Do you know what most traders who lose their deposits have in common? They are unable to accurately assess market volatility. People overload charts with oscillators, looking for moving average crossovers, divergences, overbought and oversold conditions. In general, they look for signals to go up or down. But they overlook volatility assessment, which is precisely what prevents the lion’s share of these losses.

What Is ATR?

Average True Range (ATR) – an indicator that measures symbol volatility. And this is where the trap lies for beginners. Trading is not just about direction. It’s also about the ‘breath” of the market. Imagine you’ve decided to swim across a river. Knowing the direction of the current is important, but if you don’t know the height of the waves, you’ll simply be swept away. ATR shows the height of these waves.

Many experienced traders confidently say that ATR is one of the most underrated indicators in a trader’s arsenal. Most beginners chase after the “holy grail” – super-duper indicator or chart pattern that supposedly predicts every market reversal. Meanwhile, ATR quietly sits in the corner, modestly displaying the most important information – how much the price is moving. And it is precisely this information that can save a deposit.

Why Is ATR So Undervalued?

The problem with ATR is that it does not generate trading signals in the usual sense. It does not draw arrows saying “buy here” or “sell there”. It does not intersect with any levels or change colour from green to red. For a beginner looking for a ready-made solution, ATR seems boring and useless. It’s just a line at the bottom of the chart that goes up and down. But experienced traders know that ATR is the foundation for building a proper capital management system.

Many traders set stop losses “by eye” or by a fixed number of points (for example, always 20 pips). This is financial suicide. The market on Monday morning and the market when the Fed news comes out are two different beasts. ATR allows you to adapt your trading strategy to the current market conditions. It is a realistic indicator that says, “Mate, the market is too volatile today, don’t set your stop so close.”

How Is ATR Calculated?

The indicator was developed by Wells Wilder (the same genius who gave us RSI and ADX) back in 1978. To understand how it saves money, you need to understand what “True Range” is.

The usual range of a candlestick is simply the difference between the high and low. But Wilder understood that there are gaps (price breaks) in the market. If the price opened with a huge jump up, the usual High-Low would ignore this volatility spike.

True Range (TR) selects the largest value (MAX) from three:

- Current High minus current Low

- Current High minus the closing price of the previous candle (module).

- Current Low minus the closing price of the previous candle (module).

ATR is simply the moving average of these TR values over a certain period (usually 14).

Why do we need this maths? To understand that ATR takes into account not only how the price moved within an hour, but also how it moved relative to yesterday. This gives the most accurate picture of volatility.

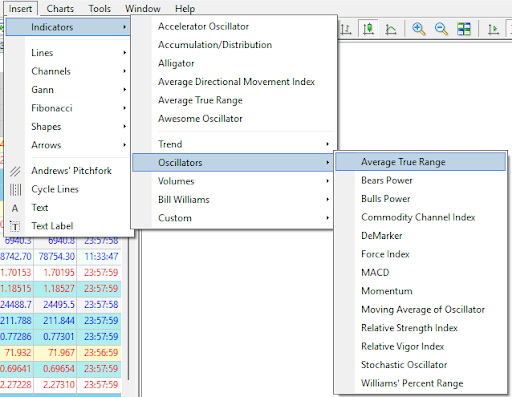

How to Use ATR in the MetaTrader Terminal (MT4/MT5)?

ATR indicator is built into MetaTrader terminals by default. It is easy to find: Insert -> Indicators -> Oscillators -> Average True Range. Although, to be honest, calling ATR an oscillator is not entirely correct, the MT developers decided to classify it that way.

Terminal settings

- Period: The default setting is 14. This is the classic setting. This period is optimal for intraday trading (D1, H4). If you are a scalper on M5, you can experiment with periods to smooth out excess noise. The longer the period, the less noise, and vice versa. For lower time frames it’s recommended to use a shorter period (7 or 10), so that ATR reacts more quickly to changes in volatility.

- Visualisation: The indicator is displayed in a separate window below the main chart as a single line.

Important point for MT is that ATR value is displayed in pips (or absolute price values). For example, if the indicator shows 0.00150 on the EUR/USD pair, this means that the average volatility for the selected period is 150 standard pips (or 15 pips on a 4-digit chart).

It is not difficult to guess that if ATR rises, volatility increases and the market becomes more active. If it falls, the market calms down and movements become sluggish. It is important to understand that ATR does not tell you where the price will go – up or down. It only tells you the strength of the movement. It is like a speedometer in a car – it shows the speed, but not the direction.

Example: The chart below shows a sharp increase in volatility for gold (XAU/USD)

How to Read and Interpret ATR?

The most common mistake made by beginners is trying to use absolute ATR values to make decisions. They see that ATR is 80 points and think, ‘Oh, that’s a lot’ or ‘That’s not much.’ But 80 points is a lot for one instrument and ridiculously small for another.

