What Is VIX?

The VIX Volatility Index is among the most well-known fear indicators used in the financial markets. It reflects investors’ expectations of stock market volatility over the next 30 days. It is often referred to as the “fear index” because a rise in the VIX value is usually associated with increased uncertainty and panic in the market.

The index is calculated based on options on the S&P 500 Index and is published by the Chicago Board Options Exchange (CBOE). Essentially, the VIX shows how much the market expects the S&P 500 Index to fluctuate in the near future.

How Does the VIX Work?

The VIX index is calculated based on the premiums (prices) of options – both puts and calls – on the S&P 500. When option premiums rise, traders expect large swings in the future. The higher the demand for defensive strategies, the higher the VIX value.

The key feature of the VIX is that it does not predict the market’s direction. It only tells you the expected strength of the swings. An increase in the VIX indicates rising expectations of volatility, while its decrease indicates calmness in the market. However, it should be that traders often use VIX as a precursor to a falling or rising stock market. And there are reasons for that. Because a sharp volatility spike usually causes stock indices to plummet. Why? Because the market sells off more actively than it buys back in. You can see how slowly stock markets rise and how quickly sell-offs occur.

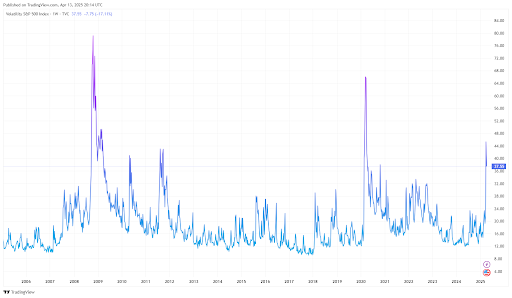

Historical VIX Peaks

VIX has a pronounced inverse correlation with the stock market: when the market falls, VIX tends to rise sharply. Here are the key moments when the VIX reached extremes:

- 2008 (financial crisis): the VIX reached record highs – almost 80 points.

- March 2020 (COVID-19): spiked above 60 again as markets crashed amid a pandemic.

- March 2024 (tariffs wars): spiked above 40 against the backdrop of the US administration’s imposition of global tariffs, the postponement of these tariffs for 90 days, and the tariff war with China.

In addition to the VIX, there are other tools to track volatility:

| Indicator |

Description |

| VVIX | Volatility VIX itself is a kind of “volatility volatility”. Useful for assessing how volatile the expectations market itself is. |

| MOVE Index | Analogous to the VIX, but for the bond market (US treasuries). Tracks the volatility of yields. |

| CBOE SKEW Index | Estimates the probability of extreme events (black swans) in the market. |

| ATR (Average True Range) | A technical indicator applicable to any instrument, including currencies. It shows the average amplitude of price fluctuations. |

| Historical Volatility (HV) | Historical volatility is based on past prices, as opposed to VIX, which is based on expectations. |

| Implied Volatility (IV) | Implied volatility on specific options. Often used in analyzing individual stocks or currency options. |

Connection VIX to the Forex and CFDs

Although the VIX is directly linked to the U.S. S&P 500 Index, its influence goes far beyond a single market. It has a significant impact on the behavior of Forex market participants and on CFD index trading, which is actively used by many retail traders.

CFD trading on global stock indices is available on forex platforms, and the VIX becomes an extremely useful indicator for assessing these instruments’ potential volatility and direction.

The most sensitive CFD indices to VIX changes:

- US500 (CFD on S&P 500) — direct correlation, sharp fall with VIX growth.

- US100 (NASDAQ) is more volatile and often reacts more strongly than the S&P 500.

- US30 (Dow Jones) — also shows a strong inverse correlation with the VIX.

- DE40 (DAX) — sensitive to the overall level of global risk.

- UK100 (FTSE) — less volatile but also suffers when the VIX rises.

- JP225 (Nikkei) — during periods of VIX growth, it often slips due to the yen’s strengthening.

When the VIX surges, traders often take profits and exit stocks and indices, leading to a correction or collapse in CFDs on indices.

Currency pairs to watch out for when the VIX spikes:

- USD/JPY — typically declines as the Yen is considered a safe haven.

- AUD/JPY, NZD/JPY, CAD/JPY — suffers from investors’ exit from risky currencies.

- EUR/USD — may show increased volatility depending on the nature of market turbulence.

- USD/CHF — demand for the franc also rises in times of market stress.

💡 Keep an eye on the correlation between the VIX and cross rates, especially those involving JPY and CHF.

How to Use VIX in a Trading Strategy

Using the VIX in a trading strategy can be a powerful tool for assessing market risk, identifying market phases, and selecting entry/exit tactics.

Here are some practical approaches to using VIX as part of a trading system:

Basic Principle: VIX is a barometer of fear.

- Low VIX = calm market, a good time for trend-following strategies.

- High VIX = panic, high volatility — counter-trend or defensive strategies are better.

Examples of trading strategies with VIX

1. Risk filter for other strategies

Use VIX as a filter:

- VIX < 20 – you can open medium-term positions and use trend strategies more aggressively.

- VIX 25-30 – signal caution: strong outliers are possible, especially in indices and currency pairs with JPY and CHF.

- VIX > 40 – do not enter the market or trade only on short timeframes with minimal volume.

2. Opposite strategies from extremes

When the VIX reaches extremes:

- VIX > 40-45 — often a panic bottom. Many traders look to long indices and short defensive currencies.

- VIX <13-14 — the market is overconfident. You can prepare for a correction and open short positions on indices or longs on defensive assets.

Confirmation via price action or technical levels is mandatory — VIX is not a signal for a deal!

3. Entry on VIX decline after a surge

After a sharp rise in VIX and a subsequent pullback, you can look for entry points for longs in indices and return to risk in currency pairs (e.g., AUD/JPY, NZD/JPY). The VIX usually declines faster than markets recover, allowing entry in the early phases of a reversal.

4. Exit Signals

If you are long in the stock market or risky currencies and the VIX starts to rise sharply — this is a reason to lock in profits or hedge. Use the VIX as a stop filter: if it crosses a certain level (e.g., 25), the strategy is paused, or profit is taken.

Combination with other indicators

|

Indicator |

Role |

| ATR / Volatility Bands | Confirmation of real volatility on the instrument |

| S&P 500 or other indices | Comparison of index behavior with volatility |

| MACD, RSI | Help identify entry points for reversals on high VIX |

| Volume | Strong movements on high VIX are often accompanied by increased volume |

Example of a simple strategy:

- NASDAQ (US100) long entry condition:

- VIX > 35 → then declines 3 days in a row.

- NASDAQ price forms a bottom on the daily timeframe.

- RSI crosses the oversold zone upwards.

- Exit:

- VIX < 20

- RSI > 70 or reaching the resistance level

VIX Significance

The VIX Index is a powerful barometer of market sentiment. For a trader, it can serve as a warning of impending instability and an opportunity to make money. When the VIX rises, you should be especially careful with high-yielding currencies and instruments with a high beta coefficient. On the contrary, a falling VIX creates conditions for a return to risky strategies. For a deeper risk assessment, it is recommended to use VIX in conjunction with other technical and macroeconomic indicators.