วันนี้เราจะมาเรียนรู้เกี่ยวกับแนวทางการบริหารความเสี่ยงอย่างชาญฉลาดในการซื้อขายกันต่อไป ในส่วนนี้ เราจะพูดถึงกลยุทธ์ที่เป็นกลางซึ่งช่วยให้ผู้ค้าใจเย็น และสร้างความสมดุลแม้ในช่วงที่ตลาดมีความผันผวน นอกจากนี้ เราจะแนะนำคุณให้รู้จักกับกลยุทธ์ “The Wheel” ซึ่งเป็นวิธีที่ได้รับความนิยม และมีโครงสร้าง ช่วยให้นักลงทุนมุ่งหวังผลตอบแทนที่สม่ำเสมอในขณะที่กำลังบริหารความเสี่ยงอย่างมีประสิทธิภาพ

กลยุทธ์ที่เป็นกลางคืออะไร?

ไม่เหมือนกลยุทธ์เชิงทิศทาง (ที่เราเดิมพันว่าราคาจะเพิ่มขึ้น หรือลดลง) การเป็นกลางจะทำกำไรเมื่อราคาอยู่ในช่วงที่กำหนด เป้าหมายคือการได้รับผลกำไรจากการลดลงของความผันผวน (IV) หรือจากมูลค่าของตราสารที่ลดลงเรื่อย ๆ (Theta) มีกลยุทธ์ที่เป็นกลางมากมายที่แตกต่างกัน วันนี้เราจะมาดูกลยุทธ์ง่าย ๆ กัน:

- Iron Butterfly

- Iron Condor

- Long Put Butterfly

- Long Call Butterfly

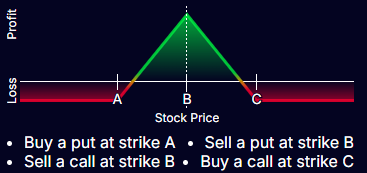

1. Iron Butterfly

นี่เป็นกลยุทธ์ที่ผสมผสานการขาย Call และ Put ด้วยราคาใช้สิทธิ์เดียวกัน รวมถึงการซื้อออปชั่นป้องกันราคาที่อยู่นอกเหนือจากราคาที่ตกลงกันไว้ด้วย เหมาะกับผู้ที่คาดหวังว่าตลาดจะไม่มีความผันผวน และเคลื่อนไหวน้อย

โครงสร้าง:

- ขาย 1 ATM Call

- ซื้อ 1 ATM Put

- ซื้อ 1 OTM Call (อยู่เหนือราคาที่ตกลงกันไว้)

- ซื้อ 1 OTM Put (อยู่ใต้ราคาที่ตกลงกันไว้)

ผลลัพธ์:

- กำไรสูงสุด – เมื่อราคาเมื่อหมดอายุยังคงใกล้เคียงกับช่วงตรงกลางของราคาที่ตกลงกันไว้

- การขาดทุนสูงสุด – จำกัดหากราคาพุ่งขึ้น หรือลงอย่างรวดเร็ว

ตัวอย่าง:

ซื้อขาย SPY อยู่ที่ 500 ดอลลาร์

- ขาย Call โดยมีราคาที่ตกลงกันไว้อยู่ที่ 500 ดอลลาร์

- ขาย Put โดยมีราคาที่ตกลงกันไว้อยู่ที่ 500 ดอลลาร์

- ซื้อ Call โดยมีราคาที่ตกลงกันไว้อยู่ที่ 510 ดอลลาร์

- ซื้อ Put โดยมีราคาที่ตกลงกันไว้อยู่ที่ 490 ดอลลาร์

ผลลัพธ์:

- หาก SPY อยู่ใกล้เคียงราคา 500 ดอลลาร์ – คุณจะได้รับส่วนเกินมูลค่าหุ้น

- หากเคลื่อนไหวออกนอกราคา 490 ดอลลาร์ หรือ 510 ดอลลาร์ – จะถูกจำกัดการขาดทุน

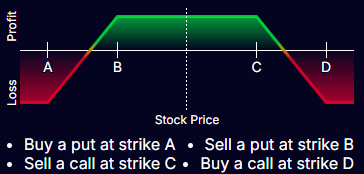

2. Iron Condor

มีการทำงานคล้ายกับ Iron Butterfly แต่ข้างในของราคาที่ตกลงกันไว้ไม่เหมือนกันซึ่งหมายความว่ามี “ลำตัว” กว้างกว่า คุณจะได้รับกำไรหากถูกขายอยู่ในช่วงระหว่างราคาที่ตกลงกันไว้ ข้อดี: มีความเสี่ยงน้อยกว่าแบบ Iron Butterfly เนื่องจากมีช่วงกำไรที่กว้างกว่า

