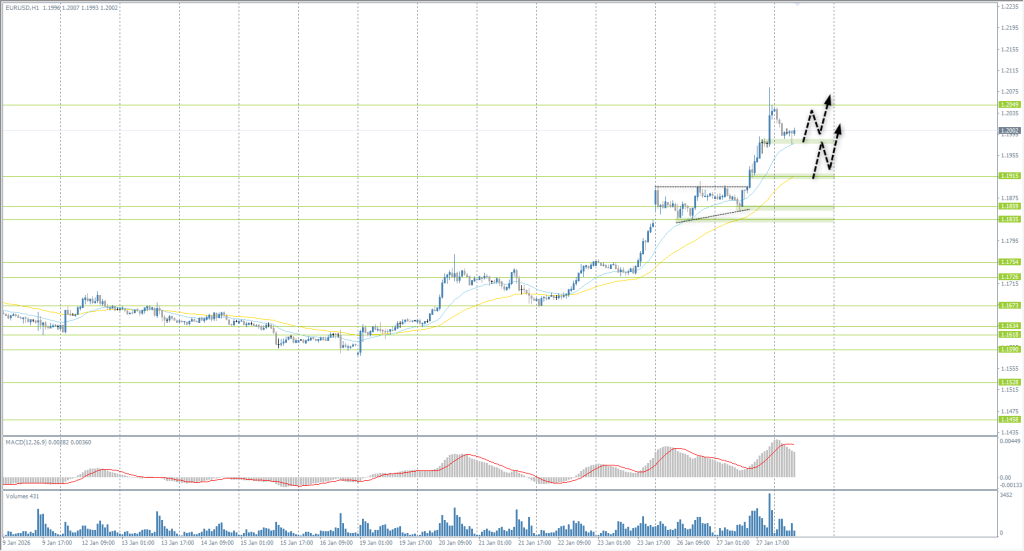

The EUR/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.1874

- سابقہ کلوز: 1.2038

- آخری دن میں % chg.: +1.38%

The Euro has strengthened above $1.19, reaching its highest level since June 2021, driven by broad US dollar weakness and the conclusion of a historic trade agreement between the EU and India. The deal, covering approximately a quarter of global GDP, creates a free trade zone encompassing about 2 billion people, marking the culmination of nearly 20 years of negotiations. Both Brussels and Delhi expect the agreement to unlock new export opportunities amid tightening US trade policies and China’s export controls. The European Commission estimates that EU exports to India could double by 2032, bolstering medium-term positive expectations for the European economy and currency. Additional market focus is centered on today’s US Federal Reserve meeting.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.1915, 1.1859, 1.1835, 1.1805, 1.1754

- ریزسٹنس لیولز: 1.2050, 1.3000

The euro rose to 1.2050, prompting moderate profit-taking on previously opened long positions. However, there are no signs of a reversal yet: the market bias remains bullish, and no active initiatives from large sellers have been observed. In current conditions, the priority remains buying with the trend. The most attractive zones for long entries are the dynamic EMA lines and the 1.1915 support level, where buying interest has previously manifested.

متبادل حالات:- Trend: Up

- Sup: 1.1915

- Res: 1.2049

- Note: For buy deals, look for a reaction at the EMA lines or wait for a correction to 1.1915 with confirmation. No optimal entry points for shorts.

نیوز فیڈ برائے: 2026.01.28

- German GfK German Consumer Climate (m/m) at 09:00 (GMT+2); – EUR (MED)

- US Fed Interest Rate Decision at 21:00 (GMT+2); – USD, XAU (HIGH)

- US FOMC Statement at 21:00 (GMT+2); – USD, XAU (HIGH)

- US Fed Press Conference at 21:30 (GMT+2). – USD, XAU (HIGH)

