การปิดหน่วยงานของรัฐบาลสหรัฐฯ เกิดขึ้นเมื่อรัฐสภา และทำเนียบขาวไม่สามารถตกลงเรื่องงบประมาณ หรือเงินทุนชั่วคราวได้ทันเวลา ส่งผลให้สถาบันของรัฐต้องปิดตัวลงบางส่วน เหตุการณ์ดังกล่าวส่งผลกระทบต่อตลาดการเงินอย่างหลีกเลี่ยงไม่ได้ บางครั้งอาจรุนแรง แต่บางครั้งก็อาจไม่รุนแรงมากนัก

ประวัติ และระยะเวลาการปิดระบบในอดีต

| ระยะเวลา | ประธานาธิบดี | ระยะเวลา | เหตุผลสั้นๆ |

| 30.09-13.10.1977 | เจ.คาร์เตอร์ | 12 วัน | ความขัดแย้งเรื่องเงินทุนสนับสนุนการทำแท้งในโรงพยาบาลของรัฐ |

| 30.09–18.10.1978 | คาร์เตอร์ | 18 วัน | ข้อพิพาทเรื่องการใช้จ่ายด้านการป้องกันประเทศ |

| 20.11-23.11.1981 | อาร์. เรแกน | 2 วัน | ภาษี และการลดงบประมาณ |

| 09.10-13.10.1984 | เรแกน | 2 วัน | เงินทุนเพื่อการศึกษา และโครงการเพื่อสังคม |

| 16.12-18.12.1995 | บี. คลินตัน | 5 วัน | ความขัดแย้งเรื่องการตัดงบประมาณ |

| 16.12.1995-06.01.1996 | คลินตัน | 21 วัน | ยาวนานที่สุดในยุค 90 ครอบคลุมทั้ง Medicare การศึกษา และภาษี |

| 01.10-17.10.2013 | บี. โอบามา | 16 วัน | ข้อพิพาทเกี่ยวกับ Obamacare |

| 20.01-23.01.2018 | ทรัมป์ | 3 วัน | นโยบายการเข้าเมือง |

| 22.12.2018-25.01.2019 | ทรัมป์ | 35 วัน | ข้อพิพาทเรื่องเงินทุนสร้างกำแพงชายแดนติดกับเม็กซิโก |

| 01.10.2025-12.11.2025 | ทรัมป์ | 36 วัน | ยาวนานที่สุดในประวัติศาสตร์ |

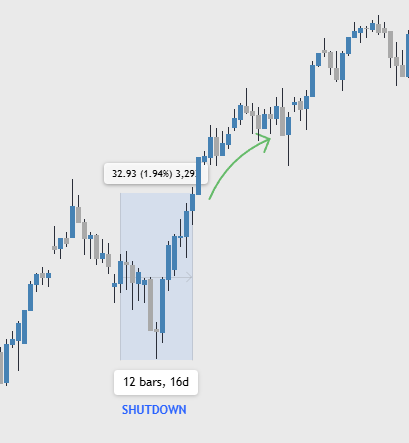

- ปิดระบบ 01.10-17.10.2013 (16 วัน)

S&P500 (US500)

ปฏิกิริยาของตลาด:

- ระหว่างการปิดระบบ: ดัชนี S&P 500 แสดงให้เห็นการเพิ่มขึ้น +1.94%

- หลังปิดตลาด: ดัชนีปรับตัวขึ้นอย่างมีความเชื่อมั่น

Gold (XAU/USD)

ปฏิกิริยาของตลาด:

- ระหว่างการปิดระบบ: ราคาทองคำลดลง -3.47%

- หลังการปิดระบบ: โดยทั่วไปจะสังเกตเห็นการฟื้นตัวของราคา

- ปิดระบบ 22.12.2018–25.01.2019 (35 วัน)

S&P500

ปฏิกิริยาของตลาด:

- ระหว่างการปิดระบบ: ราคาของดัชนีแสดงให้เห็นถึงการเพิ่มขึ้นอย่างมีความเชื่อมั่นที่ +10.82%

- หลังปิดระบบ: คาดว่าจะเติบโตอย่างต่อเนื่อง

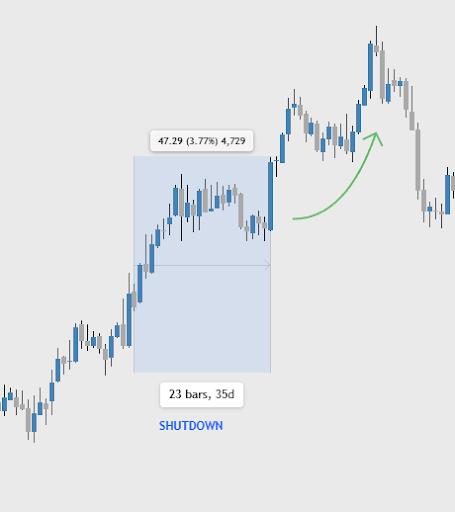

Gold (XAU/USD)

