An impulsive move (momentum) is a central element of any market dynamics. It is an impulse move that generates the bulk of profits and changes the structure of the market and the psychology of its participants. At the same time, the impulse’s move almost never start suddenly. Outwardly, it may appear sharp and unexpected, but within the market, it is always preceded by a long and logical process of preparation. To learn how to see impulse moves in advance, you need to understand how the market accumulates liquidity, how tension is created, and what signs indicate that the balance is about to be disrupted.

Any impulsive movement is the result of an imbalance between supply and demand. The price begins to move quickly when one side is unable to provide counter liquidity. It is not a matter of desire or emotion – it is pure mechanics. Liquidity is fuel. It is impossible for a major player (institutional investor) to buy a position worth $100 million in a single click without moving the price against themselves. They need time.

Mechanics of Accumulation

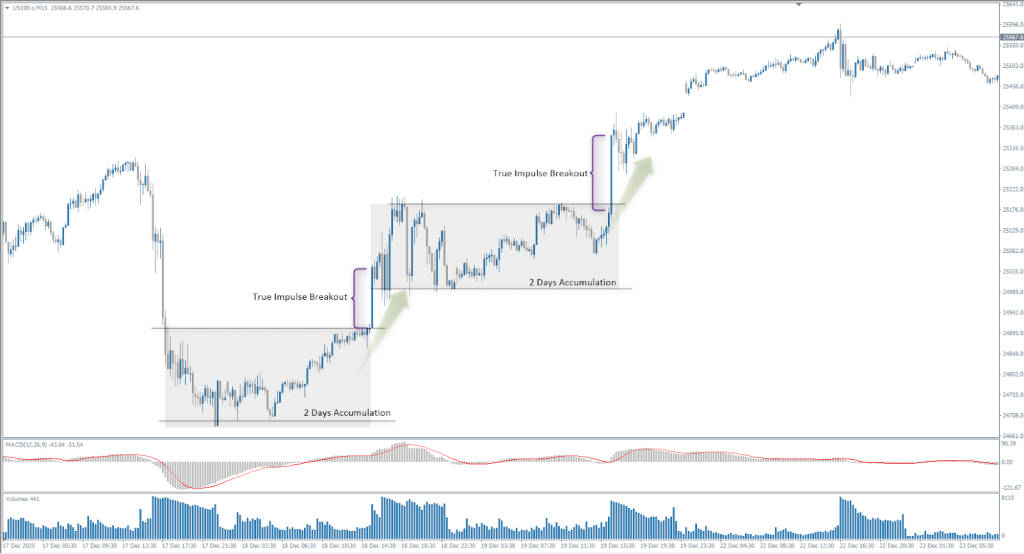

An impulse is almost always preceded by an accumulation phase. The market enters a state of reduced volatility, the range narrows, and movements become erratic and inexpressive. To an untrained observer, it seems that the market is “falling asleep,” but in fact, it is concentrating liquidity. During such periods, large players have the opportunity to gradually build up positions without moving the price too noticeably.

At the same time, retail traders lose patience, start opening chaotic trades, and actively place stop orders outside the range. These stop losses are the very liquidity that a large player will use to close their orders, or that will accelerate the movement. The longer the market remains in this state, the more liquidity accumulates at the edges, and the higher the potential for future impulse.

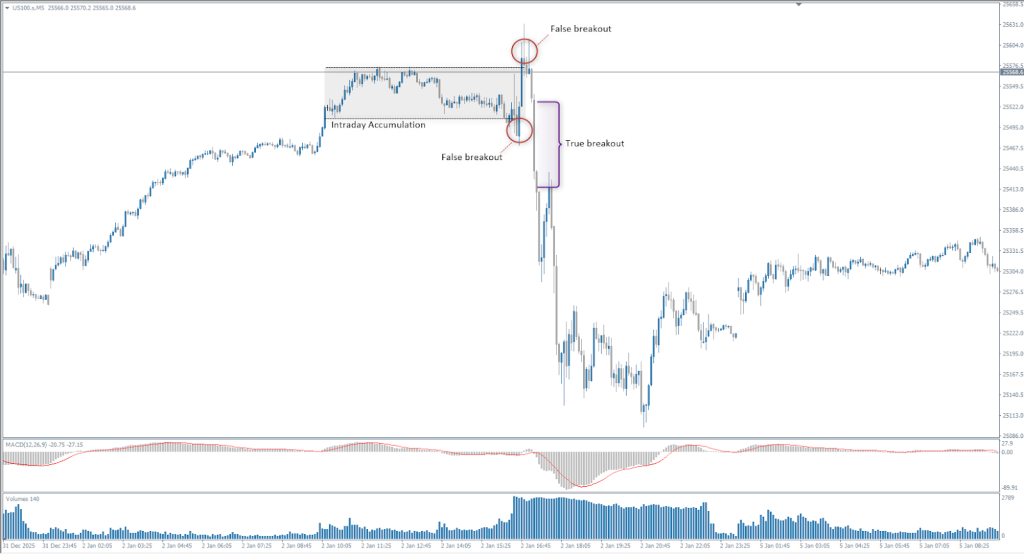

In the accumulation phase, the market often behaves aggressively and illogically. It can make sharp movements within the range, reach local highs or lows, and almost immediately return. These fluctuations are not random. They serve an important function – they provoke participants to enter prematurely and allow the market to gather additional liquidity. Many perceive such movements as the beginning of a trend, but the lack of continuation quickly brings the price back into balance. This reset creates the necessary liquidity to power real, lasting momentum.

