Backtesting is the foundation upon which conscious and stable trading is built. Almost everyone understands this in theory, but in practice, only a few get around to doing full-fledged testing. The reason is simple: despite its accessibility, the Forex market is technically inconvenient for high-quality backtesting.

Unlike the futures or stock markets, there is still no universal, built-in, and convenient tool that would allow you to quickly and objectively test a trading idea on historical data. Nevertheless, backtesting on Forex is possible – and with the right approach, it gives you a huge advantage.

Why Is Backtesting Critically Important?

We have repeatedly discussed the importance of backtesting in our digests. And we will say it again, because it is the cornerstone, the foundation on which your strategy should be built.

Any trading strategy is a hypothesis. It may look logical, attractive, and even work on a demo account or for a few weeks on a real account. But the market is not obliged to confirm your expectations. Only testing on historical data allows you to answer key questions: does the strategy have a mathematical advantage, how resistant is it to different market phases, which drawdowns are normal, and which are critical.

Without backtesting, a trader trades blindly. They do not know whether a series of losing trades is a statistical norm or a signal that the strategy has stopped working. They do not understand where discipline ends and stubbornness begins. As a result, decisions are made based on emotions rather than data.

Backtesting, on the other hand, promotes calmness. When you have seen in advance from history that a strategy can produce, for example, ten losing trades in a row, this ceases to be a tragedy in real trading. You simply follow the plan because you know the statistics.

Ask yourself: why are hedge funds now hiring quantitative analysts for big data instead of classic traders? Precisely to find inefficiencies in statistical data.

The Main Difficulty of Backtesting in Forex

The main problem with the Forex market is that most trading terminals used by retail traders either do not have a backtester at all or offer extremely limited functionality. A classic example is MetaTrader. Formally, there is a strategy tester, but it is not well-suited for manual, visual, and flexible backtesting. Historical data often has gaps, the quality of ticks leaves much to be desired, and manual testing becomes a painful process.

In addition, Forex is a decentralized market. Different brokers have different quotes, spreads, swaps, and trading conditions. This means that the same backtest can give different results depending on the data source. This often misleads beginners and creates a false impression that backtesting “doesn’t work.”

However, the problem is not with the method itself, but with the tools and approach.

Backtesting in TradingView

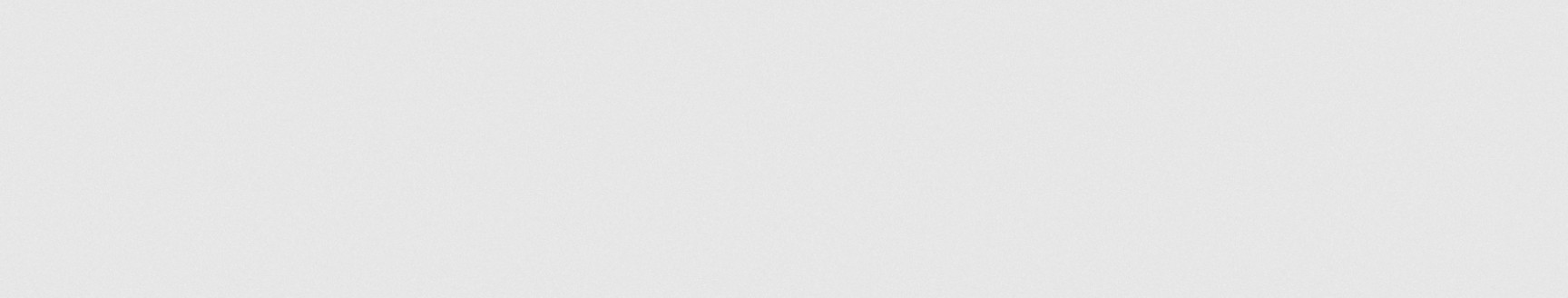

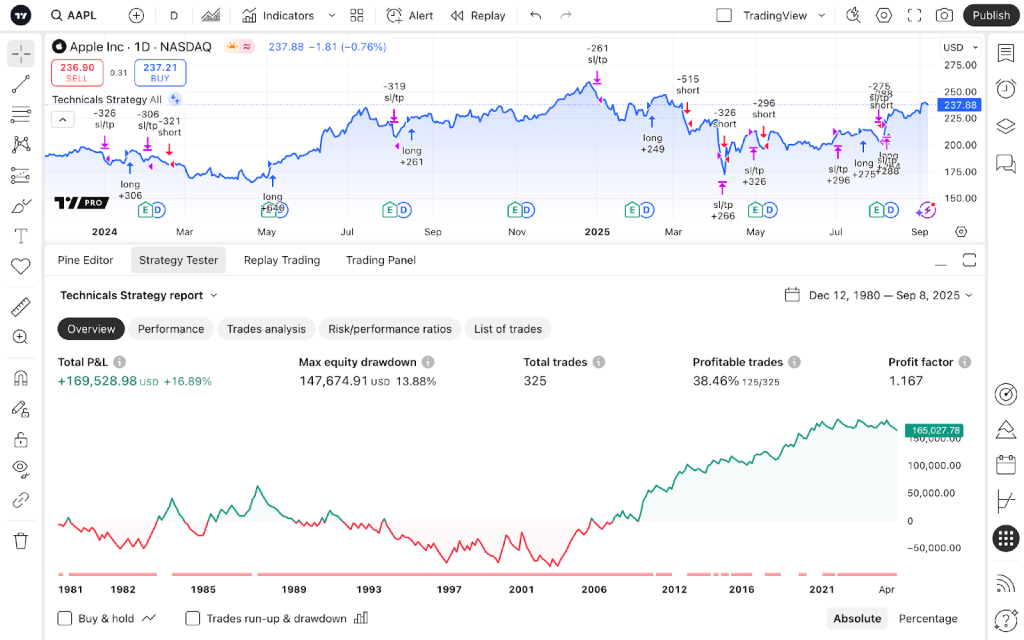

One of the most accessible and popular options today is the TradingView platform. Although it was not originally designed as a professional backtester, it works quite well for manual strategy testing. The ability to scroll through charts, hide future bars, and work with different timeframes and instruments makes the process close to real trading.