โครงสร้าง:

- ขาย OTM Call

- ซื้อ OTM เพิ่มขึ้นอีก

- ขาย OTM Put

- ซื้อ OTM Put เพิ่มขึ้นอีก

ตัวอย่าง:

ซื้อขาย SPY อยู่ที่ 500 ดอลลาร์

- ขาย Call โดยมีราคาที่ตกลงกันไว้อยู่ที่ 510 ดอลลาร์

- ซื้อ Call โดยมีราคาที่ตกลงกันไว้อยู่ที่ 515 ดอลลาร์

- ขาย Put โดยมีราคาที่ตกลงกันไว้อยู่ที่ 490 ดอลลาร์

- ซื้อ Put โดยมีราคาที่ตกลงกันไว้อยู่ที่ 485 ดอลลาร์

ผลลัพธ์:

- จะได้รับกำไรหาก SPY คงที่อยู่ระหว่าราคา 490 และ 510 ดอลลาร์

- ขาดทุน – อยู่นอกเหนือราคา 485 หรือ 515 ดอลลาร์

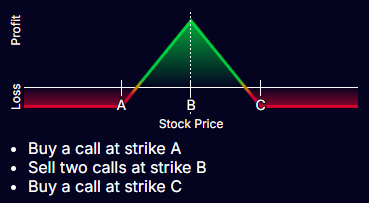

3. Long Call Butterfly

แนวคิดเบื้องหลังนี้คือการทำกำไรหากคุณคาดหวังว่าราคาจะเปลี่ยนแปลงเล็กน้อยแต่ไม่มากเกินไป

โครงสร้าง:

- ซื้อ 1 Call ในราคาที่ต่ำกว่า

- ขาย 2 Call ในราคาที่อยู่ตรงกลาง

- ซื้อ 1 Call ในราคาที่สูงกว่า

ผลลัพธ์:

ความเสี่ยงน้อย อาจได้กำไรน้อย ผลลัพธ์ที่ดีที่สุดคือหากราคาที่หมดอายุอยู่ใกล้กับตรงกลางราคาที่ตกลงกันไว้

ตัวอย่าง:

ซื้อขาย TSLA อยู่ที่ราคา 250 ดอลลาร์

- ซื้อ Call โดยมีราคาที่ตกลงกันไว้อยู่ที่ 240 ดอลลาร์

- ขาย Call โดยมีราคาที่ตกลงกันไว้อยู่ที่ 250 ดอลลาร์

- ซื้อ Call โดยมีราคาที่ตกลงกันไว้อยู่ที่ 260 ดอลลาร์

ผลลัพธ์:

หากราคาปิดอยู่ใกล้ 250 ดอลลาร์ – จะได้รับกำไรสูงสุด

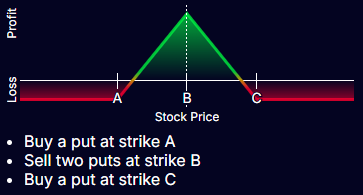

4. Long Put Butterfly

ทำงานคล้ายกัน แต่มีออปชั่น Put ใช้เมื่อคุณคาดว่าจะมีราคาลดลงเล็กน้อยแต่ไม่ใช่เกิดการร่วงหล่นอย่างรวดเร็ว

โครงสร้าง:

- ซื้อ 1 Put โดยอยู่สูงกว่าราคาที่ตกลงกันไว้

- ซื้อ 2 Put โดยอยู่ตรงกลางของราคาที่ตกลงกันไว้

- ซื้อ 1 Put โดยอยู่ต่ำกว่าราคาที่ตกลงกันไว้

ในกรณีของกลยุทธ์ที่เป็นกลางดังที่อธิบายไว้ข้างต้น การลดลงของความผันผวนจะทำให้โซนกำไรกว้างขึ้น และการเพิ่มขึ้นของความผันผวนจะทำให้ช่วงกำไรแคบลง เวลาจะสามารถช่วยได้เมื่อตำแหน่งมีกำไร และจะเป็นผลเสียเมื่อตำแหน่งนั้นไม่ทำกำไร