ปฏิกิริยาของตลาด:

- ระหว่างปิดตลาด: ราคาทองคำเพิ่มขึ้น +3.77%

- หลังปิดระบบ: คาดว่าจะเติบโตอย่างต่อเนื่อง

ประเด็นสำคัญสำหรับนักลงทุน

บทเรียนหลักที่ต้องเรียนรู้มีดังนี้:

- การปิดระบบเป็นเวลานานหมายความว่า “คำสัญญา” ทางการเมืองสามารถยืดเยื้อได้ นี่ถือเป็นปัจจัยเสี่ยงสำหรับนักลงทุน แต่ทุกคนรู้ดีว่าการปิดระบบจะสิ้นสุดลงเร็ว หรือช้า ดังนั้นจึงไม่มีความตื่นตระหนกเกิดขึ้น

- สถิติแสดงให้เห็นว่าดัชนีหุ้นมีแนวโน้มที่จะเพิ่มขึ้นระหว่างการปิดระบบซึ่งอาจเป็นผลมาจากการคาดหวังว่าการปิดระบบจะสิ้นสุดลง โดยรวมแล้ว ดัชนี S&P 500 แสดงให้เห็นผลตอบแทนเชิงบวกระหว่างช่วงปิดทำการของรัฐบาลมากกว่าครึ่งหนึ่งนับตั้งแต่ปี พ.ศ. 2519 โดยผลตอบแทนโดยเฉลี่ยในช่วงเวลาดังกล่าวเป็นไปในเชิงบวกเล็กน้อย

- ปฏิกิริยาของตลาดมักจะสะท้อนให้เห็นถึงสถานะโดยรวมของเศรษฐกิจ และนโยบายของธนาคารกลาง มากกว่าที่จะเป็นการสั่งปิดหน่วยงานของรัฐบาลเอง อย่างไรก็ตาม ความล่าช้าของข้อมูลเศรษฐกิจ (รายงานการจ้างงาน ตัวเลขเงินเฟ้อ) ระหว่างช่วงปิดทำการอาจทำให้การตัดสินใจด้านนโยบายของธนาคารกลางสหรัฐฯ มีความซับซ้อนมากขึ้น ส่งผลให้ความผันผวนในระยะสั้นเพิ่มขึ้น (ดัชนี VIX มักจะเพิ่มขึ้น)

- ทองคำมักทำหน้าที่เป็นสินทรัพย์ที่มีความปลอดภัยซึ่งเชื่อถือได้ในช่วงที่มีความไม่แน่นอนทางการเมือง และเศรษฐกิจ โดยเฉพาะอย่างยิ่งในช่วงที่รัฐบาลปิดทำการเป็นเวลานาน เมื่อพิจารณาถึงความไม่แน่นอน ทองคำ เงิน แพลตตินัม และพันธบัตรควรทำหน้าที่เป็น “เครื่องป้องกันความเสี่ยง” ที่มีประโยชน์ในช่วงเวลาดังกล่าว แม้ว่าสถิติจะแสดงให้เห็นว่าวิธีนี้ไม่ได้ผลเสมอไปก็ตาม

- แต่สถิติแสดงให้เห็นอย่างชัดเจนถึงการเติบโตทั้งในดัชนีหุ้นที่มีความเชื่อมั่น และทองคำหลังจากการปิดระบบสิ้นสุดลง สิ่งนี้บ่งชี้ว่าสำหรับนักลงทุน การปิดระบบถือเป็นวิกฤตทางการเมือง ไม่ใช่วิกฤตเศรษฐกิจ ดังนั้นตลาดจึงต้านทานนักลงทุนได้อย่างสงบ และมักจะปรับตัวขึ้นหลังจากพวกเขาตัดสินใจแล้ว

| คำถาม | คำตอบ |

| ควรขายหุ้นเนื่องจากการปิดระบบหรือไม่? | ในอดีต – คำตอบคือไม่ ตลาดฟื้นตัว และมักจะเติบโตขึ้น |

| ควรซื้อเมื่อราคาตกหรือไม่? | ใช่ วิธีนี้ได้ผลในเกือบทุกกรณี |

| ควรเข้าสู่ตลาดทองคำในช่วงที่มีความเสี่ยงทางการเมืองหรือไม่? | ใช่ ทองคำมีการเคลื่อนไหวที่มั่นคง และมักจะเพิ่มขึ้นหลังจากการปิดระบบสิ้นสุดลง |

| การปิดระบบก่อให้เกิดความเสี่ยงในระยะยาวหรือไม่? | ไม่ ผลกระทบส่วนใหญ่มักจะเป็นเพียงระยะสั้น |