The assessment of the potential of an impulse movement is directly related to the quality and duration of accumulation. Prolonged consolidation, saturated with false breakouts and dense trading within the range, almost always precedes a stronger and more extended movement. The market seems to “compensate” for the time spent in balance with a sharp breakout. An additional factor that enhances the momentum potential is its consistency with the broader market context. If the impulse develops in the direction of the senior trend or breaks out of a large equilibrium zone, the probability of its continuation increases significantly.

How to Assess Momentum Potential?

- Accumulation duration: The longer the market has been accumulating, the stronger the momentum will be. Accumulation over a month will result in a more powerful trend than hourly consolidation.

- Higher time frame context: If we are in a global downtrend on the daily chart (D1) and see upward momentum on the hourly chart (H1), it is most likely to be a short correction. The true potential is revealed when the momentum coincides with the direction of the “big money.”

- Average true range (ATR): Check how much the asset moves on average per day. If the momentum started when the price had already passed 90% of its average range for the period, the potential for continuation is extremely low.

When the market approaches the stage of impulse formation, the nature of the movement changes. The price begins to react to volume differently than before. If, in the accumulation phase, any movement quickly fades and returns to average values, then before the impulse, the market increasingly holds the levels it has reached. Rollbacks become shorter, and candle closes shift closer to extremes. This is a sign that one side is gradually losing control, while the other is beginning to dominate.

The behavior of the price near key levels is particularly indicative. Before the impulse, the market may repeatedly test the same level, as if “probing” it for strength. With each new test, the reaction becomes weaker and the retracements less deep. This state can be described as a build-up of tension. On the outside, it looks calm, but inside the balance, a sharp shift is already brewing. A real impulse often begins precisely from such a quiet, almost imperceptible phase.

Signs of an Approaching Impulse

- Abnormal attenuation (Low Volatility Squat): Before a powerful impulse, the market often becomes “glass-like.” Spreads narrow, volumes fall to a minimum. This is the calm before the storm.

- Ascending/Descending builds: If the price starts to hit the same level over and over again, and the pullbacks from it become shorter and shorter, this is a sign of an aggressive limit buyer or seller. They are literally “pushing” the crowd to the edge of the precipice.

Change in delta and open interest: In the futures market, you may see that the price is stagnant, but open interest (OI) is growing. This means that new money is entering the market, but the forces of buyers and sellers are still equal. As soon as one side gives in, there will be an explosion.

Volumes

Volume deserves special attention. It should be viewed not as an independent signal, but as an element of context. A healthy impulse is usually accompanied by an increase in volume at the start of the movement, after which the volume stabilizes or decreases moderately, allowing the price to move by the inertia of the imbalance. If the volume appears sharply and simultaneously, without further development, this often indicates not the beginning of the movement, but its completion or liquidity collection.

False breakouts

However, not every sharp movement is a real impulse. False impulses are an integral part of the market structure. Their key feature is the lack of continuation. The price may quickly pass a level but almost immediately return, forming long shadows and not holding new values. Such movements are often accompanied by emotional volume and a surge of activity from the crowd. Visually, they look powerful, but structurally, they do not change the market. Very often, if the price makes a false breakout of accumulation on one side, there is a high probability that the price will attempt to break out on the other side of accumulation.

If, after the supposed impulse, the market structure remains the same, key levels are not held, and the price returns to the old balance, this is a clear sign that the movement was false. In such cases, the market has not started a new phase, but has only completed the process of collecting liquidity. Understanding this allows you to avoid emotional entries and preserve capital.

Signs that the impulse was fake

- Lack of follow-through: After breaking through the level, the price does not continue to rise but freezes and begins to slowly slide back down.

- Long shadow (pin bar): The price jumped sharply above the level and immediately returned, leaving a long “tail.” This is a classic sign that there were no new buyers above the level, only counter-sales.

Volume divergence: The price updates the local maximum in the momentum, but the volume falls. This means that the fuel has run out and the movement is sustained only by inertia.

Closing Thoughts

In conclusion, it should be noted that impulse is a result, not a cause. It arises not because “the price wanted to move,” but because the market has gone through a certain period of accumulation and internal tension. A trader who can see these processes stops reacting to every candlestick and starts thinking structurally. The real advantage lies not in trying to catch the impulse at the start, but in the ability to recognize the conditions under which it becomes most likely.