The correct approach is to look at the change in ATR relative to its own history. If the current ATR value is at the top of its historical range over the past few months, volatility is high. If it is at the bottom, volatility is low. Scroll back through the chart for months and see where ATR is now relative to that period.

High volatility (rising ATR) is often observed during important news events, crises, and sharp market movements. At such times, the market is nervous, and movements are strong and fast. This is a time of opportunity, but also of increased risk. Your stop losses should be wider and your position size smaller so that you don’t get knocked out of the market by a random spike.

Low volatility (falling ATR) is characteristic of periods of calm when the market does not know where to go next. This can be before holidays, while waiting for important data, or simply a period of consolidation after a strong trend. Many traders dislike such periods because movements are small and profits accumulate slowly. But there is a plus — you can set narrower stops and take a larger position size with the same level of risk.

A particularly interesting moment is when ATR is at historic lows. This often heralds an explosion of volatility. The market is like a compressed spring: the longer it remains calm, the stronger the subsequent movement will be. And vice versa. Extremely high values often signal the culmination of a trend. When ATR reaches historic peaks, price movement often runs out of steam. Always pay attention to this.

How to Use ATR for Strategy Building and Risk Management?

-

How to Set a Stop Loss Using ATR?

This is exactly what will save your deposit. Let’s say you enter a long position. Look at ATR value at that moment. Multiply it by a coefficient (usually between 1.5 and 3).

If ATR = 20 points and your coefficient is 2, then your stop loss should be at least 40 points from the entry point. Why does this work? Because this stop loss takes market ‘noise’ into account. If the price hits it, then it is no longer a random fluctuation.

-

Calculating Position Size

This is related to the previous point. When you know the size of the stop loss in points, you can calculate how many lots to open in order to risk a specific amount. The formula is simple: divide the risk in dollars by the size of the stop in points, multiplied by the value of a point. This gives you the position size.

-

ATR and Take Profit (Targets)

Many use ATR for stops, but forget about targets. For example, if the average daily ATR for GBP/USD is 100 points and the pair has already moved 90 points today, it would be wrong to open a trade counting on another 50 points. The potential for movement today is practically exhausted. ATR helps you understand when it’s time to close the terminal or at least not to trade this instrument today and switch to another one that still has potential movement relative to the instrument’s average daily ATR.

-

Filtering Breakouts

When the price breaks through the low ATR level, it is often a false breakout. True, strong movements are usually accompanied by a sharp surge in volatility. If the price breaks through the level and ATR line continues to lie at the bottom, be careful, as there are no major players in this movement.

-

Adaptive Position Size

This is the highest level of capital management.

When volatility (ATR) is high, you reduce your lot size but set a wide stop.

When volatility is low, you can increase your lot size by setting a short stop. At the same time, your risk in dollars per trade remains unchanged. This makes your return curve smooth and professional.

-

Selecting Instruments for Trading

If you trade multiple instruments, using ATR helps you scan instruments for trading opportunities. If you see that an instrument shows a sharp increase in ATR after a long period of low volatility, this is a signal to pay attention to it.

Combination with Other Instruments

ATR works great in combination with other indicators and analysis methods. With support and resistance levels, for example. If the price approaches an important level and ATR is rising, a breakout is more likely. If ATR is falling, the level will most likely hold.

With trend indicators such as moving averages. A strong trend is usually accompanied by an increase in ATR in the direction of movement. If the trend continues and ATR begins to fall, this is the first sign of a possible weakening of the trend.

What can ATR not do?

It is important to understand the limitations of this indicator.

- ATR is a lagging indicator. It shows what has happened in the recent past, but does not predict the future. When volatility has already increased, and ATR has risen, the most turbulent movement may already be behind us.

- ATR does not show direction. A high ATR can occur in both an uptrend and a downtrend, or even in a sideways trend with wide fluctuations. Other tools are needed to determine direction.

- ATR is sensitive to outliers. A sharp movement over several evenings can distort the indicator readings if you use the standard period of 14. In such cases, it makes sense to either increase the period, temporarily ignore the abnormal values, or, conversely, reduce the period to a minimum to see the real volatility at the moment.

Please keep in mind that different instruments have different “normal” volatility. For example, commodities or precious metals are often more volatile than currency pairs. Therefore, comparing absolute ATR values between different asset classes is meaningless.

Final Thoughts

ATR is not a magic wand that will make you a profitable trader overnight. It is simply a measuring tool, just like a ruler or a thermometer. But a good ruler in the hands of an experienced craftsman can create masterpieces.

And remember that traders who ignore volatility do not survive long in the market. Therefore, start using ATR in your trading today. You don’t have to rebuild your entire trading system right away. Just add the indicator to the charts of the instruments you trade and observe.