การปิดทำการของรัฐบาลกลางสหรัฐอเมริกาในปี พ.ศ. 2568: ทางตันในปัจจุบัน

การปิดระบบครั้งสุดท้ายเริ่มในวันที่ 1 ตุลาคม พ.ศ. 2568 หลังจากที่ร่างกฎหมายจัดสรรงบประมาณ หรือเงินทุนชั่วคราวไม่ได้รับการอนุมัติ

สาเหตุ: ข้อพิพาทระหว่างรัฐสภา และประธานาธิบดี โดนัลด์ ทรัมป์ เกี่ยวกับเงินทุนของรัฐบาล ประกันสุขภาพ และค่าใช้จ่ายด้านการป้องกันประเทศ และความช่วยเหลือต่างประเทศ

หลังจากการปิดหน่วยงานรัฐบาลกลางของสหรัฐฯ บางส่วนเป็นเวลา 43 วัน ซึ่งถือเป็นสถิติสูงสุด ประธานาธิบดีโดนัลด์ ทรัมป์ ได้ลงนามร่างกฎหมายเมื่อวันที่ 13 พฤศจิกายน พ.ศ. 2568 เพื่อขยายเงินทุนให้กับหน่วยงานรัฐบาลหลายแห่ง ซึ่งถือเป็นการยุติการปิดหน่วยงานที่ยาวนานที่สุดในประวัติศาสตร์ของประเทศ

กฎหมายจัดสรรเงินทุนให้กับหน่วยงานเพียงจำนวนจำกัดเท่านั้น ซึ่งประกอบไปด้วย กระทรวงเกษตร กระทรวงกิจการทหารผ่านศึก หน่วยงานในสาขานิติบัญญัติ และโครงการก่อสร้างทางทหาร เงินทุนสำหรับหน่วยงานของรัฐบาลกลางอื่น ๆ ได้รับการขยายเวลาไปจนถึงวันที่ 30 มกราคม พ.ศ. 2569 เท่านั้น ซึ่งทำให้มีความเป็นไปได้ที่หน่วยงานของรัฐบาลจะปิดทำการอีกครั้งในช่วงต้นปีหน้า

ขณะลงนามร่างกฎหมายที่ทำเนียบขาว ประธานาธิบดีทรัมป์กล่าวว่า “รัฐบาลกลางกำลังกลับเข้าสู่การดำเนินงานตามปกติ” และตำหนิพรรคเดโมแครตอีกครั้งสำหรับการปิดทำการ ตามที่ประธานาธิบดีกล่าว การกระทำของฝ่ายค้าน “ก่อให้เกิดความเสียหายอย่างใหญ่หลวงต่อประเทศ” โดยเฉพาะอย่างยิ่งส่งผลให้เที่ยวบินมากกว่า 20,000 เที่ยวบินถูกยกเลิก หรือล่าช้า พนักงานของรัฐบาลกลาง และผู้รับเหมากว่าล้านคนไม่ได้รับเงินเดือน

ทำเนียบขาวประมาณการว่าความเสียหายทางเศรษฐกิจจากการปิดทำการอาจสูงถึง 1.5 ล้านล้านดอลลาร์ โดยการคำนวณอย่างแม่นยำคาดว่าจะใช้เวลาหลายเดือน

นักวิเคราะห์สังเกตว่าแม้ข้อตกลงปัจจุบันจะช่วยคลายความตึงเครียดด้านงบประมาณชั่วคราว แต่ความขัดแย้งเชิงโครงสร้างระหว่างพรรครีพับลิกัน และพรรคเดโมแครตเกี่ยวกับการใช้จ่าย และหนี้สินยังคงไม่ได้รับการแก้ไข ซึ่งจะทำให้เกิดความเสี่ยงที่จะเกิดวิกฤตการจัดหาเงินทุนอีกครั้งในช่วงปลายเดือนมกราคม หากรัฐสภาไม่สามารถอนุมัติงบประมาณที่ครอบคลุมได้