The EUR/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.1783

- سابقہ کلوز: 1.1817

- آخری دن میں % chg.: +0.29%

The euro remains under pressure from the US dollar. The Greenback continues to find support stemming from last Friday, following President Donald Trump’s nomination of Kevin Warsh as the next Federal Reserve Chairman. Warsh is viewed as a more hawkish candidate compared to other contenders. At the same time, the partial US government shutdown, which entered its fourth day on Tuesday, remains a secondary negative factor for the dollar.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.1777, 1.1754

- ریزسٹنس لیولز: 1.1839, 1.1874, 1.1953, 1.1859, 1.2050, 1.3000

The technical situation is largely unchanged from yesterday. The euro is currently trading near the 1.1839 resistance level. Buyer initiative remains weak; therefore, the 1.1839-1.1874 zone should be viewed as a supply area to look for sell trades. The downside target remains the 1.1754 support level. Buying at this stage appears suboptimal, though an impulsive break above 1.1874 would return bullish priority to the market.

متبادل حالات:- Trend: Down

- Sup: 1.1777

- Res: 1.1839

- Note: For sells, look to resistance levels at 1.1839 or 1.1874 with confirmation. There are currently no optimal entry points for buys.

نیوز فیڈ برائے: 2026.02.04

- Eurozone Services PMI (m/m) at 11:00 (GMT+2); – EUR (MED)

- Eurozone Inflation Rate (m/m) at 12:00 (GMT+2); – EUR (MED)

- US ADP Non-Farm Employment Change (m/m) at 15:15 (GMT+2); – USD (MED)

- US ISM Services PMI (m/m) at 17:00 (GMT+2). – USD (MED)

The GBP/USD currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 1.3660

- سابقہ کلوز: 1.3695

- آخری دن میں % chg.: +0.26 %

The British pound is trading near 1.37. In recent days, pressure on the sterling has been driven by a strengthening US dollar, fueled by shifting expectations regarding the future Federal Reserve leadership and a reduced likelihood of aggressive US interest rate cuts. Additionally, investors have adopted a more cautious stance ahead of the Bank of England’s monetary policy decision. Markets generally expect the regulator to keep interest rates unchanged at 3.75% this week.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 1.3710, 1.3643, 1.3568

- ریزسٹنس لیولز: 1.3737, 1.3787, 1.3871, 1.4000

The British pound is attempting to consolidate above the 1.3710 level. The 1.3710-1.3737 zone remains a strong supply area; a confident move above 1.3737 could return a bullish trend to the market. Traders should carefully evaluate price action in this area. If 1.3737 is broken, buys targeting 1.3787 may be considered. Conversely, a sharp return below 1.3710 shifts priority to intraday sells with targets below 1.3650.

متبادل حالات:- Trend: Neutral

- Sup: 1.3710

- Res: 1.3737

- Note: Look for sell trades following a sharp return below 1.3710. A breakout of 1.3737 will signal the resumption of the uptrend.

نیوز فیڈ برائے: 2026.02.04

- UK Services PMI (m/m) at 11:30 (GMT+2). – GBP (MED)

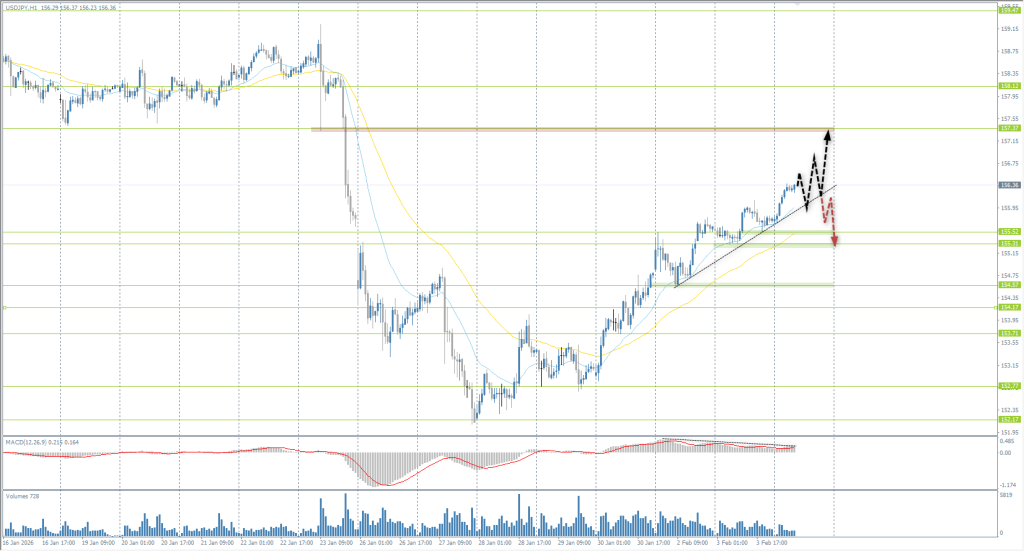

The USD/JPY currency pair

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 155.57

- سابقہ کلوز: 155.75

- آخری دن میں % chg.: +0.11 %

On Wednesday, the Japanese yen weakened toward 156 per dollar, declining for the fourth consecutive session and hitting a near two-week low amid expectations for the snap Lower House elections this weekend. Markets are pricing in a scenario where the ruling Liberal Democratic Party, led by Prime Minister Sanae Takaichi, strengthens its position. This would pave the way for a more active fiscal agenda, including increased government spending, tax cuts, and a new security strategy.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 155.52, 155.31, 154.57, 154.17, 153.71, 152.77, 152.17