In TradingView, you can test both currency pairs and CFDs on them using built-in analysis tools. For algorithmic strategies, there is the Pine Script language, which allows you to create and test simple trading systems. However, it is important to understand that full statistics, spread accounting, and realistic order execution modeling are mainly available on paid plans.

Nevertheless, for initial verification of ideas, entry and exit logic, as well as for understanding the behavior of a strategy in different market phases, TradingView is a reasonable compromise between convenience and functionality.

Forex Tester as a Specialized Solution

When it comes to specialized programs, Forex Tester is deservedly considered one of the most well-known tools for backtesting specifically on the currency market. It is paid software designed for manual and semi-automatic testing of strategies with a high level of detail.

The advantage of Forex Tester is that it allows you to simulate trading as close to reality as possible: taking into account spreads, commissions, execution speed, and different types of orders. You can scroll through the market bar by bar, analyze trades, keep a journal, and get detailed statistics.

The downside is obvious – the cost and the need for initial setup. In addition, the quality of the results still depends on the historical data you use. But with a serious approach, Forex Tester remains one of the most reliable tools for a forex trader. On the other hand, Forex Tester only offers lifetime licenses, with no need to pay for the platform on a monthly basis. Buy it once and use it forever.

Using Programs to Analyze Futures

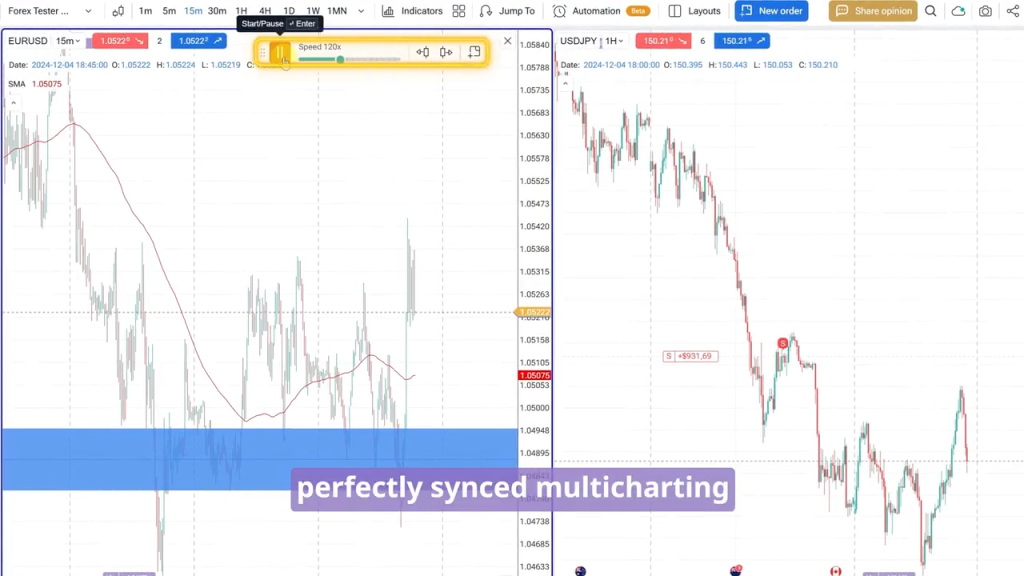

An interesting and unexpected approach is to backtest forex strategies using programs originally designed to analyze futures markets, such as SbPro X. At first glance, this seems strange, but there is logic behind it.

Many currency pairs correlate closely with currency futures. For example, EUR/USD and euro futures often show a similar movement pattern. SbPro provides high-quality historical data, cluster analysis tools, volumes, and convenient functionality for testing trading ideas.

Yes, such backtesting cannot be called ideal. Forex and futures are different markets with different microstructures. However, for testing the logic of levels, price reactions, contextual entries, and overall strategy behavior, this approach can be useful, especially if there are no other options.

Alternative Methods and Opportunities via the Internet

The modern Internet offers many more opportunities than it seems at first glance. There are online services and platforms that allow you to download historical data, simulate trades, and analyze statistics. Some traders use Python and specialized libraries for backtesting, while others use Excel or Google Sheets for manual analysis of historical trades.

You can also find historical data from different providers and compare the results to understand how resilient your strategy is to price changes. Forums, professional communities, and educational platforms often share insights and tools that simplify the testing process.

The main thing is not to get stuck on one tool. Backtesting is not a program, but a process. And the more flexible a trader is in their approach, the higher the quality of the final conclusions.

Final Line

Backtesting in the Forex market is not an easy task, but it is not impossible. Yes, the market imposes restrictions, tools are not always convenient, and data is not perfect. But the absence of ideal conditions is not a reason to abandon analysis. On the contrary, it is in such conditions that a professional approach is formed.

A trader who systematically tests their ideas, understands statistics, and makes decisions based on data will always be one step ahead of those who rely on intuition and luck. And in the long run, it is this step that determines whether trading will be a source of stable income or another disappointment.