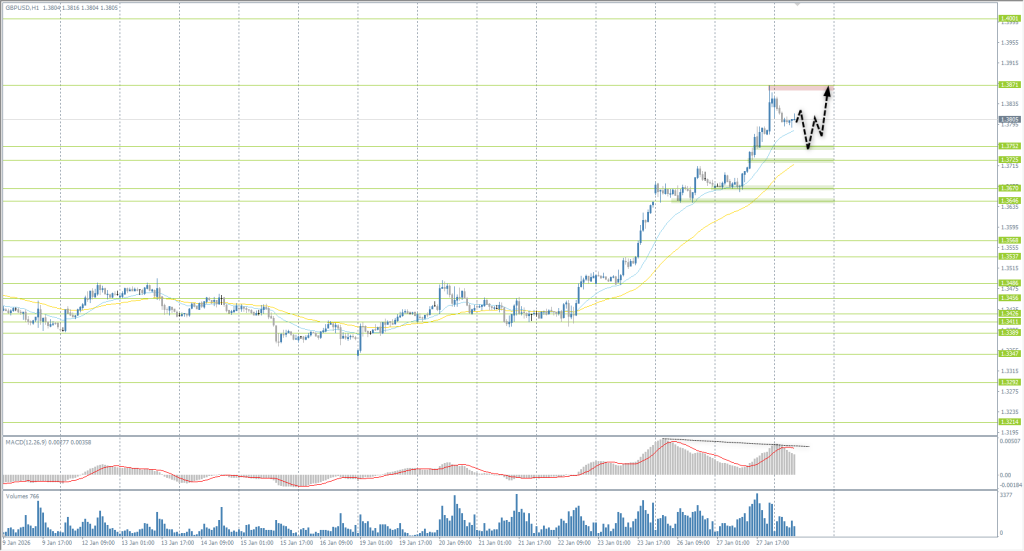

The GBP/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.3672

- سابقہ کلوز: 1.3845

- آخری دن میں % chg.: +1.26 %

Pound sterling consolidated above 1.37, hitting a 4-year high. Support for the Pound came from British Retail Consortium (BRC) data, which showed that shop prices in January rose by 1.5% y/y – the sharpest increase since February 2024 and significantly above market expectations of 0.7%. This publication has renewed concerns about persistent inflationary pressures. It has limited the room for imminent rate cuts by the Bank of England, which the market had perceived as a tailwind for the currency.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.3752, 1.3725, 1.3670, 1.3646, 1.3568

- ریزسٹنس لیولز: 1.3871, 1.4000

Following the euro, the British pound strengthened sharply as the dollar fell to three-year lows, reaching the 1.3871 resistance zone where early signs of profit-taking appeared. A divergence is forming on the MACD indicator, increasing the likelihood of a corrective pullback. However, there is currently no basis for a medium-term trend reversal. The market bias favors buyers, so the priority remains finding long opportunities on pullbacks. Key targets for assessing demand are the dynamic EMA lines and the 1.3752 support level, where a correction could provide an entry in the direction of the primary move.

متبادل حالات:- Trend: Up

- Sup: 1.3752

- Res: 1.3871

- Note: Consider long trades from the 1.3752 level or EMA lines. No optimal entry points for shorts.