- ریزسٹنس لیولز: 157.37

The technical outlook for the yen indicates a lack of significant resistance levels until 157.37. The price is moving steadily upward, with EMA lines acting as effective dynamic support. While a divergence is forming on the MACD, signaling some weakening of the upward momentum, it is premature to discuss a reversal without clear counter-initiative from sellers. In the current environment, it is logical to look for intraday buys from the EMA lines or the 155.31-155.52 support zone.

متبادل حالات:- Trend: Up

- Sup: 155.52

- Res: 157.37

- Note: Look for buy trades from the EMA lines or the 155.31-155.52 support zone. There are no optimal entry points for sell deals.

نیوز فیڈ برائے: 2026.02.04

- Japan Services PMI (m/m) at 02:30 (GMT+2). – JPY (MED)

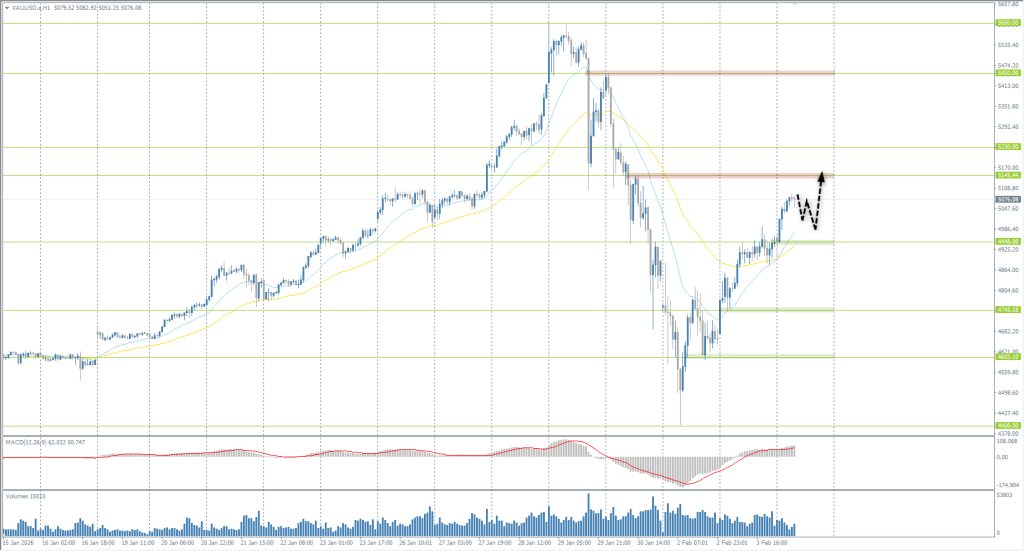

The XAU/USD currency pair (gold)

کرنسی پیئر کے تکنیکی انڈیکیٹرز:

- سابقہ اوپن: 4674

- سابقہ کلوز: 4946

- آخری دن میں % chg.: +5.81 %

On Tuesday, gold prices staged a massive rally, gaining more than 5% and reaching the $5,000 per ounce mark. This performance represented the most significant daily gain since November 2008. The technical bounce followed a sharp two-day decline; on Monday, the price had corrected to $4,405 as investors took profits after hitting an all-time high above $5,600 last Thursday. Market attention remains on the nomination of Kevin Warsh for Fed Chair, whom the market views as a policy hawk. Despite expectations for potential future rate cuts, traders are pricing in a more conservative approach to central bank balance sheet management.

ٹریڈنگ تجاویز

- سپورٹ لیولز: 4948, 4745, 4605, 4400

- ریزسٹنس لیولز: 5145, 5230

Bulls are beginning to regain initiative in the gold market. The price has firmly consolidated above 4948, opening up growth potential toward 5145. Intraday buys targeting this level can be considered. It is critical for buyers to keep the price above 4948, as this mark now serves as key support. Sells should only be considered after evaluating price action near 5145.

متبادل حالات:- Trend: Neutral

- Sup: 4948

- Res: 5145

- Note: Look for intraday buys targeting 5145. Sells should only be considered after evaluating the price reaction near 5145.

نیوز فیڈ برائے: 2026.02.04

- US ADP Non-Farm Employment Change (m/m) at 15:15 (GMT+2); – USD (MED)

- US ISM Services PMI (m/m) at 17:00 (GMT+2). – USD (MED)

یہ آرٹیکل ذاتی رائے کا اظہار ہے اور اس سے مراد سرمایہ کاری کی تجویز اور/یا آفر، اور/یا فائننشل ٹرانزیکشنز کرنے کی مسلسل درخواست، اور/یا کوئی ضمانت، اور/یا مستقبل کے ایونٹس کی پیشگوئی نہیں لینی چاہیے۔