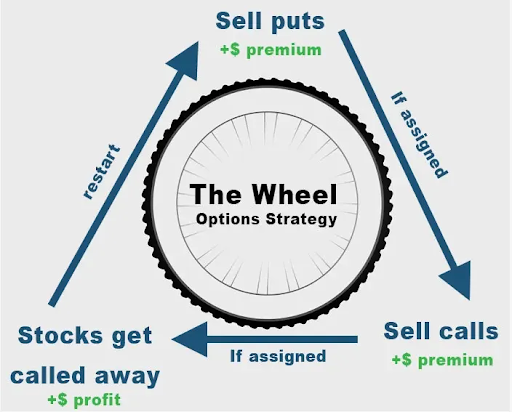

5. กลยุทธ์ Wheel

นี่เป็นกลยุทธ์ที่นักลงทุนระยะยาวชื่นชอบ มันง่าย ทำซ้ำได้ และสามารถใช้งานได้นานหลายปี แนวคิด: สร้างรายได้จากการถือหุ้น และขายออปชั่นรอบ ๆ หุ้นเหล่านั้น

มันทำงานอย่างไร?

ขั้นตอนที่ 1: ขาย 1 Put

- เลือกหุ้นที่คุณไม่อยากจะถือครอง

- ขาย Put ที่ได้รับการค้ำประกันด้วยเงินสด (เช่น มีราคาที่ตกลงกันไว้ต่ำกว่าราคาตลาดปัจจุบัน)

- หากราคายังคงอยู่เหนือราคาที่ตกลงกันไว้ – คุณก็สามารถเก็บส่วนเกินมูลค่าหุ้นเอาไว้ได้ หากราคาร่วง ให้ทำขั้นตอนที่ 2

ขั้นตอนที่ 2: คุณได้รับการโอนสิทธ์ (คุณได้รับหุ้น)

หากราคาหุ้นอยู่ต่ำกว่าราคาที่ตกลงกันไว้ของคุณเมื่อหมดอายุ คุณจะได้รับการโอนสิทธิ์ ซึ่งหมายความว่าคุณจะต้องซื้อหุ้น 100 หุ้น (ต่อสัญญา) ณ ราคาที่ตกลงกันไว้ ตอนนี้คุณเป็นเจ้าของหุ้นแล้ว ขั้นตอนต่อไปคือการขาย Covered Call

ขั้นตอนที่ 3: ขาย 1 Call

- ขายออปชั่น Call โดยให้มีราคาที่ตกลงกันไว้อยู่สูงกว่าราคาปัจจุบันของหุ้นของคุณเล็กน้อย

- คุณจะได้รับส่วนเกินมูลค่าหุ้นใหม่สำหรับการขายนั้น

- หากราคาหุ้นยังคงอยู่ต่ำกว่าราคาที่ตกลงกันไว้ – คุณจะเก็บทั้งหุ้น และส่วนเกินมูลค่าหุ้นเอาไว้ หากราคาหุ้นสูงขึ้นกว่าราคาที่ตกลงกันไว้ หุ้นของคุณจะได้รับการโอน และคุณจะขายหุ้นนั้นในราคาที่ตกลงกันไว้ โดยล็อกทั้งกำไรจากทุน และส่วนเกินมูลค่าหุ้นของออปชั่นเอาไว้

ขั้นตอนที่ 4: เริ่มรอบใหม่อีกครั้ง

ขาย 1 Put → รับการโอนสิทธิ์ → ขาย 1 Covered Call เพราะเหตุนี้เอง นี่จึงเรียกว่า Wheel – มันยังคงหมุนต่อไปเรื่อย ๆ

