Price Pivot Zones (PPZ) are areas on a chart where the market has previously paused, reversed, or slowed down. Unlike simple support and resistance levels, these are active zones where a battle between buyers and sellers took place. It is in these areas that key reversals or breakouts often form, and the price is highly likely to return to them.

Simply put, PPZs are “liquidity nodes” on the chart where the market made a decision before and is likely to make one again.

Why Are PPZs So Important?

1. They work because of mass participation

These zones are visible to the majority of traders. When the price approaches them again, pending orders, stop-losses, and new trades are triggered, causing the market to react. PPZs work not because they’re “magic,” but because they’re backed by real money and expectations.

2. Transparency and logic

Unlike abstract indicators, PPZs are based on actual price behavior, where the market has already reversed or hesitated. This makes them clear and logical, even without complex tools.

3.Foundation for decision-making

PPZs provide traders with key reference points: where to enter, where to exit, and where to expect a reaction. This is especially crucial in uncertain market conditions when a clear structure is needed.

How to Identify PPZs on a Chart?

1. Look for price reversal areas

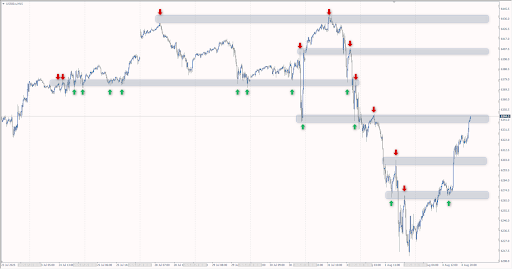

Scan the chart for sections where the price sharply changed direction, such as local highs and lows, consolidation zones before a strong move, or levels that the price has tested multiple times.

2. Draw a zone, not a line

Price rarely reverses at a single point. It’s usually a range, for example, 10-30 pips. Draw a rectangle (a zone) that encompasses these fluctuations.

3. The more a zone has been tested, the stronger it is

If the price has bounced off an area 2-3 times, it’s already a significant PPZ. If this happened on higher timeframes, it’s even more robust.

Example:

How to Use PPZs in Trading?

1. Trading the Zone (Bounce).

When the price approaches a PPZ, look for reversal signals: pin bars, engulfing bars, volume clusters, or high-momentum rejection candles. If you have confirmation, you can enter with a tight stop just outside the zone’s boundary.

2. Trading the Breakout.

If the price breaks through a PPZ on increased volume and closes above it, this is a sign of strength. You can trade in the direction of the breakout, especially if there are no other strong levels until the next target. It should be noted that the breakout should be impulsive, fast, and on large candles.

3. Retest or Trend Continuation.

When a trend is already in motion and the price returns to a PPZ that was previously resistance and has now become support, this is an excellent entry point in the direction of the trend.

Common Mistakes When Working with PPZs

Drawing too many zones

Don’t turn your chart into a “zebra crossing.” It’s better to have 2-3 strong zones than 10 weak ones. Try to mark those PPZs where the price interacts. If you have doubts about whether there was a price interaction here, then it is not a likely zone.

Entering without confirmation

An approach to a zone is not a signal. Wait for a reaction. The price can break the zone or simply move through it without reversing.

Ignoring the context

Even a strong PPZ can fail if, for example, there is a powerful, high-momentum trend. A zone is a guide, not a guarantee.

Closing Remarks

PPZs are a powerful and practical tool in any trader’s arsenal. They don’t require complex indicators but provide clear reference points. By working with PPZs, a trader begins to understand where and why the price might react. These are decision-making areas for the market as a whole.

If you build your trading system on price action, PPZs should be a core component for entries, exits, context analysis, and evaluating probabilities. If you use a different concept, PPZ can complement it perfectly, provided there are no contradictory signals (for example, the price returned to the PPZ after a breakout and reacted with a pin bar, but the indicators do not confirm the entry).