Now that you’ve mastered the basic options terminology, it’s time to move on to strategies. Understanding which Greeks dominate each strategy, when it’s appropriate to sell premium and when to buy volatility, and which positions carry the risk of assignment. This allows you to build repeatable trading schemes that work in various market scenarios.

Today, we will analyze the following options strategies:

- Long Call

- Long Put

- Covered Call

- Cash-Secured Put Strategy

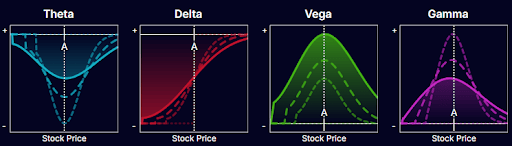

1. Long Call (Buying a Call)

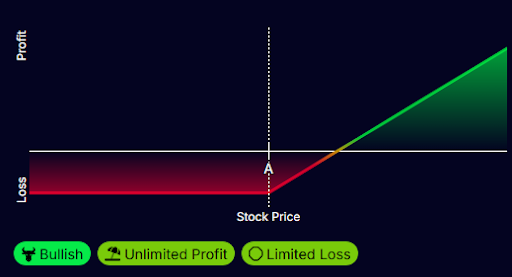

This is the most basic and straightforward strategy. You buy a Call if you anticipate a rise in the price of the underlying asset.

The potential profit is unlimited (for the Call), and the risk is limited to the premium paid. This is suitable when you are confident in a significant and rapid move upwards. It’s often used before an important earnings release or a macroeconomic event.

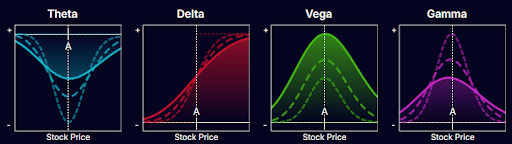

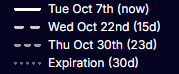

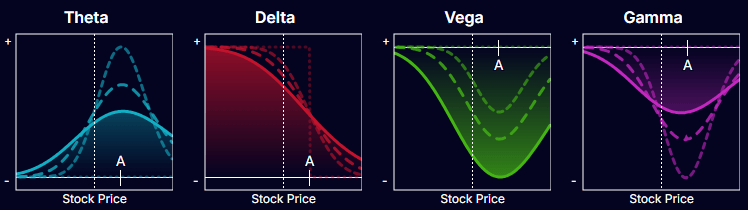

Greeks for Long Call:

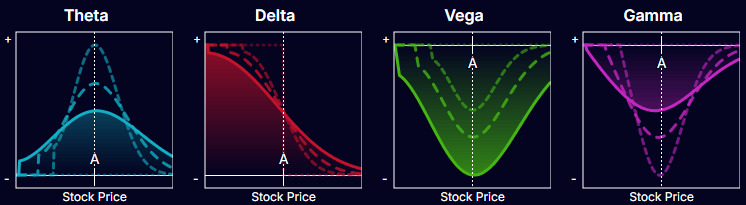

Theta is always negative for a Call, which means it will lose value over time. The rate of this loss will accelerate as the expiration date approaches, and the Call will lose most of its value in the final days or weeks.

Delta is always positive, meaning the Call option will increase in value as the stock price rises (assuming volatility remains unchanged) and lose value as the stock price falls. As the expiration date approaches, Delta will strengthen, making the Call option more sensitive to price changes.

Vega is a positive indicator, so an increase in volatility is favorable for the Call option, and a decrease is unfavorable. Vega reaches its maximum value when the underlying asset is near the strike price, making the Call option most sensitive to IV during this period.

Gamma, or the rate of change of Delta, is positive for a Long Call and is maximal near the strike price. This means Delta will change most rapidly when the stock is near the strike price.

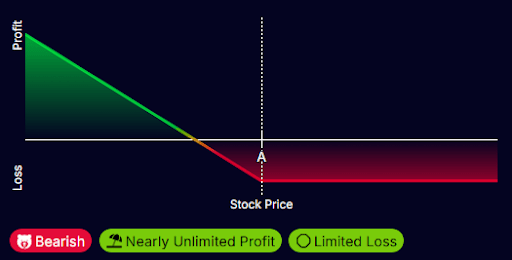

2. Long Put (Buying a Put)

You buy a Put if you anticipate a decline in the price of the underlying asset.

Here, too, the potential profit is unlimited (down to zero), and the risk is limited to the premium paid. This is suitable when you are confident in a significant and preferably rapid price decline. It’s often used before an important earnings release or a macroeconomic event.

Greeks for Long Put:

Theta is always negative for a Put option, which means it will lose value over time. The rate of this loss will accelerate as the expiration date approaches, with the Put option losing most of its value in the final days or weeks.

Delta is always negative, meaning Puts will gain value as the stock price falls (assuming volatility remains unchanged) and lose value as the stock price rises. As the expiration date approaches, Delta will strengthen, making the Put more sensitive to price changes.

Vega is a positive indicator, so an increase in volatility is favorable for the Put option, and a decrease is unfavorable. Vega reaches its maximum value when the underlying asset is near the strike price, making the Put option most sensitive to IV (Implied Volatility) during this period.

Gamma, or the rate of change of Delta, is positive for a Long Put and is maximal near the strike price. This means Delta will change most rapidly when the stock is near the strike price.