ตัวอย่างของ วงจร Wheel แบบเต็มรอบ

ขั้นตอนที่ 1: ขาย 1 Put

หุ้น XYZ = 100 ดอลลาร์

คุณขายสัญญา Put 1 สัญญา (สัญญาออปชั่น 1 สัญญา = หุ้น 100 หุ้น) โดยมีราคาที่ตกลงกันไว้ 95 ดอลลาร์ ด้วยส่วนเกินมูลค่าหุ้นอยู่ที่ 2 ดอลลาร์ โดยจะหมดอายุใน 30 วัน

- หากหุ้นอยู่เหนือ 95 ดอลลาร์จนถึงวันหมดอายุ คุณจะได้รับส่วนเกินมูลค่าหุ้นเต็มจำนวน 200 ดอลลาร์ ($2 × 100)

- คุณสามารถปิดตำแหน่งก่อนวันหมดอายุได้ (ในกรณีนั้น ส่วนเกินมูลค่าหุ้นที่คุณเก็บไว้จะน้อยลง) หลังจากที่ได้รับส่วนเกินมูลค่าหุ้นแล้ว คุณสามารถขาย Put อีกครั้งโดยมีส่วนเกินมูลค่าหุ้นใหม่ และราคาที่ตกลงกันไว้ใหม่

ขั้นตอนที่ 2: หากคุณได้รับการโอนสิทธิ์

หากราคาหุ้นร่วงลงไปเหลือ 94 ดอลลาร์เมื่อหมดอายุ คุณจะได้รับการโอนสิทธิ์ และการซื้อหุ้น 100 หุ้นที่ราคา 95 ดอลลาร์

ขั้นตอนที่ 3: ขาย 1 Call

ตอนนี้คุณขาย Call ณ ราคาที่ตกลงกันไว้ซึ่งก็คือ 100 ดอลลาร์ เพื่อให้ได้ส่วนเกินมูลค่าหุ้นจำนวน 2 ดอลลาร์

- หากราคาหุ้นยังคงอยู่ต่ำกว่า 100 ดอลลาร์เมื่อหมดอายุ คุณจะยังคงถือหุ้น 100 หุ้น และส่วนเกินมูลค่าหุ้นอีก 200 ดอลลาร์

- หากราคาหุ้นพุ่งสูงกว่า 100 ดอลลาร์ หุ้นของคุณจะถูกเรียกคืนเมื่อราคา 100 ดอลลาร์

กำไรรวมของคุณในกรณีนั้น:

- $5 ต่อหุ้น (คือส่วนต่างระหว่าง $95 และ $100) – กำไรรวม $500

- + ส่วนเกินมูลค่าหุ้นรวม $4 ($2 จาก Put + $2 จาก Call) – กำไรเพิ่มเติม $400

ขั้นตอนที่ 4: ขาย Put เพิ่มอีก 1 แล้วเริ่มใหม่อีกครั้ง

ตอนนี้คุณได้เงินสดกลับมาแล้ว เตรียมที่จะขาย Put เพิ่มอีก 1 และเริ่มวงจรใหม่อีกครั้ง

อย่าลืม:

- การโอนสิทธิ์ Put – ตอนนี้คุณเป็นเจ้าของหุ้นแล้ว อย่าตื่นตกใจ เพียงปฏิบัติตามขั้นตอนที่ 3 และเริ่มขาย Covered Call

- การโอนสิทธิ์ Call – หุ้นของคุณถูกขาย แต่คุณได้ล็อคกำไรไว้แล้ว คุณกลับได้เงินสดกลับมาแล้ว พร้อมที่จะเริ่มวงจรถัดไป

เคล็ดลับสุดท้ายสำหรับกลยุทธ์ Wheel:

- กลยุทธ์ Wheel จะได้ผลดีที่สุดกับบริษัทที่มีเสถียรภาพ และมีสภาพคล่อง (AAPL, NVDA, MSFT, KO และ XOM เป็นต้น)

- มีเงินในบัญชีสำรองไว้เสมอเพื่อครอบคลุม Put (การค้ำประกันด้วยเงินสด)

- อย่าไล่ตามหุ้นที่มีส่วนเกินมูลค่าหุ้นสูงสุด ให้เลือกหุ้นที่คุณไม่คิดจะซื้อจริง ๆ

- หาก IV สูง แสดงว่าเป็นเวลาที่ดีที่จะเริ่มต้น