آج کے لیے کوئی خبر نہیں ہے

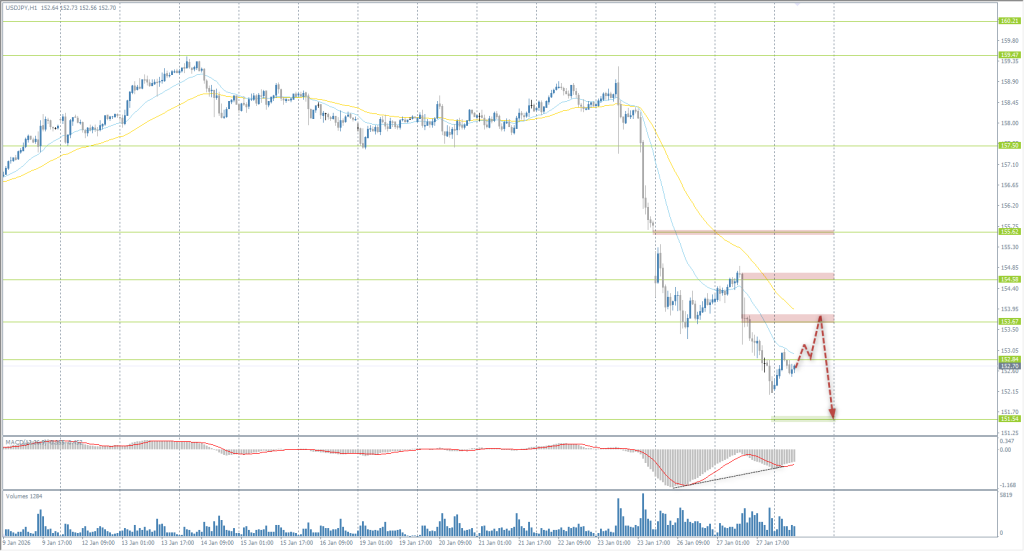

The USD/JPY currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 154.11

- سابقہ کلوز: 152.13

- آخری دن میں % chg.: -1.30 %

On Wednesday, the Japanese yen held near 152.5 per dollar, remaining close to three-month highs after an almost 4% appreciation over the last three sessions. The market continues to price in a high probability of coordinated currency intervention by Japan and the US. Meanwhile, market participants remain cautious, assessing the risk of unilateral action from Tokyo, though Bank of Japan data indicates no actual intervention has occurred thus far. Additional support for the yen came from broad US Dollar weakness. Minutes from the Bank of Japan’s December meeting showed that board members spoke in favor of continued rate hikes if growth and price forecasts remain unchanged, while maintaining a generally accommodative policy.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 151.54

- ریزسٹنس لیولز: 152.84, 153.67, 154.58, 155.62

The Japanese yen continued to strengthen, but a pronounced divergence in the MACD indicator is forming, increasing the probability of a corrective move. However, there are no signs of a trend reversal, as sustained initiative from major buyers remains absent. In the current configuration, it is more logical to look for short entry points on pullbacks. The most interesting areas are the dynamic EMA lines and the 1.3752 resistance zone, from which the move could develop further toward support near 151.54.

متبادل حالات:- Trend: Down

- Sup: 151.54

- Res: 152.84

- Note: Consider short trades from resistance levels 152.84 or 153.67, but only with confirmation. Take-profit target is the 151.54 support level.

نیوز فیڈ برائے: 2026.01.28

- Japan Monetary Policy Meeting Minutes at 01:50 (GMT+2). – JPY (MED)

The XAU/USD currency pair (gold)

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 5021

- سابقہ کلوز: 5181

- آخری دن میں % chg.: +3.18 %

On Wednesday, the price of Gold exceeded $5,200 per ounce, reaching a new record, as a sharp decline in the dollar spurred investor demand for safe-haven metals. Today, the US Federal Reserve will hold its monetary policy meeting. Market consensus is almost unanimous: the interest rate will likely remain in the current range of 3.50%-3.75%. However, a small split remains within the FOMC. Some committee members may vote for a rate cut, which investors could interpret as an attempt to set the stage for future decisions following the appointment of a new Fed Chair. Additional intrigue stems from intensifying tension between the White House and current Fed Chair Jerome Powell, fueling market fears regarding potential pressure on the regulator’s independence.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 5200, 5100, 5000, 4900

- ریزسٹنس لیولز: 5300

It took Gold less than two days to collect liquidity in a narrow range and resume its upward rally. The price is confidently clearing one option level after another and is currently aimed at the 5300 region. While the technical picture appears overheated, indicators signal overbought conditions, there is still no initiative from sellers, making short-term considerations premature. As the trend continues, it is optimal to watch for price reactions near the 5200 support or dynamic EMA lines, from which new growth impulses may emerge.

متبادل حالات:- Trend: Up

- Sup: 5200

- Res: 5300

- Note: For buy deals, evaluate the price reaction at the 5200 support level. No optimal entry points for shorts.

نیوز فیڈ برائے: 2026.01.28

- US Fed Interest Rate Decision at 21:00 (GMT+2); – USD, XAU (HIGH)

- US FOMC Statement at 21:00 (GMT+2); – USD, XAU (HIGH)

- US Fed Press Conference at 21:30 (GMT+2). – USD, XAU (HIGH)

یہ آرٹیکل ذاتی رائے کا اظہار ہے اور اس سے مراد سرمایہ کاری کی تجویز اور/یا آفر، اور/یا فائننشل ٹرانزیکشنز کرنے کی مسلسل درخواست، اور/یا کوئی ضمانت، اور/یا مستقبل کے ایونٹس کی پیشگوئی نہیں لینی چاہیے۔