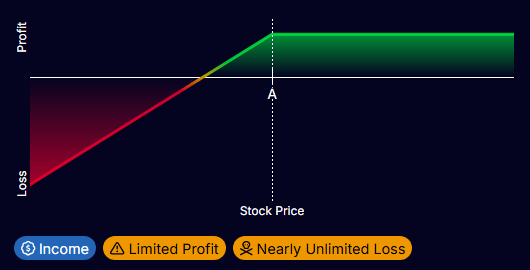

3. Covered Call

The Covered Call is another basic options strategy aimed at generating a small but steady income while holding stocks. It should be used in situations where you wouldn’t mind selling your shares at a certain point, but you are not in a rush to do so.

To use this strategy, you must already own 100 shares of the underlying asset, or start by buying 100 shares if you don’t already have them. You then sell a Call (known as a Short Call) at your desired strike price. This is the opposite of buying a Call and results in funds being credited to your account rather than debited.

If the stock price rises above the strike price, your Call will be assigned, and you will be forced to sell your 100 shares. Since the strike price is ideally above the price at which you bought the stock, you will profit from the shares plus the premium received from selling the Call.

If the stock price does not exceed the strike price, you simply keep the premium (or credit) received from selling the Call.

You can earn a steady “income” from selling Call options by repeating this process every month or every few months, depending on the expiration period.

Greeks for Covered Call:

Theta is always positive for a Short Call. This is good if you want to buy back the Call, as it loses its value over time. This is where the premium for Covered Calls comes from, as the time value represents the extrinsic premium you receive.

Delta is always positive, meaning the strategy will profit as the stock price rises (which is unsurprising, given that the strategy involves buying 100 shares of the underlying asset). The rate of profit growth decreases as the stock price rises, as the short Call option increasingly offsets the stock’s appreciation.

An increase in volatility is detrimental to the Short Call, as Vega is always negative. Selling Covered Calls when volatility is high can be more profitable but also riskier. If you want to buy back the Call, you want volatility to be lower than when you sold it.

Gamma (the rate of change of Delta) is negative, which means Delta decreases as the stock price rises.

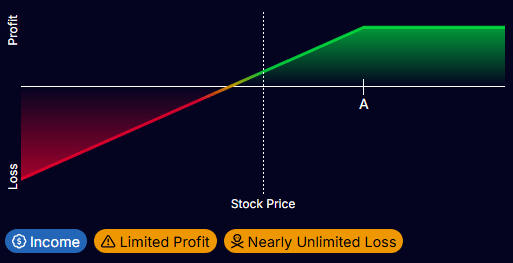

4. Cash-Secured Put Strategy (Selling a Put)

The Cash-Secured Put option is another basic options strategy aimed at generating a small but stable income, with the possibility of purchasing the underlying stock at a certain point. It is equivalent to a Short Put, but it is often called a Cash-Secured Put when the trader has enough cash set aside to buy 100 shares of the underlying asset, rather than trading on margin credit.

Since a Cash-Secured Put (or Short Put) is the opposite side of buying a Long Put, instead of having the right to sell 100 shares at the strike price if the Put is in-the-money, you take on the obligation to buy 100 shares.

- If the stock price is below the strike price at expiration, the Short Put will be exercised by its owner, and you will be assigned. In this case, you will be obliged to buy 100 shares at the strike price, using the cash you set aside (hence “cash-secured”).

- If the stock price does not fall below the strike price at expiration, you simply keep the premium (or credit) received from selling the Put option. If you have previously traded long options, you might know how easily they lose their value upon expiration. With a Short Put option, the opposite is true: you want the Put option to lose its value upon expiration so you can collect the premium.

You can earn a steady “income” by selling Put options, repeating this process every month or every few months, depending on the expiration date. If you are assigned at some point, the cycle doesn’t necessarily end there! There is another strategy called “The Wheel” which combines selling Cash-Secured Puts and Covered Calls to create a continuous income cycle.

Greeks for Short Put:

- Theta is always positive for a Short Put. This is good if you want to buy back the Put, as it will lose its value over time. This is the source of the premium for Short Puts, as the time value represents the extrinsic premium you receive.

- Delta is always positive, meaning the strategy will profit as the stock price rises. The rate of profit slows down as the Put becomes further out-of-the-money, as it is likely to expire worthless and you will receive the full premium.

- An increase in volatility is detrimental to Short Put options, as Vega is always negative. Selling Cash-Secured Puts when volatility is high can be more profitable, but also riskier. If you want to buy back the Put option, you need the volatility to be lower than when you sold it.

- Gamma (the rate of change of Delta) is negative, which means Delta decreases as the stock price rises.

A Note for Beginners on Selling Options

While the Covered Call and Cash-Secured Put strategies are often presented as “safe” or “conservative” option plays, it’s vital for new traders to understand they involve selling options, and should generally be avoided at the initial stages of options trading.

Here’s why:

- Risk of Assignment and Obligation: When you sell an option (whether a Call or a Put), you take on an obligation – not just a right. The risk of assignment (being forced to buy or sell the underlying stock) introduces complex margin requirements. For a beginner, managing this unexpected obligation can lead to significant and confusing financial stress.

- Margin & Capital Efficiency: Both strategies require substantial capital. The Covered Call requires owning 100 shares upfront, and the Cash-Secured Put requires setting aside enough cash to buy 100 shares. This ties up a large amount of capital that could be used for simpler, limited-risk strategies (like Long Call or Long Put) that focus purely on learning market direction and timing.

- Negative Vega Exposure: When you sell premium, your position has Negative Vega. This means a sudden, unexpected spike in implied volatility (which often happens when the market crashes or reacts to bad news) will immediately cause your sold option to lose money, creating a sudden and sharp paper loss that can be frightening for a novice.

In summary: Start by buying options (Long Call or Long Put) to understand how the Greeks affect value, where your risk is naturally capped, and where margin calls are not a concern. Save selling premium for when you are comfortable with margin management and assignment risk.