Forex trading requires fast and accurate order execution. But what happens at the moment when a trader clicks the “Buy” or “Sell” button in the MetaTrader terminal? Let’s analyze the whole order path – from its sending to execution.

1. Sending an Order from the Trading Terminal

When a trader sends an order (market or pending) through MetaTrader, the terminal transmits the request to the broker’s server. At this moment, the terminal checks the order’s correctness: whether there are enough funds on the account and whether the request complies with the established restrictions and trading parameters. If the order is incorrect for any of the parameters, it will not be sent further, and the broker’s server will refuse to execute it.

2. Transmission of the Order to the Broker’s Data Center

After true verification, the order is sent to the broker’s server. To reduce delays and speed up execution, brokers use data centers located in strategically important locations around the world (e.g., New York, London, Singapore). MetaTrader uses a distributed server network to route orders through the nearest data center, minimizing delays.

What happens to the order if the data center fails?

If the data center through which the order passes experiences a failure or outage, the following scenarios are possible:

- Redirection through a backup server – MetaTrader uses a distributed system of servers, and in case one data center fails, the order can be automatically redirected to another.

- Execution delay – if the backup servers are overloaded, there may be a temporary delay in order processing.

- Order cancellation – As a last resort, if it is impossible to transfer a request, the order can be canceled or returned to the terminal with an error message.

3. Order Transfer to the Liquidity Providers

Depending on the broker’s execution model (A-Book or B-Book), an order can:

- Remain within the broker (if the B-Book model, market maker scheme is used);

- It can be transferred to the interbank market (if the broker works on the A-Book model and transfers trades to liquidity providers). If the order goes to the interbank market, it goes to ECN (Electronic Communication Network) or liquidity providers, who execute it at the best available price.

When can a liquidity provider reject an order?

A liquidity provider may reject an order for several reasons:

- High volatility: if the market moves too fast, the price may change before execution.

- Insufficient liquidity: if there is insufficient order volume at the requested price, the order cannot be executed.

- Trading restrictions: some liquidity providers restrict the execution of certain order types or assets.

- Technical failures: connection problems, delays, or system errors may cause an order to be rejected.

In case of rejection, the order may be requoted (offered a new price if instant execution) or completely rejected.

4. Order Execution

When the order reaches the final execution point (broker or liquidity provider), it is executed at the current market price. If Market Execution technology is used, the trader receives the nearest available price. If Instant Execution is used, the broker can either execute the order at the declared price or reject it in case of quotation changes.

5. Execution Confirmation and Feedback

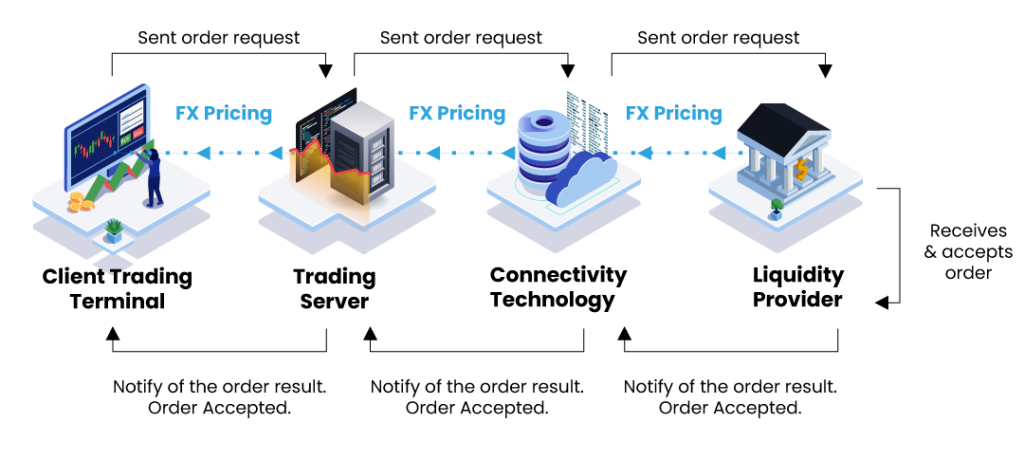

After the order execution, the information about the transaction is returned along the chain: from the liquidity provider (or broker) to the data center, then to the broker’s trading server, and back to the trader’s terminal. The whole operation takes milliseconds, but its accuracy and speed depend on the quality of the broker’s infrastructure. It is also worth noting that at high volatility with the market type of broker execution, the order may be executed with slippages.

This happens because, at high volatility, the price changes faster than the order goes through the whole chain of checks and is executed. Another rare example is when a trader receives a stop-loss (pending market order) on the news publication, but while it is being executed on the server, the price changes sharply in favor of the trader, and the new current price returns to the terminal with a profit result.

Order processing chain in MetaTrader

To visualize the whole process, we can distinguish the following sequence of stages:

- The broker’s server checks the order to ensure compliance with the trading conditions.

- Broker’s data center – transfer the order to the nearest data center to minimize delays.

- Liquidity Provider / ECN (for A-Book) or in-broker processing (for B-Book).

- Order execution – at market price on the broker’s or liquidity provider’s side.

- Data feedback – information about the executed trade is fed back through the same chain.

Final Word

The order path in MetaTrader is a complex and fast process that includes several stages: verification, transfer to the data center, possible sending to the interbank market, and final execution. The closer the broker’s server is to the main data centers, the faster orders are executed, which is especially important for scalpers and algorithmic traders. Choosing a reliable broker with a good infrastructure is key to successful trading.